Filling out tax forms can be a daunting task, especially for those who are new to the process. The New York State W-9 form is a crucial document that requires accurate and detailed information to ensure compliance with tax laws. In this article, we will guide you through the process of filling out the New York State W-9 form in five easy steps.

What is the New York State W-9 Form?

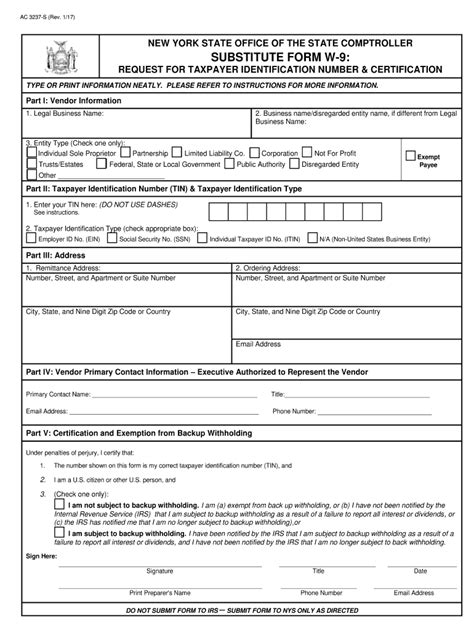

The New York State W-9 form, also known as the Request for Taxpayer Identification Number and Certification, is a document used by the state to collect taxpayer identification information from individuals and businesses. This form is required for tax purposes and must be completed accurately to avoid any penalties or delays.

Step 1: Gather Required Information

Before filling out the W-9 form, make sure you have the following information readily available:

- Your business name and address

- Your federal employer identification number (FEIN) or social security number (SSN)

- Your New York State tax identification number (if applicable)

- Your business type (sole proprietorship, partnership, corporation, etc.)

Types of Business Entities

When filling out the W-9 form, it's essential to identify your business type correctly. Here are the most common types of business entities:

- Sole Proprietorship: A business owned and operated by one individual.

- Partnership: A business owned and operated by two or more individuals.

- Corporation: A business entity that is separate from its owners.

- Limited Liability Company (LLC): A business entity that combines the liability protection of a corporation with the tax benefits of a partnership.

Step 2: Fill Out the Header Section

The header section of the W-9 form requires the following information:

- Your business name and address

- Your federal employer identification number (FEIN) or social security number (SSN)

- Your New York State tax identification number (if applicable)

Make sure to fill out this section accurately, as any errors may result in delays or penalties.

FEIN vs. SSN

If you're a business owner, you may be wondering whether to use your FEIN or SSN on the W-9 form. Here's a brief explanation:

- FEIN: A federal employer identification number is required for businesses with employees or those that operate as a corporation or partnership.

- SSN: A social security number is required for sole proprietors or single-member LLCs.

Step 3: Fill Out the Certification Section

The certification section of the W-9 form requires you to certify that the information provided is accurate and true. This section also requires you to acknowledge that you're subject to penalties and fines for providing false information.

Make sure to read the certification section carefully before signing and dating the form.

Penalties for False Information

Providing false information on the W-9 form can result in penalties and fines. Here are some potential consequences:

- A penalty of up to $500 for each false statement

- A fine of up to $1,000 for each false statement

- Potential prosecution for tax evasion or other related crimes

Step 4: Fill Out the Backup Withholding Section (If Applicable)

If you're subject to backup withholding, you'll need to fill out the backup withholding section of the W-9 form. This section requires you to provide additional information, such as your taxpayer identification number and certification that you're not subject to backup withholding.

Backup withholding is a type of withholding that's required for certain types of income, such as:

- Dividends

- Interest

- Rents

- Royalties

Step 5: Sign and Date the Form

Once you've completed the W-9 form, make sure to sign and date it. This is an important step, as the form is not valid without your signature.

Remember to keep a copy of the completed W-9 form for your records. You may need to provide a copy to your clients or customers, so make sure to have multiple copies readily available.

Why You Need to Keep a Copy

Keeping a copy of the completed W-9 form is essential for several reasons:

- You may need to provide a copy to your clients or customers

- You may need to refer to the form for future tax purposes

- You may need to provide a copy to the IRS in case of an audit

By following these five steps, you can ensure that you fill out the New York State W-9 form accurately and efficiently. Remember to keep a copy of the completed form for your records, and don't hesitate to seek help if you have any questions or concerns.

What is the purpose of the New York State W-9 form?

+The New York State W-9 form is used to collect taxpayer identification information from individuals and businesses for tax purposes.

Who needs to fill out the W-9 form?

+Individuals and businesses that operate in New York State need to fill out the W-9 form for tax purposes.

What are the consequences of providing false information on the W-9 form?

+Providing false information on the W-9 form can result in penalties and fines, as well as potential prosecution for tax evasion or other related crimes.