As the tax season approaches, many investors and taxpayers are scrambling to gather their financial documents and report their capital gains. One crucial form that plays a significant role in this process is the IRS Form 8949, also known as the Sales and Other Dispositions of Capital Assets form. In this article, we will delve into the world of capital gains reporting, focusing on the FreeTaxUSA Form 8949, and provide you with a comprehensive guide to help you navigate the process with ease.

Understanding Capital Gains Reporting

Capital gains reporting is the process of disclosing the sale or exchange of capital assets, such as stocks, bonds, real estate, and other investments, on your tax return. The IRS requires taxpayers to report these transactions using Form 8949, which helps to calculate the capital gains tax owed. Capital gains tax is a type of tax levied on the profit made from the sale of a capital asset.

Who Needs to File Form 8949?

You will need to file Form 8949 if you have sold or exchanged a capital asset during the tax year. This includes:

- Stocks and bonds

- Real estate

- Mutual funds

- Exchange-traded funds (ETFs)

- Cryptocurrencies

- Other investment assets

Even if you didn't sell any capital assets, you may still need to file Form 8949 if you received a Form 1099-B, Proceeds from Broker and Barter Exchange Transactions, from your broker or investment firm.

Breaking Down Form 8949

Form 8949 is a two-page form that consists of several sections. Let's take a closer look at each section:

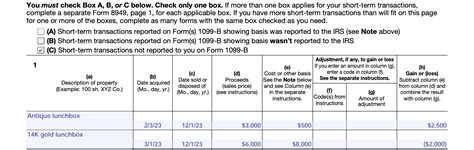

Section 1: Short-Term Capital Gains and Losses

In this section, you will report short-term capital gains and losses from the sale of assets held for one year or less. You will need to provide the following information:

- Description of the asset sold

- Date acquired

- Date sold

- Sales price

- Cost or other basis

Section 2: Long-Term Capital Gains and Losses

In this section, you will report long-term capital gains and losses from the sale of assets held for more than one year. You will need to provide the same information as in Section 1.

How to Fill Out Form 8949

Filling out Form 8949 can be a daunting task, but with the right guidance, it can be made easier. Here's a step-by-step guide to help you fill out the form:

- Gather all necessary documents, including:

- Form 1099-B

- Brokerage statements

- Investment records

- Determine the type of asset sold and the date acquired and sold.

- Calculate the gain or loss from the sale of the asset.

- Complete Section 1 or Section 2, depending on the type of asset sold.

- Report the total short-term or long-term capital gains and losses on Schedule D (Form 1040).

FreeTaxUSA Form 8949: A Convenient Filing Option

FreeTaxUSA is a popular tax preparation software that offers a convenient and user-friendly way to file Form 8949. With FreeTaxUSA, you can:

- Easily import your investment data from popular brokerages

- Automatically calculate your capital gains and losses

- Fill out Form 8949 with accuracy and ease

- E-file your tax return directly with the IRS

Common Mistakes to Avoid When Filing Form 8949

When filing Form 8949, it's essential to avoid common mistakes that can lead to errors, delays, or even audits. Here are some mistakes to watch out for:

- Incorrectly reporting the type of asset sold

- Failing to report all capital gains and losses

- Miscalculating the gain or loss from the sale of an asset

- Not signing and dating the form

Conclusion: Simplifying Capital Gains Reporting with FreeTaxUSA Form 8949

Reporting capital gains can be a complex process, but with the right guidance and tools, it can be made easier. FreeTaxUSA Form 8949 offers a convenient and user-friendly way to file your capital gains report. By following the steps outlined in this article and avoiding common mistakes, you can ensure accurate and timely filing of your tax return.

We hope this comprehensive guide has provided you with the necessary knowledge and confidence to tackle capital gains reporting with ease. If you have any further questions or concerns, please don't hesitate to reach out.

What is Form 8949 used for?

+Form 8949 is used to report the sale or exchange of capital assets, such as stocks, bonds, and real estate, on your tax return.

Who needs to file Form 8949?

+You will need to file Form 8949 if you have sold or exchanged a capital asset during the tax year.

Can I use FreeTaxUSA to file Form 8949?

+Yes, FreeTaxUSA offers a convenient and user-friendly way to file Form 8949 and report your capital gains.