The world of tax forms and paperwork can be overwhelming, especially for employees and employers in Maryland. One crucial form that plays a significant role in the state's tax system is the Maryland Employee Withholding Form. In this article, we will break down the complexities of this form and provide a clear understanding of its purpose, benefits, and how to fill it out correctly.

What is the Maryland Employee Withholding Form?

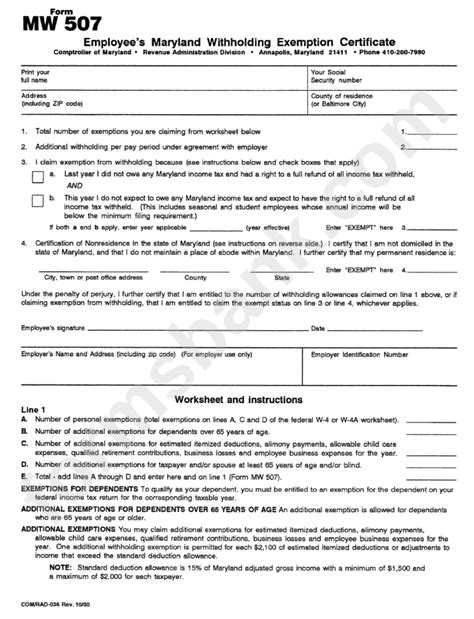

The Maryland Employee Withholding Form, also known as the MW507, is a document used by employees to claim their withholding exemptions and indicate their Maryland income tax withholding rate. This form is typically completed by employees when they start a new job or experience a change in their tax situation.

Why is the Maryland Employee Withholding Form Important?

The Maryland Employee Withholding Form is essential for several reasons:

- It helps employees claim their correct withholding exemptions, ensuring they don't overpay or underpay their state income taxes.

- It enables employers to accurately withhold Maryland state income taxes from employees' wages.

- It provides the Maryland Comptroller's Office with the necessary information to process tax returns and refunds efficiently.

Benefits of Completing the Maryland Employee Withholding Form

Completing the Maryland Employee Withholding Form offers several benefits to employees, including:

- Reduced risk of overpayment or underpayment of state income taxes

- Accurate withholding of taxes, which helps avoid penalties and interest

- Efficient processing of tax returns and refunds

- Opportunity to claim exemptions and reduce tax liability

How to Fill Out the Maryland Employee Withholding Form

To fill out the Maryland Employee Withholding Form correctly, follow these steps:

- Section 1: Employee Information

- Provide your name, address, and Social Security number.

- Enter your employer's name, address, and federal employer identification number (FEIN).

- Section 2: Withholding Exemptions

- Claim your withholding exemptions, including the number of allowances and any additional exemptions.

- Indicate if you are exempt from Maryland state income tax withholding.

- Section 3: Withholding Rate

- Choose your Maryland income tax withholding rate (2%, 4.75%, or 5.2%).

- Indicate if you want to have an additional amount withheld from each paycheck.

- Section 4: Signature and Date

- Sign and date the form to certify the information provided is accurate.

Common Mistakes to Avoid When Completing the Maryland Employee Withholding Form

When completing the Maryland Employee Withholding Form, avoid the following common mistakes:

- Incorrect Social Security number: Double-check your Social Security number to ensure it is accurate.

- Insufficient or incorrect withholding exemptions: Review your withholding exemptions carefully to avoid overpayment or underpayment of taxes.

- Failure to sign and date the form: Sign and date the form to certify the information provided is accurate.

What Happens if You Don't Complete the Maryland Employee Withholding Form?

If you fail to complete the Maryland Employee Withholding Form, you may face the following consequences:

- Overpayment or underpayment of taxes: You may overpay or underpay your state income taxes, leading to penalties and interest.

- Delayed tax refunds: The Maryland Comptroller's Office may delay processing your tax return and refund.

- Employer penalties: Your employer may face penalties for failing to withhold the correct amount of state income taxes.

Additional Resources for the Maryland Employee Withholding Form

For more information on the Maryland Employee Withholding Form, visit the following resources:

- Maryland Comptroller's Office: Visit the official website for forms, instructions, and FAQs.

- IRS Website: Review the IRS website for information on federal income tax withholding and exemptions.

- Tax Professionals: Consult with a tax professional or accountant for personalized guidance on completing the Maryland Employee Withholding Form.

What is the purpose of the Maryland Employee Withholding Form?

+The Maryland Employee Withholding Form (MW507) is used by employees to claim their withholding exemptions and indicate their Maryland income tax withholding rate.

How do I fill out the Maryland Employee Withholding Form?

+To fill out the form correctly, follow these steps: Section 1: Employee Information, Section 2: Withholding Exemptions, Section 3: Withholding Rate, and Section 4: Signature and Date.

What happens if I don't complete the Maryland Employee Withholding Form?

+If you fail to complete the form, you may face consequences such as overpayment or underpayment of taxes, delayed tax refunds, and employer penalties.

We hope this article has provided a clear understanding of the Maryland Employee Withholding Form and its importance. If you have any further questions or concerns, please don't hesitate to ask. Share your thoughts and experiences in the comments section below.