The New York State income tax return, also known as Form IT-203-B, is a crucial document for individuals and businesses operating in the state. Accurate and timely filing of this form is essential to avoid penalties and ensure compliance with state tax laws. In this article, we will provide a comprehensive guide to help you navigate the Form IT-203-B filing process, highlighting seven essential instructions to keep in mind.

Who Needs to File Form IT-203-B?

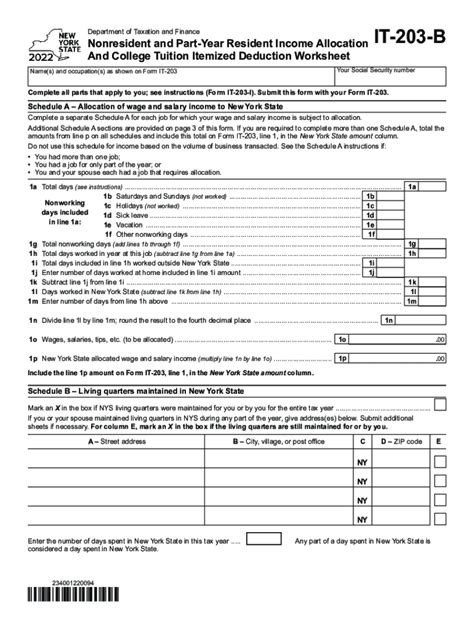

Form IT-203-B is required for individuals, estates, and trusts that are residents of New York State and have a tax liability. This includes:

- Residents of New York State who have income from employment, self-employment, or investments

- Estates and trusts that have income from New York State sources

- Non-residents who have income from New York State sources, such as rental income or income from the sale of property

What is the Filing Deadline?

The filing deadline for Form IT-203-B is typically April 15th of each year, coinciding with the federal income tax filing deadline. However, if you are filing for an automatic six-month extension, the deadline is October 15th.

1. Gather Required Documents

To file Form IT-203-B accurately, you will need to gather various documents, including:

- W-2 forms from employers

- 1099 forms for self-employment income, freelance work, or other income

- Interest statements from banks and investments

- Dividend statements from investments

- Records of charitable donations and other deductions

2. Determine Your Filing Status

Your filing status affects the tax rates and deductions you are eligible for. The following filing statuses are available:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

3. Calculate Your Income

Calculate your total income from all sources, including:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividend income

- Capital gains and losses

- Rental income

4. Claim Deductions and Credits

Deductions and credits can significantly reduce your tax liability. Common deductions and credits include:

- Standard deduction or itemized deductions

- Mortgage interest and property tax deductions

- Charitable donation deductions

- Earned income tax credit (EITC)

- Child tax credit

5. Complete the Form IT-203-B

Using the information gathered, complete Form IT-203-B, making sure to:

- Report all income accurately

- Claim all eligible deductions and credits

- Calculate your tax liability correctly

- Sign and date the form

6. File the Form and Pay Any Tax Due

File Form IT-203-B by the deadline and pay any tax due to avoid penalties and interest. You can file electronically or by mail.

7. Keep Records and Monitor Your Account

Keep a copy of your filed Form IT-203-B and supporting documents for at least three years in case of an audit. Monitor your account for any notifications or issues.

By following these seven essential filing instructions, you can ensure accurate and timely filing of your Form IT-203-B, avoiding potential penalties and ensuring compliance with New York State tax laws.

If you have any questions or concerns about filing Form IT-203-B, feel free to ask in the comments section below. Share this article with others who may find it helpful, and don't forget to bookmark our page for more informative content.

What is the penalty for late filing of Form IT-203-B?

+The penalty for late filing of Form IT-203-B is 5% of the unpaid tax for each month or part of a month, up to a maximum of 25%.

Can I file Form IT-203-B electronically?

+Yes, you can file Form IT-203-B electronically through the New York State Department of Taxation and Finance's website.

What is the deadline for filing Form IT-203-B if I am filing for an extension?

+If you are filing for an automatic six-month extension, the deadline is October 15th.