The beautiful state of Hawaii, known for its stunning natural landscapes, tropical climate, and unique cultural heritage. But when it comes to taxes, Hawaii can be a complex and challenging environment to navigate, especially for individuals and businesses seeking state tax exemptions. In this article, we will delve into the world of Hawaii's state tax exemptions, specifically focusing on the G45 Form, and provide a comprehensive guide to help you understand the process and requirements.

Understanding Hawaii's Tax Exemption System

Hawaii's tax exemption system is designed to provide relief to eligible individuals and businesses from the state's general excise tax (GET) and other taxes. The state offers various exemptions, including those for non-profit organizations, charitable institutions, and certain types of businesses. To qualify for these exemptions, applicants must meet specific requirements and submit the necessary documentation.

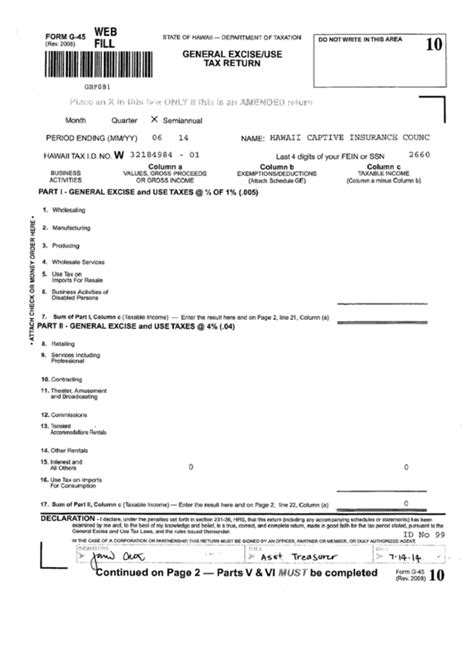

What is the G45 Form?

The G45 Form, also known as the "Exemption from General Excise Tax" form, is a critical document for individuals and businesses seeking tax exemptions in Hawaii. This form is used to apply for exemptions from the state's general excise tax, which is a 4.166% tax on gross income earned by businesses operating in Hawaii.

The G45 Form is typically used by:

- Non-profit organizations, such as charities and educational institutions

- Businesses that are exempt from the GET, such as those involved in agriculture, aquaculture, or renewable energy production

- Individuals who are exempt from the GET, such as those who are 65 years or older, or who have a disability

Eligibility Requirements for the G45 Form

To be eligible for a tax exemption in Hawaii, applicants must meet specific requirements, which vary depending on the type of exemption sought. Here are some general requirements:

- Non-Profit Organizations: Must be registered as a non-profit organization with the State of Hawaii and have a valid federal tax-exempt status.

- Businesses: Must be engaged in an exempt activity, such as agriculture, aquaculture, or renewable energy production, and meet specific income and employment requirements.

- Individuals: Must be 65 years or older, or have a disability, and meet specific income requirements.

How to Complete the G45 Form

Completing the G45 Form requires careful attention to detail and accuracy. Here are the steps to follow:

- Obtain the G45 Form: Download the G45 Form from the Hawaii Department of Taxation's website or obtain a copy from a local tax office.

- Read the Instructions: Carefully read the instructions and requirements for the G45 Form to ensure you understand what is required.

- Gather Required Documents: Collect all required documents, including proof of non-profit status, business registration, and identification.

- Complete the Form: Complete the G45 Form, ensuring accuracy and completeness.

- Submit the Form: Submit the completed G45 Form to the Hawaii Department of Taxation, along with all required documentation.

Additional Requirements and Documentation

In addition to the G45 Form, applicants may need to provide additional documentation, such as:

- Business Registration: Proof of business registration with the State of Hawaii.

- Non-Profit Status: Proof of non-profit status, such as a letter from the IRS.

- Identification: Proof of identification, such as a driver's license or passport.

- Financial Statements: Financial statements, such as balance sheets and income statements.

Timeline and Processing

The processing time for the G45 Form can vary, depending on the complexity of the application and the workload of the Hawaii Department of Taxation. Here are some general guidelines:

- Processing Time: 2-6 weeks

- Approval: Once approved, the exemption will be effective from the date of application.

- Renewal: Exemptions must be renewed annually, by submitting a new G45 Form and supporting documentation.

Common Mistakes to Avoid

When completing the G45 Form, it's essential to avoid common mistakes that can delay or reject your application. Here are some common mistakes to avoid:

- Inaccurate Information: Ensure accuracy and completeness of all information provided.

- Missing Documentation: Ensure all required documentation is submitted.

- Late Submission: Submit the G45 Form and supporting documentation by the deadline.

Conclusion

Obtaining a tax exemption in Hawaii can be a complex and challenging process, but with the right guidance and support, it can be achieved. By understanding the requirements and process for the G45 Form, individuals and businesses can navigate the system with confidence and obtain the exemptions they need to thrive in Hawaii's unique business environment.

Take Action

If you're seeking a tax exemption in Hawaii, don't wait – take action today! Complete the G45 Form, gather required documentation, and submit your application to the Hawaii Department of Taxation. With careful attention to detail and accuracy, you can navigate the process with confidence and achieve your goals.

Share Your Thoughts

Have you successfully obtained a tax exemption in Hawaii? Share your experiences and tips in the comments below!

FAQ Section

What is the purpose of the G45 Form?

+The G45 Form is used to apply for exemptions from Hawaii's general excise tax (GET).

Who is eligible for a tax exemption in Hawaii?

+Eligible applicants include non-profit organizations, businesses engaged in exempt activities, and individuals who are 65 years or older, or have a disability.

What documentation is required to complete the G45 Form?

+Required documentation includes proof of non-profit status, business registration, identification, and financial statements.