Managing your finances effectively is crucial in today's fast-paced world. One of the most convenient ways to do this is by setting up direct deposit for your paycheck, benefits, or other regular income. Navy Federal Credit Union, one of the largest and most respected credit unions in the world, offers its members the ease of managing their finances through its online platform, including the Navy Federal direct deposit form online.

Setting up direct deposit is a straightforward process that allows you to receive your funds directly into your account, eliminating the need for paper checks and providing quicker access to your money. This not only saves time but also reduces the risk of lost or stolen checks. In this article, we will explore how to complete the Navy Federal direct deposit form online, the benefits of direct deposit, and provide practical tips to help you manage your finances more efficiently.

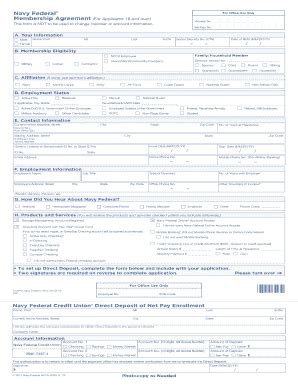

How to Complete the Navy Federal Direct Deposit Form Online

Completing the Navy Federal direct deposit form online is a simple process that can be done in a few steps:

- Log in to your Navy Federal account: Start by logging in to your Navy Federal online account. If you haven't already, you can register for online access on the Navy Federal website.

- Navigate to the direct deposit section: Once logged in, navigate to the direct deposit section. This is usually found under the "Accounts" or "Transactions" tab.

- Enter your direct deposit information: Fill out the required fields, including the type of deposit, account number, and routing number. Make sure to double-check your information to avoid any errors.

- Submit the form: Review your information and submit the form. You may need to agree to terms and conditions before the form is processed.

- Verify your direct deposit setup: After submitting the form, verify that your direct deposit setup is complete. You can do this by checking your account activity or contacting Navy Federal customer service.

Benefits of Direct Deposit

Direct deposit offers several benefits, including:

- Faster access to your funds: With direct deposit, you can access your money as soon as it's deposited into your account.

- Reduced risk of lost or stolen checks: Direct deposit eliminates the need for paper checks, reducing the risk of lost or stolen checks.

- Increased security: Direct deposit is a secure way to receive your funds, as it reduces the risk of identity theft and check fraud.

- Convenience: Direct deposit saves you time and effort, as you don't need to deposit checks or wait for them to clear.

Practical Tips for Managing Your Finances with Direct Deposit

Here are some practical tips for managing your finances with direct deposit:

- Create a budget: Start by creating a budget that accounts for all your income and expenses.

- Prioritize your expenses: Prioritize your expenses, such as rent/mortgage, utilities, and groceries.

- Use the 50/30/20 rule: Allocate 50% of your income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment.

- Take advantage of automatic savings: Set up automatic transfers from your checking account to your savings or investment accounts.

- Monitor your account activity: Regularly monitor your account activity to detect any suspicious transactions or errors.

Common Mistakes to Avoid with Direct Deposit

Here are some common mistakes to avoid with direct deposit:

- Entering incorrect account information: Double-check your account information to avoid errors.

- Not verifying direct deposit setup: Verify that your direct deposit setup is complete to avoid delays or issues.

- Not monitoring account activity: Regularly monitor your account activity to detect any suspicious transactions or errors.

- Not taking advantage of automatic savings: Set up automatic transfers to take advantage of automatic savings.

Navy Federal Direct Deposit Form Online Security

Navy Federal takes the security of its members' information seriously. The Navy Federal direct deposit form online is protected by advanced security measures, including:

- Encryption: Navy Federal uses encryption to protect your data both in transit and at rest.

- Two-factor authentication: Navy Federal offers two-factor authentication to add an extra layer of security to your account.

- Secure servers: Navy Federal's servers are secure and regularly updated to prevent any security breaches.

Conclusion: Take Control of Your Finances with Navy Federal Direct Deposit Form Online

Managing your finances effectively is crucial in today's fast-paced world. By completing the Navy Federal direct deposit form online, you can take control of your finances and enjoy the benefits of direct deposit. Remember to create a budget, prioritize your expenses, and take advantage of automatic savings. By following these practical tips and avoiding common mistakes, you can make the most of direct deposit and achieve your financial goals.

We encourage you to share your thoughts and experiences with direct deposit in the comments section below. If you have any questions or concerns, feel free to ask. Don't forget to share this article with your friends and family to help them take control of their finances.

How do I access the Navy Federal direct deposit form online?

+To access the Navy Federal direct deposit form online, log in to your Navy Federal account and navigate to the direct deposit section.

What are the benefits of direct deposit?

+Direct deposit offers several benefits, including faster access to your funds, reduced risk of lost or stolen checks, increased security, and convenience.

How do I verify my direct deposit setup?

+To verify your direct deposit setup, check your account activity or contact Navy Federal customer service.