Filling out tax forms can be a daunting task, especially when dealing with complex forms like the IRS Form 982. However, with the right guidance, you can navigate the process with ease. In this article, we will break down the essential steps to fill out IRS Form 982, also known as the Reduction of Tax Attributes Due to Discharge of Indebtedness.

Before we dive into the steps, it's essential to understand the purpose of Form 982. This form is used to report the reduction of tax attributes due to the discharge of indebtedness. When a lender forgives a debt, the borrower may be required to report the forgiven amount as taxable income. However, there are exceptions to this rule, and Form 982 is used to claim these exceptions.

Understanding the Importance of Form 982

Filling out Form 982 accurately is crucial to avoid any penalties or interest on your tax return. The form helps you calculate the reduction of tax attributes, such as the basis of assets, due to the discharge of indebtedness. By following the steps outlined in this article, you can ensure that you fill out the form correctly and avoid any potential issues with the IRS.

Step 1: Determine if You Need to File Form 982

Determining the Need to File Form 982

Before you start filling out Form 982, you need to determine if you are required to file it. You will need to file Form 982 if you have received a discharge of indebtedness, and the forgiven amount is taxable. You will receive a Form 1099-C from the lender, which will show the amount of debt forgiven.

However, there are exceptions to this rule. You may not need to file Form 982 if the debt was forgiven due to:

- Insolvency

- Bankruptcy

- Qualified farm indebtedness

- Qualified real property business indebtedness

If you are unsure whether you need to file Form 982, it's best to consult with a tax professional or the IRS.

Step 2: Gather Required Documents

Gathering Required Documents

To fill out Form 982 accurately, you will need to gather the required documents. These documents include:

- Form 1099-C, which shows the amount of debt forgiven

- A copy of the debt forgiveness agreement

- A copy of the tax return for the year the debt was forgiven

Step 3: Complete Part I of Form 982

Completing Part I of Form 982

Part I of Form 982 requires you to provide information about the debt that was forgiven. You will need to enter the following information:

- The date the debt was forgiven

- The amount of debt forgiven

- The type of debt forgiven (e.g., mortgage, credit card, etc.)

Step 4: Complete Part II of Form 982

Completing Part II of Form 982

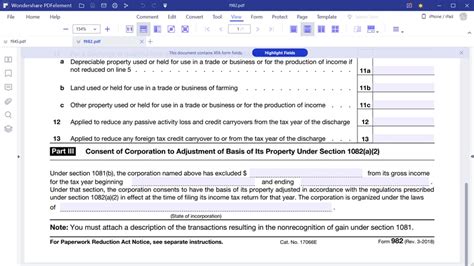

Part II of Form 982 requires you to calculate the reduction of tax attributes. You will need to enter the following information:

- The basis of the assets affected by the debt forgiveness

- The amount of tax attributes reduced

Step 5: Claim Exceptions to the Rule

Claiming Exceptions to the Rule

If you qualify for an exception to the rule, you will need to claim it on Form 982. The exceptions include:

- Insolvency

- Bankruptcy

- Qualified farm indebtedness

- Qualified real property business indebtedness

You will need to complete the relevant sections of the form and attach supporting documentation.

Step 6: Calculate the Reduction of Tax Attributes

Calculating the Reduction of Tax Attributes

Once you have completed Part II of Form 982, you will need to calculate the reduction of tax attributes. This will involve calculating the amount of tax attributes reduced due to the debt forgiveness.

Step 7: Review and Submit the Form

Reviewing and Submitting the Form

Once you have completed Form 982, you will need to review it carefully to ensure accuracy. You should also attach any supporting documentation, such as the debt forgiveness agreement and Form 1099-C.

You can submit Form 982 with your tax return or as an amended return. If you are unsure about how to submit the form, it's best to consult with a tax professional or the IRS.

Frequently Asked Questions

What is the purpose of Form 982?

+Form 982 is used to report the reduction of tax attributes due to the discharge of indebtedness.

Who needs to file Form 982?

+You will need to file Form 982 if you have received a discharge of indebtedness, and the forgiven amount is taxable.

What exceptions are available to the rule?

+The exceptions include insolvency, bankruptcy, qualified farm indebtedness, and qualified real property business indebtedness.

By following the steps outlined in this article, you can ensure that you fill out Form 982 accurately and avoid any potential issues with the IRS. Remember to gather all the required documents, complete the form carefully, and claim any exceptions to the rule. If you are unsure about any part of the process, it's best to consult with a tax professional or the IRS.