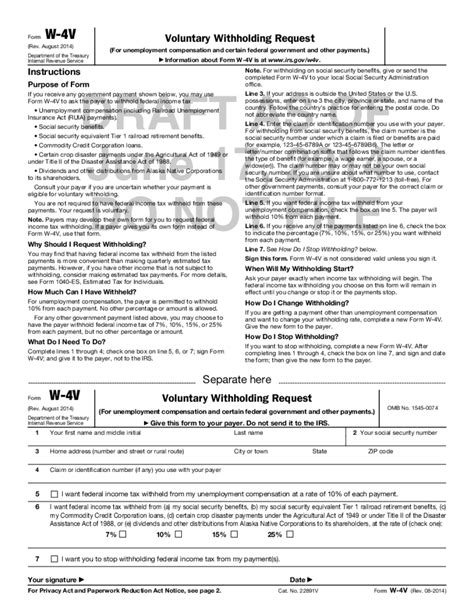

As a retiree, receiving a steady income stream is crucial for maintaining a comfortable lifestyle. However, ensuring that the correct amount of taxes is withheld from your retirement benefits is equally important. This is where Form W-4V comes into play. The Voluntary Withholding Request Form W-4V is used to request federal income tax withholding from certain government payments, including Social Security benefits, Supplemental Security Income (SSI) payments, and Railroad Retirement benefits. Filling out Form W-4V correctly is essential to avoid any potential issues with your tax obligations. In this article, we will provide you with five tips to help you fill out Form W-4V accurately.

Understanding the Purpose of Form W-4V

Before we dive into the tips, it's essential to understand the purpose of Form W-4V. This form allows you to request voluntary withholding of federal income tax from your government payments. By doing so, you can avoid owing a large amount of taxes when you file your tax return. Additionally, Form W-4V helps you to avoid penalties and interest on underpaid taxes.

Tip 1: Determine Your Tax Withholding Needs

Before filling out Form W-4V, you need to determine how much tax you want to withhold from your government payments. You can use the Tax Withholding Estimator tool provided by the IRS to estimate your tax liability. This tool will help you to determine the correct amount of tax to withhold based on your income, filing status, and other factors.

Tip 2: Choose the Correct Withholding Option

Form W-4V provides two withholding options: 7%, 10%, 12%, or 22% of your monthly benefit amount. You can choose one of these options based on your tax obligations. If you're unsure about which option to choose, you can consult with a tax professional or use the Tax Withholding Estimator tool.

How to Fill Out Form W-4V

Filling out Form W-4V is a straightforward process. Here's a step-by-step guide to help you fill out the form correctly:

- Name and Address: Enter your name and address as it appears on your government payment statement.

- Social Security Number or Individual Taxpayer Identification Number (ITIN): Enter your Social Security number or ITIN.

- Type of Payment: Check the box that corresponds to the type of payment you receive, such as Social Security benefits or SSI payments.

- Withholding Option: Choose the withholding option that suits your tax needs.

- Certification: Sign and date the form to certify that the information you provided is accurate.

Tip 3: Submit the Form Correctly

Once you've filled out Form W-4V, you need to submit it to the correct agency. If you're a Social Security beneficiary, you can submit the form to the Social Security Administration. If you're an SSI recipient, you can submit the form to the Social Security Administration or the Treasury Department. Make sure to submit the form correctly to avoid any delays in processing your request.

Tip 4: Monitor Your Withholding

After submitting Form W-4V, it's essential to monitor your withholding to ensure that the correct amount of tax is being withheld from your government payments. You can check your payment statement to verify the withholding amount. If you need to make any changes to your withholding, you can submit a new Form W-4V.

Tip 5: Review and Update Your Withholding Annually

Tax laws and regulations can change, and your tax obligations may vary from year to year. It's essential to review and update your withholding annually to ensure that you're meeting your tax obligations. You can use the Tax Withholding Estimator tool to estimate your tax liability and adjust your withholding accordingly.

Common Mistakes to Avoid When Filling Out Form W-4V

When filling out Form W-4V, it's essential to avoid common mistakes that can lead to delays in processing your request or even penalties. Here are some common mistakes to avoid:

- Incorrect Social Security number or ITIN: Make sure to enter your correct Social Security number or ITIN to avoid any delays in processing your request.

- Inaccurate withholding option: Choose the correct withholding option based on your tax obligations to avoid underpayment or overpayment of taxes.

- Incomplete or unsigned form: Ensure that you complete the form accurately and sign it to certify that the information you provided is accurate.

By following these tips, you can fill out Form W-4V correctly and ensure that the correct amount of tax is withheld from your government payments. Remember to review and update your withholding annually to ensure that you're meeting your tax obligations.

We hope this article has provided you with valuable information to help you fill out Form W-4V accurately. If you have any questions or concerns, please feel free to comment below. Share this article with your friends and family to help them understand the importance of accurate tax withholding.

What is Form W-4V used for?

+Form W-4V is used to request federal income tax withholding from certain government payments, including Social Security benefits, Supplemental Security Income (SSI) payments, and Railroad Retirement benefits.

How do I determine my tax withholding needs?

+You can use the Tax Withholding Estimator tool provided by the IRS to estimate your tax liability and determine the correct amount of tax to withhold from your government payments.

What are the withholding options available on Form W-4V?

+Form W-4V provides four withholding options: 7%, 10%, 12%, or 22% of your monthly benefit amount. You can choose one of these options based on your tax obligations.