As a resident of Missouri, it's essential to understand the process of filling out Form 108, also known as the Missouri Individual Income Tax Return. This form is used to report your income, claim deductions and credits, and calculate your tax liability. In this article, we will guide you through the 5 easy steps to fill out Form 108 Missouri, ensuring you complete it accurately and efficiently.

Understanding Form 108

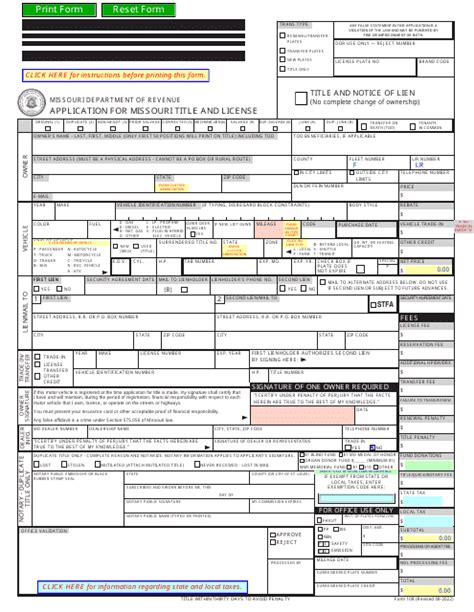

Before we dive into the steps, it's crucial to understand what Form 108 is and what it entails. Form 108 is a tax return form used by the Missouri Department of Revenue to collect individual income tax. The form requires you to report your income, deductions, and credits, which will determine your tax liability.

Step 1: Gather Required Documents

To begin filling out Form 108, you'll need to gather the necessary documents and information. These may include:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your Missouri driver's license or state ID

- Your W-2 forms from all employers

- Your 1099 forms for self-employment income, freelance work, or other sources of income

- Your interest statements from banks and investments (1099-INT)

- Your dividend statements from investments (1099-DIV)

- Your receipts for charitable donations and other itemized deductions

- Your records of mortgage interest, property taxes, and other deductions

Step 2: Fill Out Personal Information

Once you have all the necessary documents, start filling out Form 108 by providing your personal information. This includes:

- Your name and address

- Your Social Security number or ITIN

- Your filing status (single, married filing jointly, married filing separately, head of household, or qualifying widow(er))

- Your number of exemptions

- Your occupation and employer information

Step 3: Report Income

Next, report all your income from various sources, including:

- Wages, salaries, and tips

- Self-employment income

- Interest income

- Dividend income

- Capital gains or losses

- Unemployment compensation

- Other sources of income

Be sure to include all income, regardless of whether it was reported on a W-2 or 1099 form.

Step 4: Claim Deductions and Credits

After reporting your income, claim any deductions and credits you're eligible for. These may include:

- Standard deduction or itemized deductions

- Personal exemption

- Mortgage interest deduction

- Property tax deduction

- Charitable donations deduction

- Child tax credit

- Earned income tax credit (EITC)

Step 5: Calculate Tax Liability and Submit

Finally, calculate your tax liability by subtracting your deductions and credits from your total income. If you owe taxes, you can pay online, by phone, or by mail. If you're due a refund, you can choose to receive it by direct deposit or paper check.

Once you've completed Form 108, review it carefully to ensure accuracy and completeness. You can submit your form online or by mail, along with any required supporting documentation.

Additional Tips and Resources

To ensure you complete Form 108 accurately and efficiently, consider the following tips and resources:

- Use tax preparation software, such as TurboTax or H&R Block, to guide you through the process.

- Consult the Missouri Department of Revenue's website for instructions, forms, and FAQs.

- Contact a tax professional or the Missouri Department of Revenue if you have questions or concerns.

By following these 5 easy steps, you'll be able to fill out Form 108 Missouri with confidence and accuracy. Remember to gather all required documents, report your income, claim deductions and credits, calculate your tax liability, and submit your form on time to avoid penalties and interest.

Take Action Today!

Don't wait until the last minute to fill out Form 108. Start gathering your documents and information today, and follow these easy steps to ensure you complete your Missouri individual income tax return accurately and efficiently. Share this article with friends and family who may need help with their taxes, and leave a comment below with any questions or concerns.

What is the deadline for filing Form 108 Missouri?

+The deadline for filing Form 108 Missouri is typically April 15th of each year, unless you file for an extension.

Can I e-file Form 108 Missouri?

+Yes, you can e-file Form 108 Missouri through the Missouri Department of Revenue's website or through tax preparation software.

What if I need help with Form 108 Missouri?

+You can contact the Missouri Department of Revenue or a tax professional for assistance with Form 108 Missouri.