As a student, understanding the tax benefits available to you can be a daunting task. However, with the right guidance, you can take advantage of these benefits and reduce your tax liability. Keiser University, a prominent institution of higher education, provides its students with the necessary tools to navigate the complex world of taxation. One such tool is the 1098-T form, which plays a crucial role in helping students claim tax credits and deductions. In this article, we will delve into the world of tax benefits for students, focusing on the Keiser University 1098-T form.

Understanding the 1098-T Form

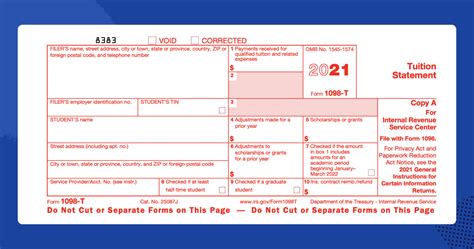

The 1098-T form, also known as the Tuition Statement, is a document provided by educational institutions to their students. It reports the amount of tuition and fees paid by the student during the tax year. This form is essential for students who want to claim tax credits and deductions on their tax returns.

Tax Benefits for Students

Keiser University students can claim two primary tax benefits: the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). Both credits can help reduce the amount of taxes owed, but they have different eligibility requirements and benefits.

American Opportunity Tax Credit (AOTC)

Eligibility and Benefits

The AOTC is a tax credit of up to $2,500 per eligible student. To qualify, students must:

- Be pursuing a degree at an eligible educational institution

- Be enrolled at least half-time for at least one academic period

- Not have filed for the AOTC or the Hope credit in more than four tax years

- Not have a felony conviction

The AOTC can be claimed for expenses related to tuition and fees, course materials, and equipment.

Lifetime Learning Credit (LLC)

Eligibility and Benefits

The LLC is a tax credit of up to $2,000 per tax return. To qualify, students must:

- Be enrolled in a course at an eligible educational institution

- Be taking the course to acquire or improve job skills

- Not have filed for the LLC in more than one tax year for the same student

The LLC can be claimed for expenses related to tuition and fees, course materials, and equipment.

How to Claim Tax Credits and Deductions

To claim tax credits and deductions, Keiser University students must follow these steps:

- Obtain the 1098-T form: Students can access their 1098-T form through the Keiser University website or by contacting the university's financial aid office.

- Gather required documents: Students will need to gather receipts and invoices for tuition and fees, course materials, and equipment.

- Complete tax forms: Students must complete the necessary tax forms, including Form 8863 for the AOTC and Form 8863 for the LLC.

- Claim tax credits and deductions: Students can claim tax credits and deductions on their tax returns, using the information from their 1098-T form and other supporting documents.

Additional Tax Benefits for Students

In addition to tax credits and deductions, Keiser University students may be eligible for other tax benefits, including:

- Student loan interest deduction: Students can deduct the interest paid on their student loans, up to $2,500.

- Education expenses: Students can deduct education expenses, including tuition and fees, course materials, and equipment.

Conclusion

Tax benefits for students can be complex and overwhelming, but with the right guidance, Keiser University students can take advantage of these benefits and reduce their tax liability. The 1098-T form is a crucial tool in this process, providing students with the necessary information to claim tax credits and deductions. By understanding the tax benefits available to them, Keiser University students can focus on their studies, knowing that they are taking advantage of the tax savings available to them.

Frequently Asked Questions

What is the 1098-T form?

+The 1098-T form, also known as the Tuition Statement, is a document provided by educational institutions to their students. It reports the amount of tuition and fees paid by the student during the tax year.

What tax credits and deductions are available to Keiser University students?

+Keiser University students may be eligible for the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). Additionally, students may be eligible for the student loan interest deduction and education expenses deduction.

How do I claim tax credits and deductions?

+To claim tax credits and deductions, students must obtain the 1098-T form, gather required documents, complete tax forms, and claim tax credits and deductions on their tax returns.