Withdrawing from a Northwestern Mutual Individual Retirement Account (IRA) can be a straightforward process if you have the right guidance. As a Northwestern Mutual IRA account holder, it's essential to understand the rules and regulations surrounding withdrawals to ensure a smooth and hassle-free experience. In this article, we'll walk you through the step-by-step process of filling out the Northwestern Mutual IRA withdrawal form.

Understanding Northwestern Mutual IRA Withdrawal Rules

Before we dive into the withdrawal form, it's crucial to understand the rules and regulations surrounding Northwestern Mutual IRA withdrawals. The IRS sets specific guidelines for IRA withdrawals, and Northwestern Mutual has its own set of rules and fees associated with withdrawals.

- The IRS requires that you start taking Required Minimum Distributions (RMDs) from your IRA by April 1st of the year after you turn 72.

- You can withdraw from your IRA at any time, but you may be subject to a 10% penalty if you withdraw before age 59 1/2.

- Northwestern Mutual may charge fees for withdrawals, such as a $25 fee for each withdrawal.

Types of Withdrawals

Northwestern Mutual offers two types of withdrawals:

- Lump Sum Withdrawal: This allows you to withdraw a single amount from your IRA.

- Systematic Withdrawal: This allows you to set up regular withdrawals from your IRA, such as monthly or quarterly.

Step-by-Step Guide to Filling Out the Northwestern Mutual IRA Withdrawal Form

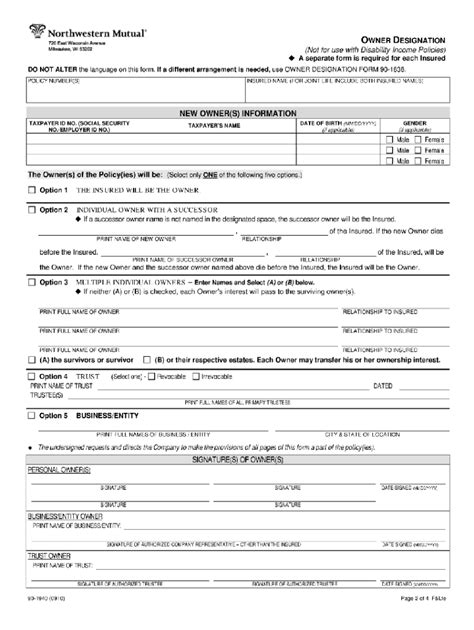

To fill out the Northwestern Mutual IRA withdrawal form, follow these steps:

- Gather Required Information: Before filling out the form, make sure you have the following information:

- Your IRA account number

- Your social security number or tax ID number

- The amount you want to withdraw

- The type of withdrawal you want (lump sum or systematic)

- Download the Form: You can download the Northwestern Mutual IRA withdrawal form from the company's website or by contacting their customer service department.

- Fill Out the Form: Complete the form with the required information. Make sure to sign and date the form.

- Attach Required Documents: Depending on the type of withdrawal, you may need to attach additional documents, such as a voided check or a letter of instruction.

- Submit the Form: Submit the completed form to Northwestern Mutual via mail, fax, or email.

Additional Requirements

In addition to filling out the withdrawal form, you may need to complete additional requirements, such as:

- Providing Identification: You may need to provide identification, such as a driver's license or passport, to verify your identity.

- Completing a W-4P Form: If you're taking a lump sum withdrawal, you may need to complete a W-4P form to elect withholding.

Tips and Considerations

Before withdrawing from your Northwestern Mutual IRA, consider the following tips:

- Consult with a Financial Advisor: It's always a good idea to consult with a financial advisor to ensure you're making the best decision for your financial situation.

- Understand the Fees: Make sure you understand the fees associated with withdrawals, such as the $25 fee for each withdrawal.

- Consider the Tax Implications: Withdrawals from an IRA are considered taxable income, so make sure you understand the tax implications of your withdrawal.

Frequently Asked Questions

Here are some frequently asked questions about Northwestern Mutual IRA withdrawals:

- Q: How long does it take to process a withdrawal?

- A: Withdrawals are typically processed within 3-5 business days.

- Q: Can I withdraw from my IRA at any time?

- A: Yes, but you may be subject to a 10% penalty if you withdraw before age 59 1/2.

- Q: Are there any fees associated with withdrawals?

- A: Yes, Northwestern Mutual may charge fees for withdrawals, such as a $25 fee for each withdrawal.

Conclusion

Withdrawing from a Northwestern Mutual IRA can be a straightforward process if you have the right guidance. By understanding the rules and regulations surrounding withdrawals and following the step-by-step guide outlined in this article, you can ensure a smooth and hassle-free experience. Remember to consult with a financial advisor and understand the fees and tax implications associated with withdrawals.

What is the minimum age to withdraw from a Northwestern Mutual IRA?

+The minimum age to withdraw from a Northwestern Mutual IRA is 59 1/2. However, you may be subject to a 10% penalty if you withdraw before this age.

How long does it take to process a Northwestern Mutual IRA withdrawal?

+Withdrawals are typically processed within 3-5 business days.

Are there any fees associated with Northwestern Mutual IRA withdrawals?

+Yes, Northwestern Mutual may charge fees for withdrawals, such as a $25 fee for each withdrawal.

We hope this article has provided you with valuable insights and guidance on the Northwestern Mutual IRA withdrawal process. If you have any further questions or concerns, please don't hesitate to reach out to us.