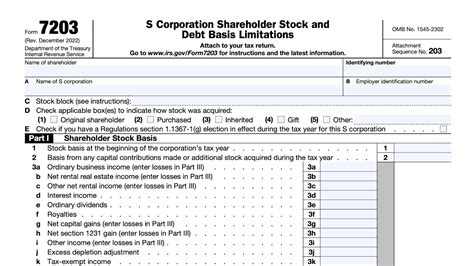

The IRS Form 7203, also known as the S Corporation Shareholder Stock and Debt Basis Limitations, is a crucial document for S corporations and their shareholders. It's essential to understand the purpose, benefits, and filing guidelines of this form to ensure compliance with the IRS regulations. In this article, we'll delve into the details of IRS Form 7203, provide examples, and outline the filing guidelines to help you navigate the process.

What is IRS Form 7203?

IRS Form 7203 is used by S corporations to report the stock and debt basis limitations for each shareholder. The form is used to calculate the shareholder's basis in the corporation's stock and debt, which is essential for determining the taxable income or loss that can be passed through to the shareholders. The form is typically filed with the corporation's tax return, Form 1120S.

Purpose of IRS Form 7203

The primary purpose of IRS Form 7203 is to:

- Calculate the shareholder's basis in the corporation's stock and debt

- Determine the taxable income or loss that can be passed through to the shareholders

- Ensure compliance with the IRS regulations regarding S corporation shareholder basis

Benefits of Filing IRS Form 7203

Filing IRS Form 7203 provides several benefits to S corporations and their shareholders, including:

- Accurate calculation of shareholder basis, which is essential for determining taxable income or loss

- Compliance with IRS regulations, reducing the risk of penalties and audits

- Transparency and accountability, as the form provides a clear record of shareholder basis and taxable income or loss

Example of IRS Form 7203

Here's an example of how to complete IRS Form 7203:

- Corporation X has two shareholders, A and B, who own 50% of the corporation's stock each.

- Corporation X has $100,000 in stock basis and $50,000 in debt basis.

- Shareholder A has a basis in the corporation's stock of $50,000 and debt basis of $25,000.

- Shareholder B has a basis in the corporation's stock of $50,000 and debt basis of $25,000.

The form would be completed as follows:

| Shareholder | Stock Basis | Debt Basis |

|---|---|---|

| A | $50,000 | $25,000 |

| B | $50,000 | $25,000 |

Filing Guidelines for IRS Form 7203

Here are the filing guidelines for IRS Form 7203:

- The form must be filed with the corporation's tax return, Form 1120S.

- The form must be completed for each shareholder who has a basis in the corporation's stock and debt.

- The form must be signed by an authorized representative of the corporation.

- The form must be filed by the due date of the corporation's tax return, which is typically March 15th for calendar-year corporations.

Who Must File IRS Form 7203?

The following must file IRS Form 7203:

- S corporations with shareholders who have a basis in the corporation's stock and debt.

- Shareholders who have a basis in the corporation's stock and debt.

Penalties for Not Filing IRS Form 7203

Failure to file IRS Form 7203 can result in penalties, including:

- Late filing penalty: $50 per day, up to a maximum of $1,000

- Accuracy-related penalty: 20% of the understated tax liability

- Failure to pay penalty: 0.5% of the unpaid tax liability per month, up to a maximum of 25%

Conclusion

IRS Form 7203 is a critical document for S corporations and their shareholders. It's essential to understand the purpose, benefits, and filing guidelines of this form to ensure compliance with the IRS regulations. By following the guidelines outlined in this article, you can ensure accurate calculation of shareholder basis, transparency, and accountability.

What is the purpose of IRS Form 7203?

+The primary purpose of IRS Form 7203 is to calculate the shareholder's basis in the corporation's stock and debt, determine the taxable income or loss that can be passed through to the shareholders, and ensure compliance with the IRS regulations regarding S corporation shareholder basis.

Who must file IRS Form 7203?

+S corporations with shareholders who have a basis in the corporation's stock and debt, and shareholders who have a basis in the corporation's stock and debt.

What are the penalties for not filing IRS Form 7203?

+Failure to file IRS Form 7203 can result in penalties, including late filing penalty, accuracy-related penalty, and failure to pay penalty.