As a non-resident of New Jersey, understanding the tax implications of your income can be overwhelming. Filing taxes in a state you don't reside in can be complex, but with the right guidance, you can navigate the process with ease. In this article, we'll delve into the world of New Jersey non-resident tax forms, providing you with a step-by-step guide to ensure you're meeting your tax obligations.

The Importance of Filing Non-Resident Tax Forms

New Jersey requires non-residents to file tax returns if they earn income from sources within the state. This includes income from employment, self-employment, rental properties, and investments. Failure to file can result in penalties, fines, and even loss of refunds. By understanding the non-resident tax form requirements, you can avoid these consequences and ensure compliance with the New Jersey tax laws.

Types of Non-Resident Tax Forms

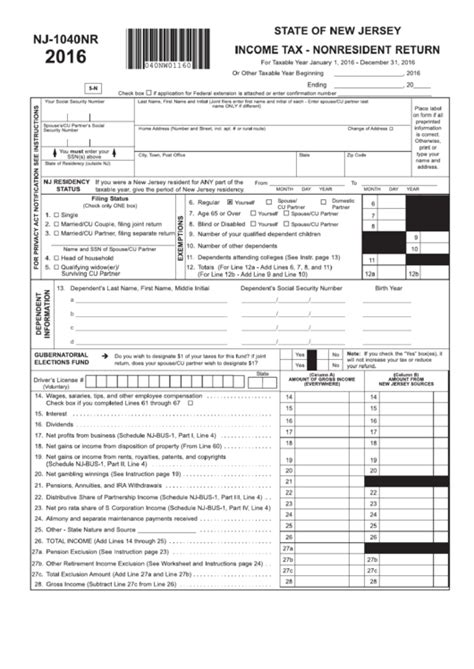

New Jersey offers two primary non-resident tax forms: Form NJ-1040NR and Form NJ-1040.

Form NJ-1040NR: Non-Resident Income Tax Return

This form is used by non-residents who earn income from New Jersey sources. It's a comprehensive form that requires you to report all income earned from New Jersey, including:

- Wages and salaries

- Self-employment income

- Rental income

- Investment income

- Capital gains

Form NJ-1040: Individual Income Tax Return

While primarily used by residents, non-residents may also use Form NJ-1040 if they have income from New Jersey sources that's not reported on Form NJ-1040NR. This form is used for simpler tax returns, such as those with only wage income.

Filing Requirements for Non-Residents

To determine if you need to file a non-resident tax form, follow these guidelines:

- You're a non-resident of New Jersey

- You earned income from New Jersey sources

- Your gross income exceeds $10,000 (single filers) or $20,000 (joint filers)

- You have a tax liability (owed taxes) or are due a refund

Step-by-Step Guide to Filing Non-Resident Tax Forms

Step 1: Gather Required Documents

- Form W-2 (Employment Income)

- Form 1099 (Miscellaneous Income)

- Form K-1 (Partnership Income)

- Form 1098 (Mortgage Interest)

- Other relevant tax documents

Step 2: Choose the Correct Form

- Determine which form (NJ-1040NR or NJ-1040) you need to file based on your income sources

- Download or obtain the correct form from the New Jersey Division of Taxation website

Step 3: Fill Out the Form

- Follow the instructions provided with the form

- Complete all required sections, including:

- Income

- Deductions

- Credits

- Taxes

Step 4: Calculate Your Tax Liability

- Use the tax tables or tax calculator provided with the form

- Determine if you owe taxes or are due a refund

Step 5: Submit Your Return

- Mail or e-file your return by the deadline (April 15th for most filers)

- Include all required documentation, such as W-2s and 1099s

Additional Tips and Reminders

- Keep accurate records of your income and expenses

- Consult a tax professional if you're unsure about filing requirements or forms

- Take advantage of tax credits and deductions you're eligible for

- File an amended return (Form NJ-1040X) if you need to correct errors or claim additional credits

New Jersey Non-Resident Tax FAQs

Q: What is the deadline for filing non-resident tax forms in New Jersey?

A: The deadline is typically April 15th, but may vary for certain filers.

Q: Do I need to file a non-resident tax form if I only earned income from New Jersey sources?

A: Yes, if your gross income exceeds $10,000 (single filers) or $20,000 (joint filers).

Q: Can I e-file my non-resident tax return?

A: Yes, you can e-file using the New Jersey Division of Taxation's online portal.

By following this step-by-step guide, you'll be well on your way to navigating the world of New Jersey non-resident tax forms. Remember to stay organized, consult a tax professional if needed, and take advantage of available credits and deductions. Happy filing!

What is the purpose of Form NJ-1040NR?

+Form NJ-1040NR is used by non-residents to report income earned from New Jersey sources.

Do I need to file a non-resident tax form if I'm a part-year resident?

+Yes, if you earned income from New Jersey sources during your residency period.

Can I claim a refund on my non-resident tax return?

+Yes, if you overpaid taxes or have a credit due to you.