Missouri taxpayers have access to various tax credits that can help reduce their state tax liability. One of the most important forms for claiming these credits is the Mo Form 2643. In this article, we will provide a comprehensive guide to understanding and completing Mo Form 2643.

What is Mo Form 2643?

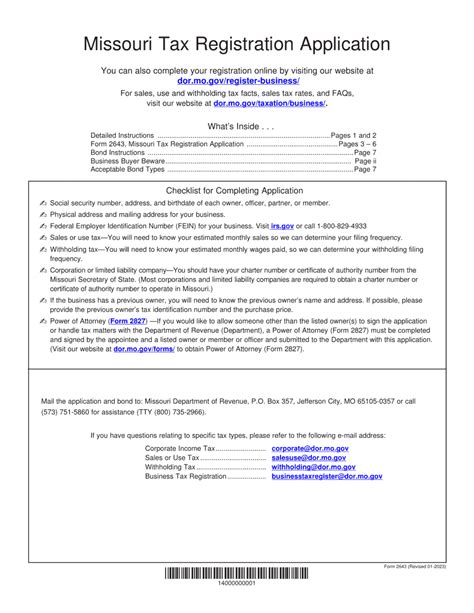

Mo Form 2643 is a tax form used by the Missouri Department of Revenue to claim various tax credits. The form is used to calculate the total amount of tax credits claimed and to report the credits on the taxpayer's Missouri individual income tax return (Form MO-1040). The form is typically filed along with the taxpayer's state income tax return.

Types of Tax Credits Available

Missouri offers several tax credits that can be claimed on Mo Form 2643. Some of the most common tax credits include:

- Missouri Circuit Breaker Tax Credit: This credit is available to individuals who are 65 or older, blind, or disabled, and have a household income below a certain threshold.

- Missouri Property Tax Credit: This credit is available to individuals who own a home in Missouri and pay property taxes.

- Missouri Earned Income Tax Credit (EITC): This credit is available to individuals who work and have earned income below a certain threshold.

- Missouri Business Use of Home Tax Credit: This credit is available to individuals who use their home for business purposes.

How to Complete Mo Form 2643

To complete Mo Form 2643, taxpayers will need to gather the following information:

- Their Missouri individual income tax return (Form MO-1040)

- Documentation supporting the tax credits they are claiming (e.g., receipts, invoices, etc.)

- The Missouri tax credit claim form (Mo Form 2643)

The form is divided into several sections, each corresponding to a different type of tax credit. Taxpayers will need to complete the sections that correspond to the credits they are claiming.

Section 1: Missouri Circuit Breaker Tax Credit

To claim the Missouri Circuit Breaker Tax Credit, taxpayers will need to complete Section 1 of Mo Form 2643. This section requires taxpayers to provide information about their household income, age, and disability status.

Section 2: Missouri Property Tax Credit

To claim the Missouri Property Tax Credit, taxpayers will need to complete Section 2 of Mo Form 2643. This section requires taxpayers to provide information about their property taxes, including the amount of taxes paid and the assessed value of their property.

Section 3: Missouri Earned Income Tax Credit (EITC)

To claim the Missouri EITC, taxpayers will need to complete Section 3 of Mo Form 2643. This section requires taxpayers to provide information about their earned income, including their wages, salaries, and tips.

Section 4: Missouri Business Use of Home Tax Credit

To claim the Missouri Business Use of Home Tax Credit, taxpayers will need to complete Section 4 of Mo Form 2643. This section requires taxpayers to provide information about their business use of their home, including the square footage of the home used for business purposes and the amount of business expenses.

Tips for Claiming Missouri Tax Credits

Here are some tips for claiming Missouri tax credits:

- Make sure to read and follow the instructions carefully

- Gather all necessary documentation before starting the form

- Double-check your math to ensure accuracy

- Consider consulting a tax professional if you are unsure about any part of the process

Avoiding Common Mistakes

Here are some common mistakes to avoid when claiming Missouri tax credits:

- Failure to complete all required sections of the form

- Failure to provide required documentation

- Mathematical errors

- Claiming credits for which you are not eligible

Conclusion and Next Steps

In conclusion, Mo Form 2643 is an important tax form for Missouri taxpayers who want to claim various tax credits. By following the instructions and tips outlined in this article, taxpayers can ensure that they complete the form accurately and avoid common mistakes. If you have any questions or concerns about claiming Missouri tax credits, consider consulting a tax professional or contacting the Missouri Department of Revenue.

What is the deadline for filing Mo Form 2643?

+The deadline for filing Mo Form 2643 is April 15th of each year, unless you have filed for an extension.

Can I claim Missouri tax credits if I don't owe state income tax?

+Yes, you can still claim Missouri tax credits even if you don't owe state income tax. However, the amount of the credit will be limited to the amount of tax you owe.

Can I claim Missouri tax credits if I file an amended return?

+Yes, you can claim Missouri tax credits on an amended return. However, you will need to file a separate Mo Form 2643 for the amended return.