Filing taxes can be a daunting task, especially with the numerous forms and requirements that vary from state to state. In Montana, residents are required to file their state income taxes using the Montana Tax Form 2, also known as the Individual Income Tax Return. This form is used to report an individual's income, deductions, and credits, and to calculate their tax liability.

To ensure a smooth and stress-free tax filing experience, we have compiled five essential tips for filing Montana Tax Form 2.

Tip 1: Gather All Necessary Documents and Information

Before starting the tax filing process, it is crucial to gather all necessary documents and information. This includes:

- W-2 forms from all employers

- 1099 forms for freelance work or self-employment income

- Interest statements from banks and investments

- Dividend statements

- Charitable donation receipts

- Medical expense receipts

- Any other relevant tax-related documents

Having all these documents readily available will help ensure that you accurately report your income, deductions, and credits.

What to Do If You're Missing Documents

If you're missing any necessary documents, don't panic. You can:

- Contact your employer or financial institution to request duplicate copies

- Use the IRS's online portal to retrieve transcripts of your W-2 and 1099 forms

- File Form 4852, Substitute for Form W-2, to report missing or incorrect W-2 information

Tip 2: Choose the Correct Filing Status

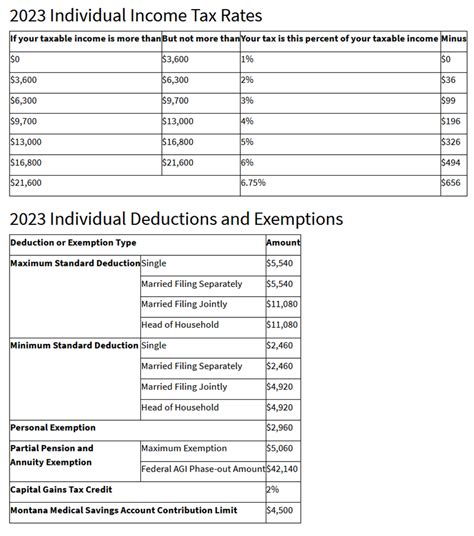

Your filing status determines which tax rates and deductions apply to you. In Montana, you can file as single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

To choose the correct filing status, consider the following:

- If you're married, you can file jointly or separately

- If you're single, you'll file as single

- If you're the head of household, you'll file as head of household

- If you're a qualifying widow(er), you'll file as qualifying widow(er)

Tip 3: Claim All Eligible Deductions and Credits

Montana offers various deductions and credits to reduce your tax liability. Some common deductions and credits include:

- Standard deduction or itemized deductions

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education credits

- Charitable donation deductions

How to Claim Deductions and Credits

To claim deductions and credits, follow these steps:

- Review the Montana Tax Form 2 instructions to determine which deductions and credits you're eligible for

- Complete the relevant schedules and forms, such as Schedule A for itemized deductions or Schedule EIC for the EITC

- Attach supporting documentation, such as receipts or invoices, to your tax return

Tip 4: Report All Income and Capital Gains

You must report all income earned during the tax year, including:

- Wages and salaries

- Self-employment income

- Interest and dividends

- Capital gains from the sale of investments or assets

Failure to report all income can result in penalties and interest. To avoid this, ensure you:

- Review your W-2 and 1099 forms for accuracy

- Report all self-employment income on Schedule C

- Complete Schedule D to report capital gains and losses

Tip 5: E-File or Mail Your Return by the Deadline

The deadline to file Montana Tax Form 2 is typically April 15th. You can e-file your return through the Montana Department of Revenue's website or mail a paper return.

Benefits of E-Filing

E-filing offers several benefits, including:

- Faster processing and refund times

- Reduced risk of errors and rejections

- Ability to track the status of your return online

To e-file, you'll need to create an account on the Montana Department of Revenue's website and follow the online instructions.

By following these five tips, you'll be well on your way to accurately and efficiently filing your Montana Tax Form 2. Remember to stay organized, take advantage of deductions and credits, and e-file or mail your return by the deadline to avoid penalties and interest.

Don't hesitate to reach out to a tax professional or the Montana Department of Revenue if you have questions or need assistance with the tax filing process.

FAQ Section:

What is the deadline to file Montana Tax Form 2?

+The deadline to file Montana Tax Form 2 is typically April 15th.

Can I e-file my Montana Tax Form 2?

+Yes, you can e-file your Montana Tax Form 2 through the Montana Department of Revenue's website.

What happens if I miss the deadline to file my Montana Tax Form 2?

+If you miss the deadline, you may be subject to penalties and interest on any unpaid tax liability.