As the tax season approaches, many individuals and businesses in Kentucky are preparing to file their taxes. One of the most important forms for Kentucky residents is the KY Form 740, also known as the Kentucky Individual Income Tax Return. In this article, we will delve into the world of Kentucky tax filing, explaining the ins and outs of KY Form 740, its requirements, and how to navigate the process with ease.

What is KY Form 740?

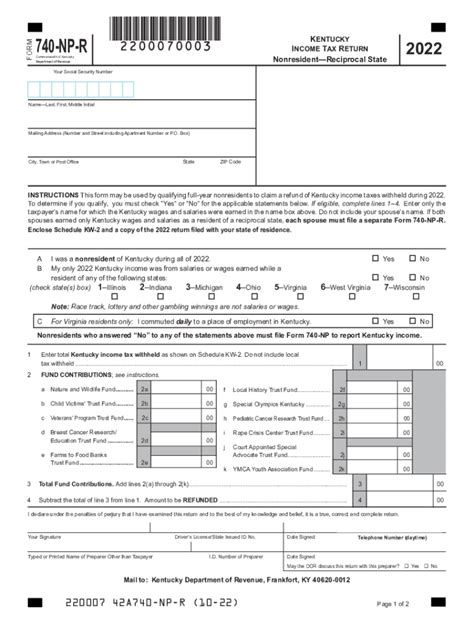

KY Form 740 is the primary form used by individuals to file their state income taxes in Kentucky. The form is used to report income, claim deductions and credits, and calculate the amount of taxes owed to the state. The Kentucky Department of Revenue (DOR) requires all residents to file a KY Form 740 if their gross income exceeds a certain threshold.

Who Needs to File KY Form 740?

Not everyone is required to file a KY Form 740. However, if you meet any of the following conditions, you are required to file:

- You are a Kentucky resident and your gross income exceeds $12,000 ($24,000 for joint filers).

- You have Kentucky-sourced income and are required to file a federal income tax return.

- You are a non-resident with Kentucky-sourced income.

Filing Status and Residency

When filing KY Form 740, you will need to determine your filing status and residency. Kentucky recognizes the same filing statuses as the federal government:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Kentucky also recognizes two types of residency: resident and non-resident. Residents are individuals who have lived in Kentucky for at least six months of the tax year. Non-residents are individuals who have lived in Kentucky for less than six months.

Determining Residency

To determine your residency, you will need to answer a series of questions on KY Form 740. These questions include:

- Did you maintain a home in Kentucky for the entire tax year?

- Did you spend more than six months in Kentucky during the tax year?

- Did you file a Kentucky income tax return for the previous tax year?

Income and Deductions

When completing KY Form 740, you will need to report all income earned during the tax year. This includes:

- Wages, salaries, and tips

- Interest and dividends

- Capital gains and losses

- Business income

- Rental income

You may also be eligible for various deductions and credits, including:

- Standard deduction

- Itemized deductions

- Earned income tax credit (EITC)

- Child tax credit

Itemized Deductions

Itemized deductions can help reduce your taxable income. Common itemized deductions include:

- Medical expenses

- Mortgage interest

- Charitable donations

- State and local taxes

Credits and Refunds

Kentucky offers various credits and refunds to help reduce your tax liability. These include:

- Earned income tax credit (EITC)

- Child tax credit

- Education credit

- Kentucky tax credit for low-income individuals

Refund Options

If you are eligible for a refund, you can choose from several options:

- Direct deposit

- Paper check

- Kentucky Education Savings Plan (KESPA)

Filing KY Form 740

KY Form 740 can be filed electronically or by mail. The Kentucky DOR recommends e-filing, as it is faster and more accurate.

E-Filing Options

You can e-file KY Form 740 using:

- Kentucky's online tax filing system

- Tax preparation software

- A tax professional

Paying Kentucky State Taxes

If you owe taxes, you can pay online, by phone, or by mail. The Kentucky DOR accepts several payment options, including:

- Electronic funds transfer (EFT)

- Credit/debit card

- Check or money order

Payment Plans

If you are unable to pay your tax bill in full, you may be eligible for a payment plan. The Kentucky DOR offers several payment plan options, including:

- Installment agreement

- Temporary hardship

Amending KY Form 740

If you need to make changes to your KY Form 740, you can file an amended return. You will need to complete KY Form 740-X, which is the amended Kentucky individual income tax return.

Reasons for Amending

You may need to amend your KY Form 740 if:

- You received additional income or deductions

- You need to correct errors or omissions

- You need to claim a credit or deduction you missed

Conclusion

Filing KY Form 740 can seem overwhelming, but with the right guidance, you can navigate the process with ease. Remember to determine your filing status and residency, report all income, claim deductions and credits, and pay any taxes owed. If you need to make changes, you can file an amended return. Don't hesitate to reach out to a tax professional or the Kentucky DOR if you have any questions or concerns.

What is the deadline for filing KY Form 740?

+The deadline for filing KY Form 740 is typically April 15th of each year.

Can I e-file KY Form 740?

+Yes, you can e-file KY Form 740 using Kentucky's online tax filing system, tax preparation software, or a tax professional.

What is the penalty for not filing KY Form 740?

+The penalty for not filing KY Form 740 can range from 10% to 47.6% of the tax owed, depending on the circumstances.