As a resident of Maryland, it's essential to understand the importance of filing your taxes correctly to avoid any penalties or delays in receiving your refund. One of the most critical forms you'll need to file is the Maryland Form 502R, which is used to report your resident income tax. In this article, we'll guide you through the process of filing Maryland Form 502R correctly, highlighting five key ways to ensure you get it right.

Understanding Maryland Form 502R

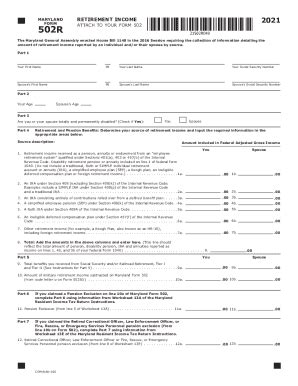

Before we dive into the five ways to file Maryland Form 502R correctly, let's take a moment to understand what this form is and why it's so important. Maryland Form 502R is the resident income tax return form, which is used to report your income, deductions, and credits to the state of Maryland. This form is typically filed annually, and the deadline is usually April 15th.

Who Needs to File Maryland Form 502R?

If you're a resident of Maryland, you're required to file Form 502R if you meet certain income thresholds. These thresholds vary depending on your filing status, age, and income level. Generally, if you're single and have a gross income of $10,000 or more, you'll need to file this form.

5 Ways to File Maryland Form 502R Correctly

Now that we've covered the basics, let's move on to the five ways to file Maryland Form 502R correctly.

1. Gather All Required Documents

Before you start filling out Form 502R, make sure you have all the necessary documents. These may include:

- Your W-2 forms from your employer(s)

- Your 1099 forms for any freelance or contract work

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's Social Security number or ITIN (if filing jointly)

- Any receipts or documentation for deductions or credits you're claiming

2. Choose the Correct Filing Status

Your filing status determines which tax rates and deductions you're eligible for. Make sure you choose the correct filing status on Form 502R. The options include:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

3. Report All Income

When filing Form 502R, you'll need to report all your income from various sources, including:

- Wages, salaries, and tips

- Interest and dividends

- Capital gains and losses

- Self-employment income

- Unemployment compensation

4. Claim All Eligible Deductions and Credits

Maryland offers various deductions and credits that can reduce your tax liability. Make sure you claim all the ones you're eligible for, including:

- Standard deduction

- Itemized deductions

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education credits

5. E-File or Mail Your Return Correctly

Once you've completed Form 502R, you'll need to submit it to the state of Maryland. You can either e-file your return or mail it to the address listed on the form. Make sure you follow the instructions carefully to avoid any delays or errors.

Common Mistakes to Avoid

When filing Maryland Form 502R, it's essential to avoid common mistakes that can lead to delays or penalties. Some of these mistakes include:

- Inaccurate or incomplete information

- Missing or incorrect Social Security numbers or ITINs

- Failure to report all income

- Incorrect filing status

- Missing or incomplete documentation for deductions and credits

Conclusion

Filing Maryland Form 502R correctly is crucial to avoid any penalties or delays in receiving your refund. By following the five ways outlined in this article, you can ensure you get it right. Remember to gather all required documents, choose the correct filing status, report all income, claim all eligible deductions and credits, and e-file or mail your return correctly. If you're unsure about any part of the process, consider consulting a tax professional or seeking guidance from the state of Maryland.

What's Next?

If you have any questions or concerns about filing Maryland Form 502R, we encourage you to leave a comment below. Share this article with your friends and family who may need help with their taxes. Don't forget to check out our other articles on tax-related topics for more valuable insights and tips.

What is the deadline for filing Maryland Form 502R?

+The deadline for filing Maryland Form 502R is typically April 15th.

Do I need to file Maryland Form 502R if I'm a non-resident?

+No, non-residents do not need to file Maryland Form 502R. However, you may need to file a non-resident return if you have income from Maryland sources.

Can I e-file my Maryland Form 502R?

+Yes, you can e-file your Maryland Form 502R through the state's website or through a tax preparation software.