Understanding and submitting Form 15112 can seem like a daunting task, especially for those who are new to the process. However, with the right guidance, it can be a straightforward and efficient process. In this article, we will break down the process into 5 easy steps to follow, making it easier for you to submit Form 15112 with confidence.

What is Form 15112?

Before we dive into the steps, it's essential to understand what Form 15112 is. Form 15112 is a document used by the Internal Revenue Service (IRS) to report certain types of income, such as self-employment income, freelance work, or income from a small business. The form is used to calculate the taxpayer's tax liability and to report any taxes owed.

Step 1: Gather Required Documents

To submit Form 15112, you will need to gather certain documents and information. These may include:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your business name and address (if applicable)

- Your business tax identification number (if applicable)

- Records of your income, including invoices, receipts, and bank statements

- Records of your expenses, including receipts and bank statements

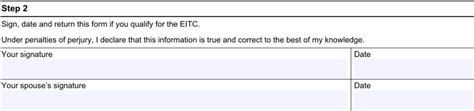

Step 2: Download and Complete Form 15112

Once you have gathered the required documents, you can download Form 15112 from the IRS website. The form is available in PDF format and can be completed electronically or manually. Be sure to follow the instructions carefully and complete all required fields.

Step 3: Calculate Your Tax Liability

To calculate your tax liability, you will need to complete the tax calculation worksheet on Form 15112. This will involve reporting your income and expenses, as well as calculating your tax owed. You may want to consider using tax software or consulting with a tax professional to ensure accuracy.

Step 4: Submit Form 15112

Once you have completed Form 15112, you can submit it to the IRS. You can do this by mail or electronically through the IRS e-file system. Be sure to follow the instructions carefully and include all required documentation.

What to Expect After Submitting Form 15112

After submitting Form 15112, you can expect to receive a confirmation from the IRS. This may take several weeks or even months, depending on the volume of submissions. Once your form has been processed, you will receive a notice indicating whether you owe taxes or have a refund due.

Step 5: Pay Any Taxes Owed

If you owe taxes, you will need to pay them by the due date to avoid penalties and interest. You can pay online, by phone, or by mail. Be sure to include your name, Social Security number or ITIN, and the tax year on your payment.

Benefits of Submitting Form 15112

Submitting Form 15112 can provide several benefits, including:

- Accurate tax calculation: By submitting Form 15112, you can ensure that your tax liability is accurately calculated.

- Avoid penalties and interest: Submitting Form 15112 on time can help you avoid penalties and interest on any taxes owed.

- Refund eligibility: If you have overpaid taxes, submitting Form 15112 can help you receive a refund.

Common Mistakes to Avoid

When submitting Form 15112, there are several common mistakes to avoid. These include:

- Inaccurate or incomplete information: Make sure to provide accurate and complete information on the form.

- Missing documentation: Be sure to include all required documentation, such as receipts and bank statements.

- Late submission: Submit the form on time to avoid penalties and interest.

Conclusion

Submitting Form 15112 can seem like a daunting task, but by following these 5 easy steps, you can ensure that your form is completed accurately and submitted on time. Remember to gather required documents, download and complete the form, calculate your tax liability, submit the form, and pay any taxes owed. By avoiding common mistakes and following the instructions carefully, you can ensure a smooth and efficient process.

Share Your Experience

Have you submitted Form 15112 before? Share your experience in the comments below. Do you have any tips or advice for others who are submitting the form for the first time? We would love to hear from you!

What is Form 15112 used for?

+Form 15112 is used to report certain types of income, such as self-employment income, freelance work, or income from a small business.

How do I submit Form 15112?

+You can submit Form 15112 by mail or electronically through the IRS e-file system.

What is the deadline for submitting Form 15112?

+The deadline for submitting Form 15112 varies depending on the tax year. Check the IRS website for specific deadlines.