Are you a taxpayer looking to exclude interest from Series EE bonds from your taxable income? If so, you'll need to file IRS Form 8815, also known as the Exclusion of Interest from Series EE Bonds. In this article, we'll delve into the details of Form 8815, explaining its purpose, eligibility requirements, and step-by-step instructions on how to complete it.

What is IRS Form 8815?

IRS Form 8815 is used to report the exclusion of interest from Series EE bonds from taxable income. Series EE bonds are a type of savings bond issued by the U.S. Department of the Treasury. The interest earned on these bonds is generally taxable; however, if you meet certain requirements, you may be eligible to exclude the interest from your taxable income.

Who is eligible to file Form 8815?

To be eligible to file Form 8815, you must meet the following requirements:

- You must have purchased Series EE bonds after 1989.

- You must have been 24 years or older before the bond's issue date.

- You must have used the bond proceeds to pay for higher education expenses, such as tuition and fees, for yourself, your spouse, or your dependents.

- You must have a qualified education institution, which includes accredited colleges, universities, and vocational schools.

How to complete Form 8815

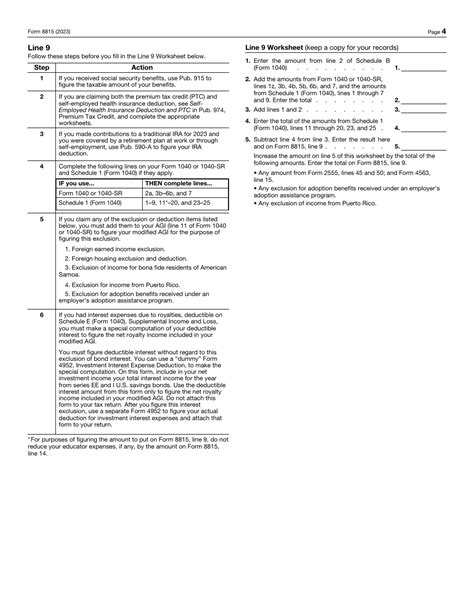

Completing Form 8815 is a straightforward process. Here's a step-by-step guide to help you:

- Gather required information: You'll need to gather the following information:

- Your name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN).

- The bond's serial number, issue date, and face value.

- The interest earned on the bond.

- The amount of qualified education expenses paid.

- Complete Part I: Bond Information: Enter the bond's serial number, issue date, and face value in Part I of the form.

- Complete Part II: Interest Earned: Calculate the interest earned on the bond and enter it in Part II.

- Complete Part III: Qualified Education Expenses: Enter the amount of qualified education expenses paid in Part III.

- Calculate the exclusion: Calculate the exclusion by subtracting the qualified education expenses from the interest earned. Enter the result in Part IV.

- Sign and date the form: Sign and date the form, and attach it to your tax return (Form 1040).

Benefits of filing Form 8815

Filing Form 8815 can provide several benefits, including:

- Reduced taxable income: By excluding the interest earned on Series EE bonds, you can reduce your taxable income, which may lower your tax liability.

- Increased refund: If you're eligible to exclude the interest, you may be entitled to a larger refund.

- Simplified tax preparation: Filing Form 8815 can simplify your tax preparation process, as you won't need to report the interest earned on your tax return.

Common mistakes to avoid

When completing Form 8815, be sure to avoid the following common mistakes:

- Incorrect bond information: Ensure you enter the correct bond serial number, issue date, and face value.

- Inaccurate interest calculation: Calculate the interest earned accurately to avoid errors.

- Insufficient documentation: Keep records of qualified education expenses paid, as you may need to provide documentation to support your exclusion.

Additional resources

For more information on IRS Form 8815, you can:

- Visit the IRS website: The IRS website provides detailed instructions and FAQs on Form 8815.

- Consult a tax professional: If you're unsure about completing Form 8815, consider consulting a tax professional or financial advisor.

- Contact the IRS: Reach out to the IRS directly if you have questions or concerns about Form 8815.

Conclusion

Filing IRS Form 8815 can be a straightforward process if you understand the requirements and follow the step-by-step instructions. By excluding the interest earned on Series EE bonds from your taxable income, you can reduce your tax liability and simplify your tax preparation process. Remember to avoid common mistakes and seek additional resources if needed.

Now that you've learned about IRS Form 8815, take the next step and start preparing your form today!

Share your experience: Have you filed Form 8815 before? Share your experience and tips in the comments below.

Get help: If you have questions or concerns about Form 8815, ask in the comments, and we'll do our best to assist you.

What is the deadline to file Form 8815?

+The deadline to file Form 8815 is typically April 15th of each year, or the due date of your tax return (Form 1040).

Can I file Form 8815 electronically?

+Yes, you can file Form 8815 electronically through the IRS Free File program or by using tax software.

What happens if I don't file Form 8815?

+If you don't file Form 8815, you may be subject to penalties and interest on the unpaid taxes.