Michigan Lady Bird Deed Form: A Guide To Property Transfer

For individuals looking to transfer property in Michigan, understanding the process can be overwhelming, especially when it comes to navigating the various types of deeds available. One option that has gained popularity in recent years is the Lady Bird Deed, also known as an Enhanced Life Estate Deed. This type of deed allows property owners to transfer ownership while retaining control and minimizing the risk of Medicaid estate recovery. In this article, we will delve into the world of Michigan Lady Bird Deed Form, exploring its benefits, working mechanisms, and steps to create one.

What is a Lady Bird Deed?

A Lady Bird Deed, named after Lyndon B. Johnson's wife, Lady Bird Johnson, is a type of deed that allows the grantor (the property owner) to transfer ownership of their property while retaining a life estate. This means that the grantor maintains control over the property until their death, at which point the property automatically transfers to the named beneficiaries (grantees). The Lady Bird Deed is particularly useful for individuals who want to avoid probate, minimize estate taxes, and protect their assets from Medicaid estate recovery.

Benefits of a Lady Bird Deed

The Lady Bird Deed offers several benefits, including:

- Avoidance of Probate: By transferring ownership through a Lady Bird Deed, the property is not subject to probate, which can be a lengthy and costly process.

- Minimized Estate Taxes: The Lady Bird Deed allows the grantor to transfer ownership while minimizing estate taxes, as the property is not considered part of the grantor's taxable estate.

- Protection from Medicaid Estate Recovery: The Lady Bird Deed protects the grantor's assets from Medicaid estate recovery, which can help ensure that the grantor's property is not seized to repay Medicaid benefits.

- Retained Control: The grantor maintains control over the property until their death, allowing them to continue living in the property or renting it out.

How Does a Lady Bird Deed Work?

The Lady Bird Deed works by creating a life estate, which allows the grantor to maintain control over the property until their death. The deed names the grantor as the life tenant and the beneficiaries as the remaindermen. Upon the grantor's death, the property automatically transfers to the remaindermen, avoiding probate and minimizing estate taxes.

Steps to Create a Lady Bird Deed in Michigan

To create a Lady Bird Deed in Michigan, follow these steps:

- Determine the Property: Identify the property you wish to transfer using a Lady Bird Deed.

- Choose the Beneficiaries: Select the individuals or entities you wish to inherit the property upon your death.

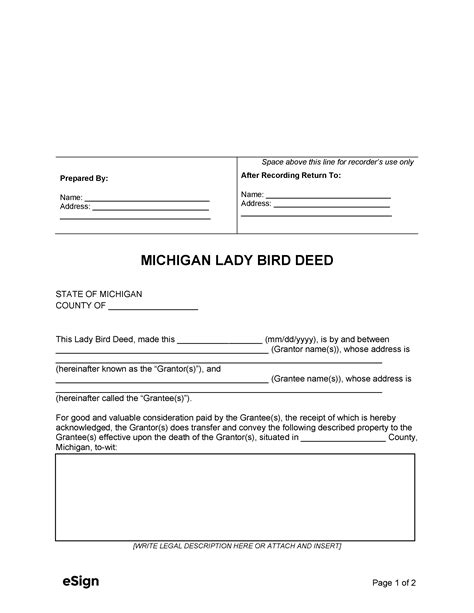

- Draft the Deed: Create a Lady Bird Deed document, which should include the following information:

- The grantor's name and address

- The property description

- The names and addresses of the beneficiaries

- A statement granting the grantor a life estate

- A statement granting the beneficiaries a remainder interest

- Sign and Notarize: Sign the deed in the presence of a notary public.

- Record the Deed: Record the deed with the Michigan County Register of Deeds.

Michigan Lady Bird Deed Form Requirements

When creating a Lady Bird Deed in Michigan, it is essential to ensure that the document meets the state's requirements. The deed should include the following:

- Granting Clause: A statement granting the grantor a life estate and the beneficiaries a remainder interest.

- Habendum Clause: A statement describing the property and the interests being conveyed.

- Tenendum Clause: A statement outlining the terms of the life estate and remainder interest.

Frequently Asked Questions

What is the difference between a Lady Bird Deed and a Quitclaim Deed?

+A Lady Bird Deed allows the grantor to retain a life estate, while a Quitclaim Deed transfers ownership immediately.

Can I use a Lady Bird Deed to transfer property to a trust?

+Yes, a Lady Bird Deed can be used to transfer property to a trust, but it is essential to consult with an attorney to ensure the deed is properly drafted.

Is a Lady Bird Deed revocable?

+Yes, a Lady Bird Deed can be revoked, but it is essential to follow the proper procedures to avoid any unintended consequences.

In Conclusion

The Michigan Lady Bird Deed Form is a valuable tool for individuals looking to transfer property while maintaining control and minimizing the risk of Medicaid estate recovery. By understanding the benefits and working mechanisms of a Lady Bird Deed, property owners can ensure a smooth transfer of ownership and protect their assets for future generations. If you are considering using a Lady Bird Deed, consult with an attorney to ensure the deed is properly drafted and meets the state's requirements.

We hope this article has provided you with valuable insights into the world of Michigan Lady Bird Deed Form. If you have any further questions or would like to share your experiences with Lady Bird Deeds, please leave a comment below.