Investing in investments that generate investment income, such as interest, dividends, and capital gains, can be an excellent way to grow your wealth over time. However, as an investor, it's essential to understand the tax implications of your investments to minimize your tax liability and maximize your returns. One of the key tax forms you'll need to file is Form 4952, Investment Interest Expense Deduction. In this article, we'll provide a comprehensive, step-by-step guide on how to complete Form 4952 and make the most of your investment interest expense deduction.

Understanding Form 4952: Investment Interest Expense Deduction

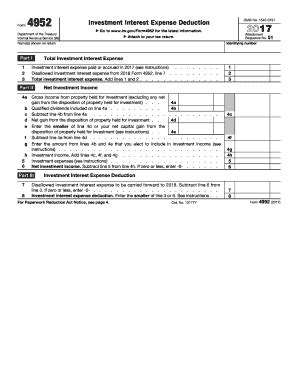

Form 4952 is used to calculate the investment interest expense deduction, which allows investors to deduct the interest paid on loans used to purchase investment property, such as stocks, bonds, and real estate. The form is used to determine the amount of investment interest expense that can be deducted on Schedule A (Itemized Deductions) of your tax return.

Who Needs to File Form 4952?

Not everyone who invests in investment property needs to file Form 4952. You'll need to file the form if you have investment interest expense that exceeds your investment income. This typically applies to investors who:

- Borrow money to purchase investment property

- Have investment income that is less than the interest paid on the loan

- Want to deduct the investment interest expense on their tax return

Step 1: Gather Required Information

Before you start completing Form 4952, you'll need to gather some essential information. This includes:

- Your investment income from all sources, including interest, dividends, and capital gains

- The interest paid on loans used to purchase investment property

- The amount of investment interest expense carried over from previous years

- Your net investment income, which is your total investment income minus any investment expenses

Step 2: Calculate Your Investment Income

To calculate your investment income, you'll need to add up the income from all your investment sources. This includes:

- Interest from bonds, CDs, and other interest-bearing accounts

- Dividends from stocks and mutual funds

- Capital gains from the sale of investment property

- Other investment income, such as rental income from real estate

Step 3: Calculate Your Investment Interest Expense

To calculate your investment interest expense, you'll need to add up the interest paid on all loans used to purchase investment property. This includes:

- Interest on margin loans used to purchase stocks or bonds

- Interest on loans used to purchase real estate

- Interest on other loans used to purchase investment property

Step 4: Calculate Your Net Investment Income

To calculate your net investment income, you'll need to subtract your investment expenses from your total investment income. This includes:

- Investment management fees

- Other investment expenses, such as accounting fees and investment advisory fees

Step 5: Complete Form 4952

Now that you have all the required information, you can start completing Form 4952. The form is divided into three parts:

- Part I: Investment Income and Expenses

- Part II: Investment Interest Expense

- Part III: Net Investment Income

In Part I, you'll report your investment income and expenses. In Part II, you'll calculate your investment interest expense. In Part III, you'll calculate your net investment income.

Step 6: Carry Over Excess Investment Interest Expense

If you have excess investment interest expense that cannot be deducted in the current year, you can carry it over to future years. To do this, you'll need to complete Part IV of Form 4952.

Conclusion

Completing Form 4952 can be a complex process, but by following these steps, you can ensure that you're taking advantage of the investment interest expense deduction. Remember to gather all the required information, calculate your investment income and expenses, and complete the form accurately. If you're unsure about any part of the process, it's always a good idea to consult with a tax professional.

What is Form 4952 used for?

+Form 4952 is used to calculate the investment interest expense deduction, which allows investors to deduct the interest paid on loans used to purchase investment property.

Who needs to file Form 4952?

+Investors who have investment interest expense that exceeds their investment income need to file Form 4952.

What information do I need to gather to complete Form 4952?

+You'll need to gather your investment income, interest paid on loans used to purchase investment property, investment expenses, and net investment income.