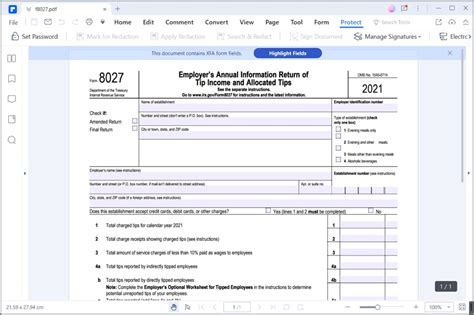

Filing employment taxes can be a daunting task, especially for small business owners and payroll professionals. One crucial form that employers must submit annually is Form 8027, the Employer's Annual Information Return of Tip Income and Allocated Tips. In this article, we will guide you through the process of completing Form 8027 in 5 easy steps.

The importance of accurate and timely filing of Form 8027 cannot be overstated. The form helps the IRS track and report tip income, ensuring that employees pay their fair share of taxes. Failure to comply with the filing requirements can result in penalties and fines. In the following sections, we will break down the steps to complete Form 8027 and provide practical examples to help you navigate the process.

Step 1: Gather Required Information

Before starting the Form 8027, you need to gather essential information about your business and employees. This includes:

- Employer Identification Number (EIN)

- Business name and address

- Total tipped employees and their Social Security numbers

- Total tips reported by employees

- Total tips allocated to employees

- Total gross receipts from food and beverage sales

- Tips received from credit card companies

Tips for Gathering Information

- Ensure you have accurate records of employee tips, including those received from credit card companies.

- Verify the Social Security numbers of all tipped employees.

- Review your business's financial statements to determine total gross receipts from food and beverage sales.

Step 2: Determine If You Need to File Form 8027

Not all employers need to file Form 8027. To determine if you need to file, answer the following questions:

- Do you have 10 or more employees who received tips in a calendar year?

- Did your business receive tips from credit card companies?

- Did your business allocate tips to employees?

If you answered "yes" to any of these questions, you need to file Form 8027.

Exceptions to Filing Form 8027

- If you have fewer than 10 employees who received tips, you are not required to file Form 8027.

- If you did not receive tips from credit card companies, you are not required to file Form 8027.

Step 3: Complete Form 8027

Once you have determined that you need to file Form 8027, complete the form by following these steps:

- Enter your EIN, business name, and address in the top section of the form.

- Report the total number of tipped employees, their Social Security numbers, and total tips reported.

- Report the total tips allocated to employees.

- Report the total gross receipts from food and beverage sales.

- Report tips received from credit card companies.

Tips for Completing Form 8027

- Ensure you report accurate information, as the IRS will use this data to verify employee tax returns.

- Use the correct format for reporting tips and allocated tips.

Step 4: Submit Form 8027

After completing Form 8027, submit it to the IRS by the required deadline. The deadline for filing Form 8027 is February 28th of each year. You can submit the form electronically or by mail.

Electronic Filing

- The IRS recommends electronic filing, as it reduces errors and processing time.

- Use the IRS's Electronic Federal Tax Payment System (EFTPS) to submit your Form 8027.

Step 5: Maintain Accurate Records

Maintaining accurate records of employee tips and allocated tips is crucial for completing Form 8027 and ensuring compliance with IRS regulations.

Record-Keeping Tips

- Keep detailed records of employee tips, including those received from credit card companies.

- Verify the accuracy of employee tip reports.

- Store records securely and maintain them for at least three years.

By following these 5 easy steps, you can ensure accurate and timely completion of Form 8027. Remember to maintain accurate records and verify the information reported on the form.

We hope this guide has helped you navigate the process of completing Form 8027. If you have any further questions or concerns, please don't hesitate to reach out.

What is the deadline for filing Form 8027?

+The deadline for filing Form 8027 is February 28th of each year.

Do I need to file Form 8027 if I have fewer than 10 employees who received tips?

+No, you do not need to file Form 8027 if you have fewer than 10 employees who received tips.