The N-11 tax form - a crucial document for individuals and businesses in Ireland to report their income and claim tax credits. However, navigating the complexities of this form can be a daunting task, especially for those who are new to taxation or unsure about the requirements. In this article, we will break down the N-11 tax form into manageable sections, providing a comprehensive guide on how to complete it accurately and efficiently.

Understanding the Purpose of the N-11 Tax Form

The N-11 tax form is used by the Revenue Commissioners in Ireland to assess an individual's or business's tax liability. It is essential to complete this form accurately to avoid any penalties or delays in receiving tax refunds. The N-11 form is used to report income from various sources, including employment, self-employment, rental income, and investments.

Benefits of Completing the N-11 Tax Form Correctly

Completing the N-11 tax form correctly can have numerous benefits, including:

- Avoiding penalties and fines for incorrect or late submissions

- Ensuring timely receipt of tax refunds

- Reducing the risk of audits and investigations

- Maximizing tax credits and reliefs

- Demonstrating compliance with tax laws and regulations

Gathering Necessary Information and Documents

Before starting to complete the N-11 tax form, it is essential to gather all necessary information and documents. These may include:

- P60 and P45 forms from employers

- Invoices and receipts for business expenses

- Bank statements and account details

- Rental income statements

- Investment income statements

- Charitable donations receipts

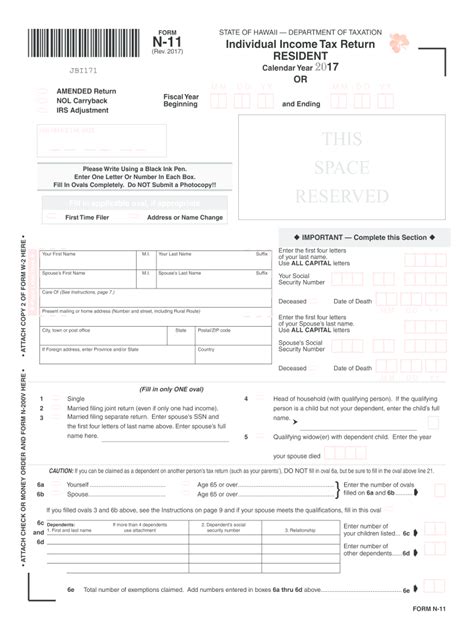

Completing the N-11 Tax Form: A Step-by-Step Guide

Step 1: Personal Details

The first section of the N-11 tax form requires personal details, including:

- Name and address

- Date of birth

- PPS number

- Contact information

Step 2: Income from Employment

This section requires details of income from employment, including:

- Employer's name and address

- P45 and P60 forms

- Gross income and tax deducted

Step 3: Income from Self-Employment

This section requires details of income from self-employment, including:

- Business name and address

- Accounting period and profits

- Capital allowances and reliefs

Step 4: Rental Income

This section requires details of rental income, including:

- Property address and description

- Rental income and expenses

- Capital allowances and reliefs

Step 5: Investments and Other Income

This section requires details of investments and other income, including:

- Investment income and expenses

- Dividend income and tax credits

- Other income and reliefs

Step 6: Tax Credits and Reliefs

This section requires details of tax credits and reliefs, including:

- Standard rate band and tax credits

- Charitable donations and reliefs

- Medical expenses and reliefs

Step 7: Declaration and Signature

The final section requires a declaration and signature, confirming that the information provided is accurate and complete.

Tips and Best Practices for Completing the N-11 Tax Form

- Ensure accuracy and completeness of information

- Use the correct tax year and forms

- Claim all eligible tax credits and reliefs

- Keep records and supporting documentation

- Seek professional advice if unsure or complex

Common Mistakes to Avoid When Completing the N-11 Tax Form

- Inaccurate or incomplete information

- Late or missed submissions

- Failure to claim eligible tax credits and reliefs

- Insufficient records and supporting documentation

Conclusion

Completing the N-11 tax form can be a challenging task, but with the right guidance and support, it can be made easier. By following the step-by-step guide and tips outlined in this article, individuals and businesses can ensure accurate and efficient completion of the N-11 tax form. Remember to gather all necessary information and documents, and seek professional advice if unsure or complex.

Share your experiences and tips for completing the N-11 tax form in the comments below. If you have any questions or need further clarification, please don't hesitate to ask.

What is the deadline for submitting the N-11 tax form?

+The deadline for submitting the N-11 tax form is typically October 31st for paper submissions and November 14th for online submissions.

What are the penalties for late or incorrect submissions?

+Penalties for late or incorrect submissions can include fines, interest, and even audits and investigations.

Can I claim tax credits and reliefs if I am self-employed?

+Yes, self-employed individuals can claim tax credits and reliefs, including capital allowances and medical expenses.