The Internal Revenue Service (IRS) is a crucial institution in the United States, responsible for collecting taxes and enforcing tax laws. However, receiving a notice from the IRS can be intimidating, especially if it's regarding a tax deficiency. One such notice is the IRS Form 5564, Notice of Deficiency. In this article, we will delve into the world of IRS Form 5564, explaining what it is, why you might receive it, and most importantly, how to handle it.

Understanding IRS Form 5564: Notice of Deficiency

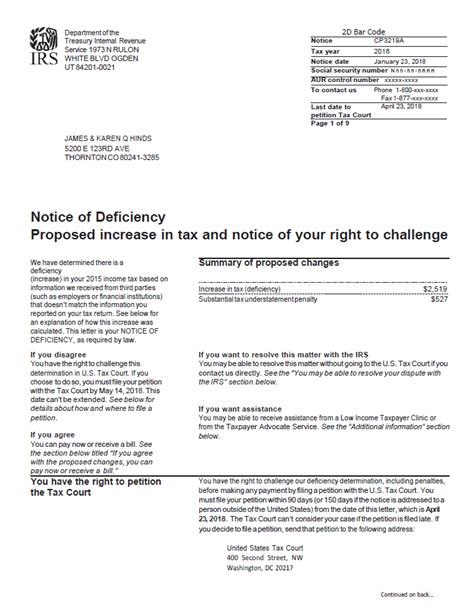

The IRS Form 5564, Notice of Deficiency, is a formal notification from the IRS that you owe additional taxes, penalties, or interest. This notice is usually sent after the IRS has reviewed your tax return and determined that you have underpaid your taxes. The notice will outline the amount of the deficiency, as well as any penalties and interest that have accrued.

Why You Might Receive a Notice of Deficiency

There are several reasons why you might receive a Notice of Deficiency from the IRS. Some common reasons include:

- Underreporting income

- Overclaiming deductions or credits

- Failing to report certain types of income

- Not filing a tax return

- Making mathematical errors on your tax return

5 Ways to Handle a Notice of Deficiency

Receiving a Notice of Deficiency can be overwhelming, but it's essential to take action promptly to avoid additional penalties and interest. Here are five ways to handle a Notice of Deficiency:

1. Review the Notice Carefully

When you receive a Notice of Deficiency, it's crucial to review it carefully to understand the reasons for the deficiency and the amount owed. Check the notice for any errors or discrepancies, and make sure you understand the calculations.

2. Respond to the Notice

You have 90 days from the date of the notice to respond to the IRS. You can either:

- Pay the deficiency in full

- Request a payment plan

- Disagree with the notice and appeal

Make sure to respond promptly to avoid additional penalties and interest.

3. Pay the Deficiency

If you agree with the notice, you can pay the deficiency in full. You can pay online, by phone, or by mail. Make sure to include the notice number and your tax ID number to ensure the payment is applied correctly.

4. Request a Payment Plan

If you're unable to pay the deficiency in full, you can request a payment plan. The IRS offers several payment options, including installment agreements and currently not collectible status. You can apply for a payment plan online or by phone.

5. Appeal the Notice

If you disagree with the notice, you can appeal it. You'll need to submit a written protest to the IRS, explaining why you disagree with the notice. You can also request a conference with an IRS appeals officer to discuss your case.

Additional Tips for Handling a Notice of Deficiency

Here are some additional tips for handling a Notice of Deficiency:

- Don't ignore the notice. Failure to respond can result in additional penalties and interest.

- Seek professional help. A tax professional or attorney can help you navigate the process and ensure you're taking the right steps.

- Keep records. Keep a copy of the notice and any correspondence with the IRS.

- Be proactive. Don't wait until the last minute to respond to the notice.

Conclusion

Receiving a Notice of Deficiency from the IRS can be intimidating, but it's essential to take action promptly to avoid additional penalties and interest. By understanding the notice, reviewing it carefully, and responding promptly, you can resolve the issue and avoid further complications. Remember to seek professional help if you're unsure about how to handle the notice, and keep records of all correspondence with the IRS.

We hope this article has provided you with valuable information on how to handle a Notice of Deficiency from the IRS. If you have any questions or comments, please feel free to share them below.

What is a Notice of Deficiency?

+A Notice of Deficiency is a formal notification from the IRS that you owe additional taxes, penalties, or interest.

Why did I receive a Notice of Deficiency?

+You may have received a Notice of Deficiency due to underreporting income, overclaiming deductions or credits, or failing to report certain types of income.

How do I respond to a Notice of Deficiency?

+You can respond to a Notice of Deficiency by paying the deficiency in full, requesting a payment plan, or appealing the notice.