Tax season is here, and Minnesota residents are busy gathering their documents and filling out forms to report their income and claim their refunds. One of the most important forms for Minnesota residents is the M1W, also known as the Minnesota Withholding Tax Return. In this article, we will guide you through the process of filling out the M1W form correctly, highlighting common mistakes to avoid and providing tips to ensure accuracy.

Minnesota Form M1W is used by employers to report the amount of Minnesota income tax withheld from their employees' wages. It's essential to fill out this form accurately to avoid any penalties or fines. In this article, we will cover the five ways to fill out Minnesota Form M1W correctly, including understanding the form's structure, gathering required information, and avoiding common errors.

Understanding the Form's Structure

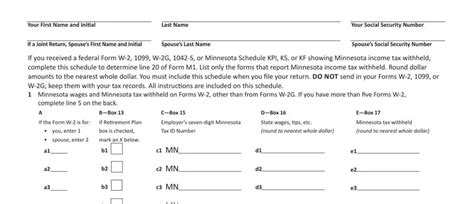

Before we dive into the details, let's take a look at the structure of the M1W form. The form is divided into several sections, each requiring specific information. The sections include:

- Employer information

- Withholding tax information

- Wage and tax withholding details

- Certification

1. Gather Required Information

To fill out the M1W form correctly, you'll need to gather the required information. This includes:

- Employer identification number (EIN)

- Employer name and address

- Employee names, addresses, and social security numbers

- Wage and tax withholding information for each employee

- Total wages and tax withholding for the quarter

Make sure to have all the necessary documents and information readily available before starting to fill out the form.

2. Fill Out Employer Information

The first section of the M1W form requires employer information. This includes:

- Employer identification number (EIN)

- Employer name and address

- Contact person's name and phone number

Make sure to enter this information accurately, as it will be used to identify your business and communicate with you.

Employer Information Tips

- Double-check your EIN to ensure it's correct.

- Use the exact name and address listed on your business registration documents.

- Provide a contact person's name and phone number in case the Minnesota Department of Revenue needs to reach you.

3. Report Withholding Tax Information

The next section requires you to report withholding tax information. This includes:

- Total wages paid to employees

- Total tax withheld from employee wages

- Tax withholding rate

Make sure to report this information accurately, as it will be used to calculate your business's tax liability.

Withholding Tax Information Tips

- Use the correct tax withholding rate for your business.

- Report total wages and tax withheld for the quarter, not just for individual employees.

- Double-check your calculations to ensure accuracy.

4. Complete Wage and Tax Withholding Details

This section requires you to provide wage and tax withholding details for each employee. This includes:

- Employee name and social security number

- Wages paid to the employee

- Tax withheld from the employee's wages

Make sure to report this information accurately for each employee.

Wage and Tax Withholding Details Tips

- Use the correct social security number for each employee.

- Report wages and tax withheld for each employee separately.

- Double-check your calculations to ensure accuracy.

5. Certify the Form

The final section requires you to certify the form. This includes:

- Signing the form

- Dating the form

- Providing a contact person's name and phone number

Make sure to sign and date the form, and provide a contact person's name and phone number in case the Minnesota Department of Revenue needs to reach you.

Certification Tips

- Sign the form legibly and in ink.

- Date the form accurately.

- Provide a contact person's name and phone number.

By following these five ways to fill out Minnesota Form M1W correctly, you'll be able to avoid common mistakes and ensure accuracy. Remember to gather required information, fill out employer information, report withholding tax information, complete wage and tax withholding details, and certify the form.

Additional Tips

- Use the correct form version for the tax year you're reporting.

- Make sure to file the form on time to avoid penalties.

- Keep a copy of the form for your records.

By following these tips and guidelines, you'll be able to fill out Minnesota Form M1W correctly and avoid any potential issues. Remember to stay organized, double-check your calculations, and seek help if you need it.

Call to Action

We hope this article has helped you understand how to fill out Minnesota Form M1W correctly. If you have any questions or need further assistance, please don't hesitate to reach out to us. Remember to file your form on time and keep a copy for your records. Happy filing!

What is Minnesota Form M1W?

+Minnesota Form M1W is a tax form used by employers to report the amount of Minnesota income tax withheld from their employees' wages.

Who needs to file Minnesota Form M1W?

+All employers who have withheld Minnesota income tax from employee wages need to file Form M1W.

What is the deadline for filing Minnesota Form M1W?

+The deadline for filing Form M1W is typically April 30th for the first quarter, July 31st for the second quarter, October 31st for the third quarter, and January 31st for the fourth quarter.