As a business owner, navigating the complexities of tax laws and forms can be a daunting task. One form that often raises questions is the LLC-12NC form. If you're an LLC owner in North Carolina, understanding this form is crucial for compliance with state regulations. Here's what you need to know about the LLC-12NC form.

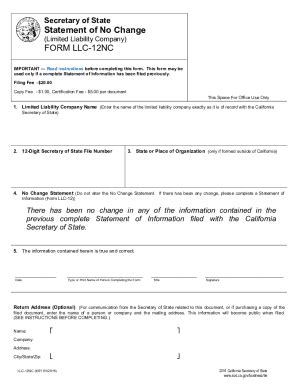

What is the LLC-12NC Form?

The LLC-12NC form is a document required by the North Carolina Department of Revenue for Limited Liability Companies (LLCs) operating within the state. It serves as a notice to the department of the LLC's existence and its intention to do business in North Carolina. This form is crucial for new LLCs, as it facilitates registration and compliance with state tax laws.

Purpose and Function of the LLC-12NC Form

The primary purpose of the LLC-12NC form is to register your LLC with the North Carolina Department of Revenue. By submitting this form, you're providing essential information about your business, such as its name, address, and the names of its owners (or members). This information is used to create a record of your LLC's existence and to determine its tax obligations.

Key Information Required on the LLC-12NC Form

When completing the LLC-12NC form, you'll need to provide the following information:

- Business name and address

- Federal Employer Identification Number (FEIN)

- Names and addresses of all LLC members

- Description of the business's primary activity

- Name and title of the person filing the form

Who Needs to File the LLC-12NC Form?

The LLC-12NC form is required for all LLCs operating in North Carolina. This includes:

- Domestic LLCs (formed in North Carolina)

- Foreign LLCs (formed outside of North Carolina but doing business in the state)

If your LLC is not registered with the North Carolina Department of Revenue, you'll need to file the LLC-12NC form to avoid penalties and fines.

How to File the LLC-12NC Form

The LLC-12NC form can be filed online or by mail. Here are the steps to follow:

- Online filing: Visit the North Carolina Department of Revenue's website and submit the form through their online portal.

- Mail filing: Download the form from the department's website, complete it, and mail it to the address listed on the form.

LLC-12NC Form Filing Deadline

The LLC-12NC form must be filed within 30 days of forming your LLC or within 30 days of the beginning of the tax year. Failure to file the form by the deadline may result in penalties and fines.

Penalties for Not Filing the LLC-12NC Form

If you fail to file the LLC-12NC form, your LLC may be subject to penalties and fines. These can include:

- Late filing fees

- Interest on unpaid taxes

- Loss of business license

To avoid these penalties, it's essential to file the LLC-12NC form on time and accurately.

Conclusion: Why the LLC-12NC Form Matters

The LLC-12NC form is a critical document for LLCs operating in North Carolina. By understanding its purpose, requirements, and filing process, you can ensure compliance with state regulations and avoid penalties. Don't neglect this essential step in registering your LLC – file the LLC-12NC form today.

What is the LLC-12NC form used for?

+The LLC-12NC form is used to register your LLC with the North Carolina Department of Revenue.

Who needs to file the LLC-12NC form?

+All LLCs operating in North Carolina, including domestic and foreign LLCs.

What happens if I don't file the LLC-12NC form?

+If you fail to file the LLC-12NC form, your LLC may be subject to penalties and fines, including late filing fees, interest on unpaid taxes, and loss of business license.

We hope you found this article informative and helpful in understanding the LLC-12NC form. If you have any further questions or concerns, please don't hesitate to comment below or share this article with others who may benefit from this information.