Direct deposit has revolutionized the way we receive our salaries, benefits, and refunds. Gone are the days of waiting for checks to arrive in the mail or having to make a trip to the bank to deposit them. With direct deposit, your money is automatically transferred into your account, saving you time and hassle. If you're a Meta Bank customer looking to take advantage of this convenient feature, you're in the right place. In this article, we'll guide you through the easy enrollment process for Meta Bank's direct deposit form.

Direct deposit is a popular payment method that allows individuals to receive funds directly into their checking or savings account. It's widely used for payroll, government benefits, and tax refunds. By using direct deposit, you can enjoy faster access to your money, reduced risk of lost or stolen checks, and less chance of identity theft. Moreover, direct deposit is often more cost-effective than traditional check payments, eliminating the need for check printing and mailing.

If you're new to Meta Bank or looking to update your existing direct deposit information, don't worry – the enrollment process is quick and straightforward. We'll walk you through each step, ensuring you understand the requirements and benefits of Meta Bank's direct deposit form.

Benefits of Meta Bank Direct Deposit

Meta Bank's direct deposit offers numerous advantages, including:

- Faster access to your money: With direct deposit, your funds are available in your account on the designated payment date, eliminating the need to wait for checks to clear.

- Increased security: Direct deposit reduces the risk of lost, stolen, or tampered checks, protecting your sensitive financial information.

- Convenience: Direct deposit eliminates the need to visit a bank branch or ATM to deposit checks, saving you time and effort.

- Cost-effectiveness: Direct deposit is often more cost-effective than traditional check payments, reducing the need for check printing and mailing.

Meta Bank Direct Deposit Form: Easy Enrollment Guide

To enroll in Meta Bank's direct deposit, follow these simple steps:

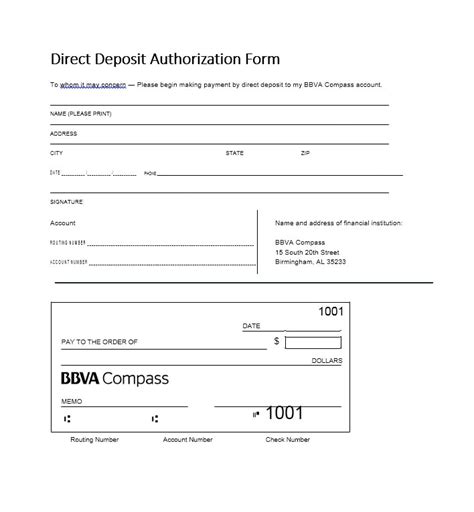

- Gather required information: You'll need your Meta Bank account number, routing number, and the type of account you want to deposit funds into (checking or savings).

- Obtain the direct deposit form: You can download the Meta Bank direct deposit form from the bank's official website or pick one up at a local branch. Alternatively, you can contact Meta Bank's customer service to request a form.

- Fill out the form: Complete the form with your account information, ensuring accuracy to avoid any delays or errors.

- Submit the form: Return the completed form to Meta Bank via mail, fax, or in-person at a local branch.

- Verify your account: Once Meta Bank receives your enrollment form, they'll verify your account information to ensure accurate deposits.

Common Uses for Meta Bank Direct Deposit

Meta Bank's direct deposit is commonly used for:

- Payroll deposits: Receive your salary or wages directly into your account.

- Government benefits: Get your social security, disability, or veterans' benefits deposited directly into your account.

- Tax refunds: Receive your tax refund quickly and securely via direct deposit.

- Student loan refunds: Get your student loan refund deposited directly into your account.

Troubleshooting Common Issues with Meta Bank Direct Deposit

If you encounter any issues with your Meta Bank direct deposit, try the following:

- Verify your account information: Ensure your account number and routing number are accurate.

- Check your deposit schedule: Confirm the payment date and time to ensure you're not missing a deposit.

- Contact Meta Bank's customer service: Reach out to the bank's customer support team for assistance with any issues or concerns.

Security and Protection with Meta Bank Direct Deposit

Meta Bank takes the security and protection of your financial information seriously. The bank's direct deposit system utilizes advanced security measures, including:

- Encryption: Your sensitive information is encrypted to prevent unauthorized access.

- Secure servers: Meta Bank's servers are protected by robust firewalls and intrusion detection systems.

- Monitoring: The bank's system is continuously monitored for suspicious activity.

Conclusion: Simplify Your Finances with Meta Bank Direct Deposit

In conclusion, Meta Bank's direct deposit form is a convenient and secure way to receive your funds. By following the easy enrollment guide outlined in this article, you can simplify your finances and enjoy faster access to your money. If you have any questions or concerns, don't hesitate to reach out to Meta Bank's customer service team. Take the first step towards a more streamlined financial experience – enroll in Meta Bank's direct deposit today!

We hope this article has been informative and helpful. If you have any questions or would like to share your experience with Meta Bank's direct deposit, please leave a comment below. Don't forget to share this article with friends and family who may benefit from this convenient payment method.

What is the Meta Bank direct deposit form used for?

+The Meta Bank direct deposit form is used to enroll in the bank's direct deposit service, which allows you to receive funds directly into your checking or savings account.

How do I obtain the Meta Bank direct deposit form?

+You can download the Meta Bank direct deposit form from the bank's official website, pick one up at a local branch, or contact Meta Bank's customer service to request a form.

Is Meta Bank's direct deposit secure?

+Yes, Meta Bank's direct deposit system utilizes advanced security measures, including encryption, secure servers, and continuous monitoring to protect your sensitive financial information.