The world of finance and accounting can be overwhelming, especially when dealing with complex forms and regulations. One such form that may seem daunting at first is the FS Form 5444. However, with a clear understanding of its purpose and a step-by-step guide, completing this form can be a breeze.

In this article, we will delve into the world of FS Form 5444, exploring its significance, benefits, and a detailed guide on how to complete it with ease. Whether you're a seasoned financial expert or just starting out, this comprehensive guide will walk you through the process, ensuring you're equipped to tackle this form with confidence.

What is FS Form 5444?

FS Form 5444, also known as the "Detail of Accounts" form, is a financial document used by the United States government to report and manage financial transactions. This form is primarily used by federal agencies to provide a detailed account of their financial activities, including receipts, expenditures, and balances.

The main purpose of FS Form 5444 is to ensure transparency and accountability in government financial transactions. By providing a detailed breakdown of financial activities, this form helps to identify areas of inefficiency, track expenses, and make informed decisions about future financial planning.

Benefits of Using FS Form 5444

The use of FS Form 5444 offers several benefits, including:

- Improved transparency: By providing a detailed account of financial activities, this form promotes transparency and accountability in government financial transactions.

- Enhanced financial management: FS Form 5444 helps to identify areas of inefficiency, track expenses, and make informed decisions about future financial planning.

- Compliance with regulations: This form ensures compliance with federal regulations and standards, reducing the risk of errors and penalties.

- Streamlined financial reporting: FS Form 5444 provides a standardized format for financial reporting, making it easier to analyze and compare financial data.

How to Complete FS Form 5444

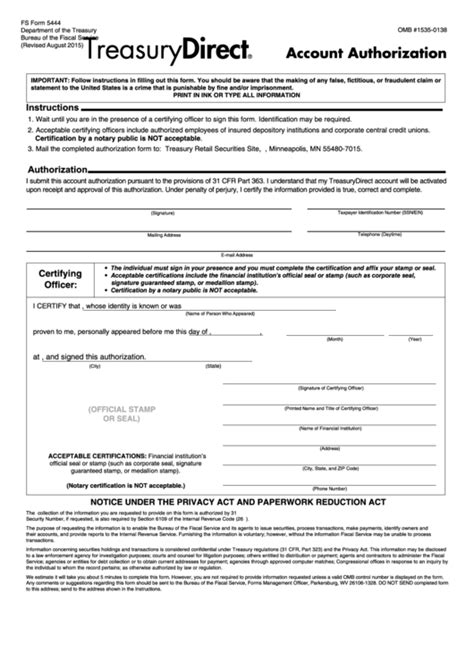

Completing FS Form 5444 requires attention to detail and a thorough understanding of the form's requirements. Here's a step-by-step guide to help you complete this form with ease:

- Gather required information: Before starting to complete the form, gather all necessary financial data, including receipts, expenditures, and balances.

- Read the instructions: Carefully read the instructions provided on the form to ensure you understand the requirements and format.

- Fill in the header: Enter the agency name, report period, and other required information in the header section.

- Complete the detail of accounts: Fill in the detail of accounts section, providing a breakdown of financial activities, including receipts, expenditures, and balances.

- Calculate totals: Calculate the totals for each section and enter them in the designated fields.

- Verify and review: Verify the accuracy of the information and review the form for completeness and accuracy.

FS Form 5444 Sections and Fields

FS Form 5444 consists of several sections and fields, each requiring specific information. Here's a breakdown of the main sections and fields:

- Header: Agency name, report period, and other required information.

- Detail of Accounts: Breakdown of financial activities, including receipts, expenditures, and balances.

- Totals: Calculated totals for each section.

- Certification: Certification statement, signed by the agency's financial representative.

Tips and Best Practices

To ensure accuracy and completeness when completing FS Form 5444, follow these tips and best practices:

- Use a standardized format: Use a standardized format for financial reporting to ensure consistency and accuracy.

- Verify information: Verify the accuracy of the information before submitting the form.

- Use clear and concise language: Use clear and concise language when completing the form to avoid errors and misinterpretations.

- Seek assistance: Seek assistance from financial experts or agency representatives if you're unsure about any aspect of the form.

Common Errors and Mistakes

When completing FS Form 5444, it's essential to avoid common errors and mistakes. Here are some of the most common errors to watch out for:

- Inaccurate information: Inaccurate or incomplete information can lead to errors and penalties.

- Incorrect formatting: Incorrect formatting can make the form difficult to read and understand.

- Missing signatures: Missing signatures or certifications can invalidate the form.

Conclusion

Completing FS Form 5444 requires attention to detail and a thorough understanding of the form's requirements. By following the steps outlined in this guide, you'll be able to complete this form with ease and accuracy. Remember to verify information, use clear and concise language, and seek assistance if needed. By avoiding common errors and mistakes, you'll ensure that your agency's financial transactions are transparent, accountable, and compliant with federal regulations.

What is the purpose of FS Form 5444?

+The main purpose of FS Form 5444 is to provide a detailed account of financial activities, including receipts, expenditures, and balances, to ensure transparency and accountability in government financial transactions.

Who is required to complete FS Form 5444?

+FS Form 5444 is primarily used by federal agencies to provide a detailed account of their financial activities.

What are the consequences of errors or inaccuracies on FS Form 5444?

+Inaccurate or incomplete information can lead to errors and penalties, and may result in delays or rejection of the form.