As a Mercari seller, you're likely no stranger to the world of online marketplaces and the freedom that comes with being your own boss. However, with this freedom comes the responsibility of navigating the complexities of tax season. One crucial aspect of tax season is understanding and reporting your income using 1099 tax forms. In this comprehensive guide, we'll break down everything you need to know about 1099 tax forms and reporting as a Mercari seller.

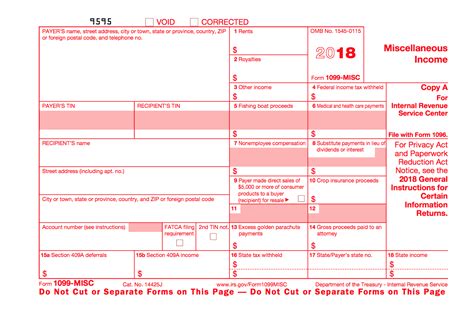

What is a 1099 Tax Form?

A 1099 tax form is a series of documents used by the Internal Revenue Service (IRS) to report various types of income that aren't subject to withholding taxes. As a Mercari seller, you'll receive a 1099-K form if you meet certain requirements, which we'll discuss later. The 1099-K form reports the gross amount of payment and third-party network transactions, such as those made through Mercari.

Who Receives a 1099-K Form?

Not all Mercari sellers will receive a 1099-K form. According to the IRS, a 1099-K form is required for sellers who have:

- Made over $20,000 in gross payments through Mercari

- Had more than 200 transactions through Mercari

If you meet these requirements, Mercari will send you a 1099-K form by January 31st of each year, detailing your earnings from the previous tax year.

**Understanding Your 1099-K Form**

Your 1099-K form will include the following information:

- Gross amount of payment: This is the total amount of money you earned through Mercari, before any fees or expenses.

- Third-party network transactions: This refers to the transactions made through Mercari, which are subject to reporting on the 1099-K form.

- Merchant category code: This code identifies the type of business or industry, which in this case, is online sales.

Reporting Your 1099-K Income

As a Mercari seller, you'll need to report your 1099-K income on your tax return. You'll use the information on your 1099-K form to complete Schedule C (Form 1040), which is the form used to report business income and expenses.

Here are the steps to follow:

- Complete Schedule C: Report your gross income from your 1099-K form on Schedule C, along with any business expenses you incurred.

- Calculate your net profit: Subtract your business expenses from your gross income to calculate your net profit.

- Report your net profit: Report your net profit on Form 1040, along with any other income you earned.

**Business Expenses and Deductions**

As a Mercari seller, you may be eligible to deduct business expenses on your tax return. Common business expenses for online sellers include:

- Shipping and postage: You can deduct the cost of shipping and postage for items sold through Mercari.

- Packaging materials: You can deduct the cost of packaging materials, such as boxes, bubble wrap, and tape.

- Inventory costs: You can deduct the cost of inventory, such as the cost of purchasing items to resell.

Tips for Accurate Reporting

To ensure accurate reporting, keep the following tips in mind:

- Keep accurate records: Keep accurate records of your income and expenses, including receipts and invoices.

- Use accounting software: Consider using accounting software, such as QuickBooks or Xero, to help track your income and expenses.

- Consult a tax professional: If you're unsure about how to report your 1099-K income, consider consulting a tax professional.

**Common Mistakes to Avoid**

Here are some common mistakes to avoid when reporting your 1099-K income:

- Not reporting all income: Make sure to report all income earned through Mercari, even if you didn't receive a 1099-K form.

- Not deducting business expenses: Don't miss out on deductions for business expenses, which can help reduce your tax liability.

- Not keeping accurate records: Keep accurate records of your income and expenses to avoid errors and potential audits.

Conclusion

Reporting your 1099-K income as a Mercari seller can seem overwhelming, but by following these tips and guidelines, you can ensure accurate reporting and minimize your tax liability. Remember to keep accurate records, deduct business expenses, and consult a tax professional if needed.

We hope this guide has been informative and helpful. If you have any questions or concerns, please leave a comment below.

What is a 1099-K form?

+A 1099-K form is a document used by the IRS to report gross payment and third-party network transactions, such as those made through Mercari.

Who receives a 1099-K form?

+Mercari sellers who have made over $20,000 in gross payments and had more than 200 transactions through Mercari will receive a 1099-K form.

How do I report my 1099-K income?

+You'll report your 1099-K income on Schedule C (Form 1040), along with any business expenses you incurred.