Changing the beneficiary of your Northwestern Mutual life insurance policy can seem like a daunting task, but it's essential to ensure that your loved ones are protected in the event of your passing. In this article, we'll guide you through the process of filling out a Northwestern Mutual change of beneficiary form, making it easy and stress-free.

Life insurance policies are designed to provide financial security for your dependents, and having the right beneficiary in place is crucial. Circumstances can change over time, such as a divorce, marriage, or the birth of a child, and it's essential to update your beneficiary information accordingly. Failure to do so can lead to disputes and delays in the claims process, causing unnecessary stress for your loved ones.

The good news is that updating your beneficiary information is relatively straightforward, and we'll walk you through the process step-by-step. We'll also provide you with tips and best practices to ensure that your change of beneficiary form is completed accurately and efficiently.

Why Update Your Beneficiary Information?

Before we dive into the process, let's discuss why updating your beneficiary information is so important:

- Changes in relationships: If you've recently gotten married, divorced, or had a child, you may want to update your beneficiary to reflect these changes.

- New dependents: If you've recently adopted a child or taken in a dependent, you'll want to ensure they're protected in the event of your passing.

- Inheritance disputes: Failure to update your beneficiary information can lead to disputes and delays in the claims process, causing unnecessary stress for your loved ones.

- Tax implications: In some cases, updating your beneficiary information can have tax implications, so it's essential to seek professional advice if you're unsure.

How to Update Your Beneficiary Information

Now that we've discussed the importance of updating your beneficiary information, let's walk through the process:

- Gather the necessary documents: You'll need to have your policy documents and identification ready.

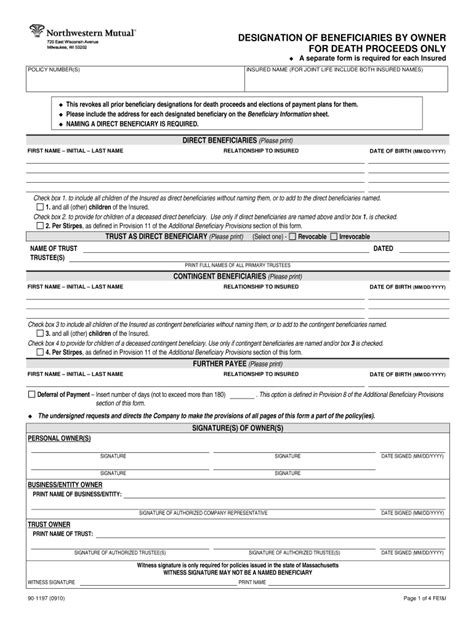

- Complete the change of beneficiary form: You can obtain a change of beneficiary form from Northwestern Mutual's website or by contacting their customer service department.

- Fill out the form accurately: Make sure to fill out the form accurately and completely, providing all required information.

- Sign and date the form: Once you've completed the form, sign and date it.

- Submit the form: You can submit the form to Northwestern Mutual via mail, email, or fax.

What Information Do I Need to Provide?

When completing the change of beneficiary form, you'll need to provide the following information:

- Your policy number: This can be found on your policy documents or by contacting Northwestern Mutual's customer service department.

- Your current beneficiary information: You'll need to provide the name, address, and social security number of your current beneficiary.

- New beneficiary information: You'll need to provide the name, address, and social security number of your new beneficiary.

- Relationship to beneficiary: You'll need to provide your relationship to the new beneficiary (e.g., spouse, child, etc.).

Tips and Best Practices

Here are some tips and best practices to keep in mind when updating your beneficiary information:

- Review your policy regularly: It's essential to review your policy regularly to ensure that your beneficiary information is up-to-date.

- Seek professional advice: If you're unsure about updating your beneficiary information or have complex circumstances, seek professional advice from a financial advisor or attorney.

- Keep a copy of the form: Make sure to keep a copy of the completed form for your records.

Common Mistakes to Avoid

Here are some common mistakes to avoid when updating your beneficiary information:

- Failing to sign and date the form: Make sure to sign and date the form to ensure that it's valid.

- Providing incomplete information: Make sure to provide all required information to avoid delays in the claims process.

- Not keeping a copy of the form: Make sure to keep a copy of the completed form for your records.

Conclusion

Updating your beneficiary information is a crucial step in ensuring that your loved ones are protected in the event of your passing. By following the steps outlined in this article, you can make the process easy and stress-free. Remember to review your policy regularly, seek professional advice if needed, and keep a copy of the completed form for your records.

What is the purpose of a change of beneficiary form?

+The purpose of a change of beneficiary form is to update the beneficiary information on your life insurance policy.

How do I obtain a change of beneficiary form?

+You can obtain a change of beneficiary form from Northwestern Mutual's website or by contacting their customer service department.

What information do I need to provide on the change of beneficiary form?

+You'll need to provide your policy number, current beneficiary information, new beneficiary information, and relationship to beneficiary.