As a retiree or annuitant, you're likely no stranger to tax forms and paperwork. But when it comes to filling out Form W-4V, also known as the Voluntary Withholding Request, it's essential to get it right to avoid any unwanted surprises come tax time. In this article, we'll break down the five ways to fill out Form W-4V correctly, ensuring you're in compliance with the IRS and making the most of your retirement income.

What is Form W-4V, and Why Do I Need It?

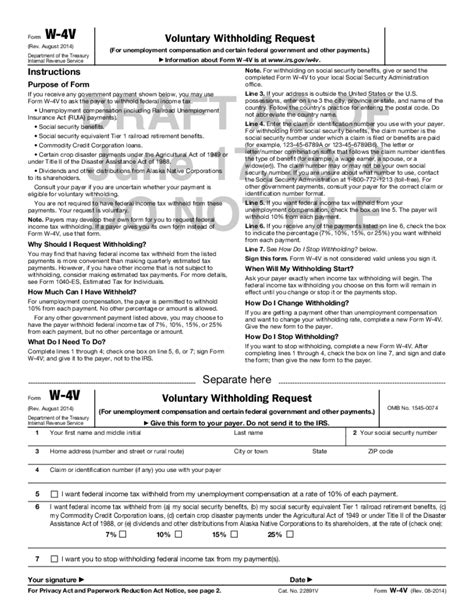

Form W-4V is a voluntary tax withholding request form used by retirees and annuitants to request withholding from certain government payments, such as Social Security benefits, pensions, and annuity payments. By completing this form, you're allowing the payer to withhold federal income taxes from your payments, which can help you avoid a large tax bill when you file your tax return.

5 Ways to Fill Out Form W-4V Correctly

1. Determine Your Eligibility

Before filling out Form W-4V, ensure you're eligible to do so. You can use this form if you receive any of the following types of payments:

- Social Security benefits

- Pension or annuity payments

- Railroad Retirement benefits

- Veterans' benefits

- Federal unemployment benefits

If you're unsure about your eligibility, consult with the payer or the IRS.

2. Choose Your Withholding Option

You have two withholding options to choose from:

- Option 1: Withhold 7%, 10%, 12%, or 22% of your payment for federal income taxes.

- Option 2: Withhold a specific dollar amount from each payment.

Choose the option that best suits your tax situation. Keep in mind that if you choose to withhold a specific dollar amount, you'll need to calculate the amount based on your tax liability.

3. Complete Section 1: Payment Type and Withholding Option

In Section 1, you'll need to:

- Identify the type of payment you're receiving (e.g., Social Security benefits, pension, or annuity payments)

- Choose your withholding option (Option 1 or Option 2)

- Specify the withholding percentage or dollar amount

Make sure to follow the instructions carefully, and double-check your entries to avoid errors.

4. Complete Section 2: Certification

In Section 2, you'll need to certify that the information provided is accurate and that you're eligible to make this request. This section also includes a warning about the penalties for making false statements.

Read this section carefully, and ensure you understand the implications of making a false statement.

5. Submit the Form and Keep a Copy

Once you've completed the form, submit it to the payer, and keep a copy for your records. Make sure to submit the form at least 30 days before you want the withholding to begin.

It's also essential to review and update your withholding election periodically to ensure it remains accurate and reflects any changes in your tax situation.

Tips and Reminders

- Use the most recent version of Form W-4V, as older versions may not be accepted.

- Ensure you have the correct payer's address and contact information to avoid delays.

- Keep a copy of the completed form and any correspondence with the payer for your records.

- Review and update your withholding election periodically to ensure it remains accurate.

Conclusion

Filling out Form W-4V correctly is crucial to ensure you're in compliance with the IRS and making the most of your retirement income. By following these five steps and tips, you'll be able to complete the form with confidence and avoid any unwanted surprises come tax time. Remember to review and update your withholding election periodically to ensure it remains accurate and reflects any changes in your tax situation.

FAQ Section

What is the purpose of Form W-4V?

+Form W-4V is used to request voluntary withholding from certain government payments, such as Social Security benefits, pensions, and annuity payments.

How do I choose my withholding option?

+You can choose to withhold 7%, 10%, 12%, or 22% of your payment for federal income taxes, or withhold a specific dollar amount from each payment.

How often should I review and update my withholding election?

+It's essential to review and update your withholding election periodically to ensure it remains accurate and reflects any changes in your tax situation.

We hope this article has provided you with valuable insights and guidance on filling out Form W-4V correctly. If you have any further questions or concerns, please don't hesitate to reach out to us.