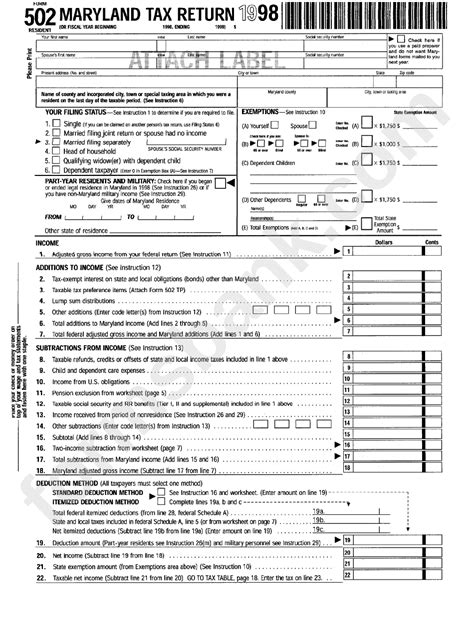

As a Maryland resident, filing your state income tax return can be a daunting task, especially if you're new to the process. The Maryland tax form 502 is the standard form used by individuals to report their income and claim any deductions or credits they're eligible for. To help make the process smoother, here are five tips for filing Maryland tax form 502.

Understanding the Filing Requirements

Before you start filling out the form, it's essential to understand who needs to file a Maryland state income tax return. You're required to file a return if your gross income meets certain thresholds, which vary depending on your filing status and age. For the 2022 tax year, you'll need to file a return if your gross income is at least $12,950 for single filers under 65, $19,400 for joint filers under 65, or $15,650 for single filers 65 and older.

Gathering Necessary Documents

To ensure a smooth filing process, gather all necessary documents before starting your return. These may include:

- Your W-2 forms from your employer(s)

- 1099 forms for any freelance or contract work

- Interest statements from banks and investments (1099-INT)

- Dividend statements (1099-DIV)

- Charitable donation receipts

- Medical expense receipts

- Any other relevant tax-related documents

Choosing the Right Filing Status

Your filing status affects the amount of taxes you owe and the deductions you're eligible for. Maryland recognizes the same filing statuses as the federal government:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Choose the status that best applies to your situation, and make sure to claim any dependents you're eligible for.

Claiming Deductions and Credits

Maryland offers various deductions and credits to help reduce your tax liability. Some of the most common include:

- Standard deduction: You can claim the standard deduction, which varies depending on your filing status and age.

- Itemized deductions: If you have significant medical expenses, mortgage interest, or charitable donations, you may be able to itemize your deductions.

- Earned Income Tax Credit (EITC): If you're a low-to-moderate income worker, you may be eligible for the EITC.

- Child and Dependent Care Credit: If you paid for child care or adult care while working or looking for work, you may be eligible for this credit.

Filing Options and Deadlines

You can file your Maryland tax form 502 electronically or by mail. Electronic filing is generally faster and more convenient, but you can also mail your return to the address listed on the form.

The deadline for filing your Maryland state income tax return is typically April 15th, but this can vary if you're filing an amended return or requesting an extension.

Seeking Help and Resources

If you're unsure about any aspect of the filing process, don't hesitate to seek help. You can:

- Visit the Maryland Comptroller's website for tax forms, instructions, and FAQs.

- Contact the Maryland Taxpayer Service Division for assistance with your return.

- Consult a tax professional or accountant for personalized guidance.

By following these tips and taking advantage of available resources, you can make filing your Maryland tax form 502 a more manageable and stress-free experience.

Additional Tips and Reminders

- Make sure to keep accurate records of your income, expenses, and tax-related documents.

- Take advantage of free or low-cost tax preparation services, such as the Volunteer Income Tax Assistance (VITA) program.

- Be aware of any tax law changes or updates that may affect your return.

- Consider using tax preparation software to help guide you through the filing process.

We hope these tips have been helpful in guiding you through the process of filing your Maryland tax form 502. If you have any further questions or concerns, don't hesitate to reach out to the Maryland Comptroller's office or a tax professional for assistance.

What is the deadline for filing Maryland tax form 502?

+The deadline for filing Maryland tax form 502 is typically April 15th, but this can vary if you're filing an amended return or requesting an extension.

Can I file my Maryland tax return electronically?

+Yes, you can file your Maryland tax return electronically through the Maryland Comptroller's website or through tax preparation software.

What is the standard deduction for Maryland tax form 502?

+The standard deduction for Maryland tax form 502 varies depending on your filing status and age. You can find the current standard deduction amounts on the Maryland Comptroller's website.