Missouri is one of the few states in the United States that allows property owners to transfer their real estate to beneficiaries through a beneficiary deed, also known as a transfer-on-death (TOD) deed. This type of deed enables individuals to retain control of their property during their lifetime while also designating who will receive the property upon their passing. In this article, we will explore the ins and outs of the Missouri beneficiary deed form, including its benefits, requirements, and the steps to create one.

The Importance of a Beneficiary Deed in Missouri

A beneficiary deed is an essential tool for Missouri property owners who want to ensure that their real estate is transferred to their desired beneficiaries without the need for probate. Probate is a lengthy and often costly process that involves the court's supervision of the distribution of a deceased person's assets. By using a beneficiary deed, property owners can avoid probate and ensure that their beneficiaries receive the property quickly and efficiently.

Benefits of a Missouri Beneficiary Deed

There are several benefits to using a beneficiary deed in Missouri, including:

- Avoiding Probate: As mentioned earlier, a beneficiary deed allows property owners to transfer their real estate to beneficiaries without the need for probate.

- Retaining Control: Property owners retain control of their property during their lifetime and can revoke or change the beneficiary deed at any time.

- Tax Benefits: Beneficiary deeds can provide tax benefits, such as reducing the amount of taxes owed by the beneficiaries.

- Flexibility: Beneficiary deeds can be used to transfer a wide range of properties, including residential, commercial, and agricultural properties.

Requirements for a Missouri Beneficiary Deed

To create a valid beneficiary deed in Missouri, the following requirements must be met:

- The Deed Must Be in Writing: The beneficiary deed must be in writing and signed by the property owner.

- The Deed Must Be Recorded: The beneficiary deed must be recorded with the county recorder's office where the property is located.

- The Deed Must Contain Certain Language: The beneficiary deed must contain specific language that indicates the property owner's intention to transfer the property to the beneficiary upon their passing.

- The Beneficiary Must Be Identified: The beneficiary deed must identify the beneficiary and their address.

Steps to Create a Missouri Beneficiary Deed

Creating a beneficiary deed in Missouri involves the following steps:

- Determine the Type of Property: Determine the type of property you want to transfer, such as residential, commercial, or agricultural.

- Choose a Beneficiary: Choose the beneficiary who will receive the property upon your passing.

- Draft the Deed: Draft the beneficiary deed, including the required language and information.

- Sign the Deed: Sign the beneficiary deed in the presence of a notary public.

- Record the Deed: Record the beneficiary deed with the county recorder's office where the property is located.

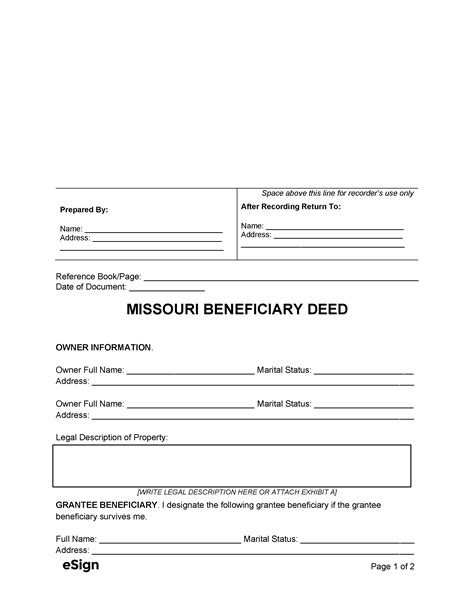

Missouri Beneficiary Deed Form: What to Include

When creating a beneficiary deed in Missouri, there are certain pieces of information that must be included. These include:

- Property Description: A description of the property being transferred, including the address and parcel number.

- Beneficiary Information: The name and address of the beneficiary.

- Granting Language: Language that indicates the property owner's intention to transfer the property to the beneficiary upon their passing.

- Signature: The property owner's signature, notarized by a notary public.

Common Mistakes to Avoid When Creating a Missouri Beneficiary Deed

When creating a beneficiary deed in Missouri, there are several common mistakes to avoid, including:

- Failure to Record the Deed: Failing to record the beneficiary deed with the county recorder's office can render the deed invalid.

- Incomplete or Inaccurate Information: Failing to include required information or including inaccurate information can render the deed invalid.

- Failure to Sign the Deed: Failing to sign the beneficiary deed in the presence of a notary public can render the deed invalid.

Tax Implications of a Missouri Beneficiary Deed

The tax implications of a beneficiary deed in Missouri depend on several factors, including the value of the property and the beneficiary's relationship to the property owner. In general, beneficiary deeds can provide tax benefits, such as reducing the amount of taxes owed by the beneficiaries. However, it is essential to consult with a tax professional to understand the specific tax implications of a beneficiary deed in Missouri.

Revoking or Changing a Missouri Beneficiary Deed

A Missouri beneficiary deed can be revoked or changed at any time by the property owner. To revoke or change a beneficiary deed, the property owner must create a new deed that revokes the previous deed and records it with the county recorder's office.

Frequently Asked Questions About Missouri Beneficiary Deeds

Here are some frequently asked questions about Missouri beneficiary deeds:

- What is a beneficiary deed in Missouri? A beneficiary deed in Missouri is a type of deed that allows property owners to transfer their real estate to beneficiaries upon their passing.

- How do I create a beneficiary deed in Missouri? To create a beneficiary deed in Missouri, you must determine the type of property you want to transfer, choose a beneficiary, draft the deed, sign the deed, and record the deed with the county recorder's office.

- What are the benefits of a beneficiary deed in Missouri? The benefits of a beneficiary deed in Missouri include avoiding probate, retaining control of the property, and providing tax benefits.

Conclusion

A Missouri beneficiary deed is an essential tool for property owners who want to ensure that their real estate is transferred to their desired beneficiaries without the need for probate. By understanding the benefits, requirements, and steps to create a beneficiary deed, property owners can make informed decisions about their property and ensure that their wishes are carried out upon their passing.

Now it's your turn! Have you considered creating a beneficiary deed in Missouri? Share your thoughts and experiences in the comments below. And if you have any questions or need further guidance, don't hesitate to ask.

What is the purpose of a beneficiary deed in Missouri?

+The purpose of a beneficiary deed in Missouri is to allow property owners to transfer their real estate to beneficiaries upon their passing, avoiding the need for probate.

How do I create a beneficiary deed in Missouri?

+To create a beneficiary deed in Missouri, you must determine the type of property you want to transfer, choose a beneficiary, draft the deed, sign the deed, and record the deed with the county recorder's office.

Can I revoke or change a beneficiary deed in Missouri?

+Yes, a Missouri beneficiary deed can be revoked or changed at any time by the property owner. To revoke or change a beneficiary deed, the property owner must create a new deed that revokes the previous deed and records it with the county recorder's office.