As a resident of Louisiana, it's essential to understand the tax filing process to avoid any penalties or fines. One crucial aspect of tax filing is the Louisiana Tax Form Schedule E, which reports income and expenses related to rental properties, royalties, and other investments. In this article, we will delve into the details of Schedule E, its importance, and provide a step-by-step guide on how to file it accurately.

What is Schedule E?

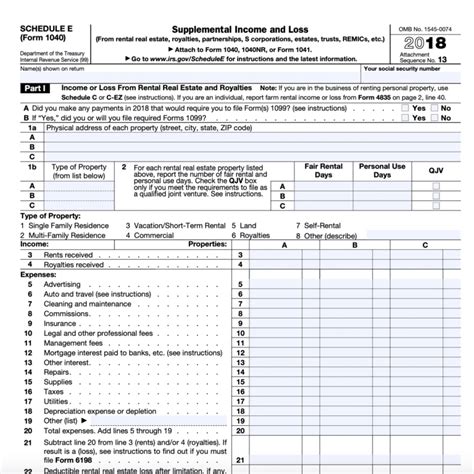

Schedule E is a supplemental tax form that reports income and expenses related to rental properties, royalties, and other investments. It's a critical component of the Louisiana state tax return, as it helps calculate the taxpayer's net income from these sources. Schedule E is divided into two parts: Part I reports income and expenses from rental properties and royalties, while Part II reports income and expenses from other investments, such as partnerships and S corporations.

Why is Schedule E Important?

Schedule E is essential because it helps taxpayers report their income and expenses accurately, which in turn affects their overall tax liability. Failing to file Schedule E or reporting incorrect information can result in penalties, fines, and even audits. By accurately completing Schedule E, taxpayers can ensure they are taking advantage of all the deductions and credits available to them.

Who Needs to File Schedule E?

Not everyone needs to file Schedule E. Typically, individuals who own rental properties, receive royalties, or have investments in partnerships or S corporations need to file this form. If you're unsure whether you need to file Schedule E, consult with a tax professional or review the instructions provided by the Louisiana Department of Revenue.

How to File Schedule E: A Step-by-Step Guide

Filing Schedule E can seem daunting, but by following these steps, you can ensure accuracy and avoid any potential issues.

- Gather Required Documents: Before starting, gather all necessary documents, including:

- Rental property income statements

- Royalty statements

- Partnership and S corporation income statements

- Expenses related to these investments

- Complete Part I: Rental Properties and Royalties:

- Report rental income and expenses on Line 1-4

- Report royalty income and expenses on Line 5-8

- Complete Part II: Other Investments:

- Report partnership and S corporation income on Line 9-12

- Report expenses related to these investments on Line 13-16

- Calculate Net Income: Calculate the net income from rental properties, royalties, and other investments by subtracting total expenses from total income.

- Report Net Income on Form IT-540: Report the net income from Schedule E on Line 12 of Form IT-540, the Louisiana state tax return.

Common Mistakes to Avoid

When filing Schedule E, it's essential to avoid common mistakes that can lead to penalties or audits. Some common mistakes include:

- Failing to report all income and expenses

- Incorrectly calculating net income

- Failing to sign and date the form

Tips for Accurate Filing

To ensure accurate filing, follow these tips:

- Consult with a tax professional if you're unsure about any aspect of Schedule E

- Keep accurate records of income and expenses throughout the year

- Double-check calculations and ensure all required fields are completed

Conclusion

Filing Schedule E is a critical aspect of the Louisiana state tax return process. By understanding the importance of Schedule E and following the step-by-step guide provided, taxpayers can ensure accurate reporting of their income and expenses. Remember to avoid common mistakes and seek professional help if needed. By doing so, you'll be well on your way to a stress-free tax filing experience.

We encourage you to share your experiences or questions about filing Schedule E in the comments below. Don't forget to share this article with friends and family who may benefit from this information.

What is the deadline for filing Schedule E?

+The deadline for filing Schedule E is typically April 15th, but it may vary depending on the taxpayer's situation. Consult with a tax professional or review the instructions provided by the Louisiana Department of Revenue for specific guidance.

Can I file Schedule E electronically?

+Yes, you can file Schedule E electronically through the Louisiana Department of Revenue's website or through a tax preparation software. Consult with a tax professional for guidance on electronic filing options.

What happens if I fail to file Schedule E?

+Failing to file Schedule E can result in penalties, fines, and even audits. It's essential to file Schedule E accurately and on time to avoid any potential issues.