Understanding Form TC-69C is crucial for individuals and businesses involved in the fuel tax reporting process in the state of Utah, USA. The form serves as a vital document for fuel tax returns, and its accurate completion is essential for compliance with the Utah State Tax Commission regulations.

The Importance of Accurate Fuel Tax Reporting

Fuel tax reporting is a critical aspect of tax compliance for businesses and individuals involved in the transportation industry. Inaccurate or incomplete reporting can lead to penalties, fines, and even audits. Therefore, it is essential to understand the nuances of Form TC-69C to ensure accurate and timely submission of fuel tax returns.

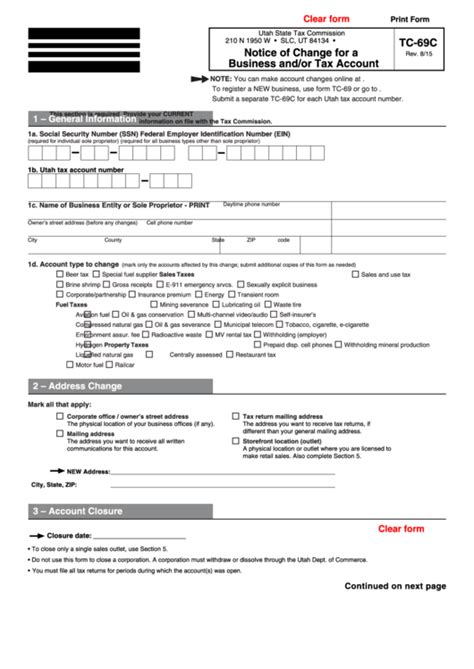

What is Form TC-69C?

Form TC-69C is the Utah Fuel Tax Return form, used to report fuel tax liabilities and claim refunds for fuel taxes paid on fuels used for non-highway purposes. The form is used by businesses and individuals who are required to file fuel tax returns with the Utah State Tax Commission.

Components of Form TC-69C

The form consists of several sections, including:

- Business information: This section requires the business name, address, and tax identification number.

- Fuel tax liability: This section requires the calculation of fuel tax liability, including the total gallons of fuel used, the tax rate, and the total tax due.

- Refund claim: This section allows businesses to claim refunds for fuel taxes paid on fuels used for non-highway purposes.

- Supporting schedules: This section requires the completion of supporting schedules, including Schedule A (Fuel Tax Liability) and Schedule B (Refund Claim).

How to Complete Form TC-69C

To complete Form TC-69C, businesses and individuals must follow these steps:

- Gather required information: Collect all necessary information, including business records, fuel receipts, and tax identification numbers.

- Calculate fuel tax liability: Calculate the total gallons of fuel used, the tax rate, and the total tax due.

- Complete supporting schedules: Complete Schedule A (Fuel Tax Liability) and Schedule B (Refund Claim).

- Review and verify: Review the form for accuracy and completeness, and verify the calculations.

Benefits of Accurate Form TC-69C Completion

Accurate completion of Form TC-69C offers several benefits, including:

- Compliance with Utah State Tax Commission regulations

- Avoidance of penalties and fines

- Timely refund of fuel taxes paid on fuels used for non-highway purposes

- Reduced risk of audits

Common Mistakes to Avoid

Common mistakes to avoid when completing Form TC-69C include:

- Inaccurate or incomplete business information

- Incorrect calculation of fuel tax liability

- Failure to complete supporting schedules

- Inadequate documentation

Consequences of Non-Compliance

Failure to accurately complete Form TC-69C can result in severe consequences, including:

- Penalties and fines

- Audits

- Loss of business licenses

- Damage to business reputation

Best Practices for Form TC-69C Completion

To ensure accurate and timely completion of Form TC-69C, businesses and individuals should follow these best practices:

- Maintain accurate and detailed business records

- Use software or consulting services to assist with fuel tax reporting

- Verify calculations and review the form for accuracy and completeness

- Submit the form on time to avoid penalties and fines

Conclusion

Understanding Form TC-69C is crucial for individuals and businesses involved in the fuel tax reporting process in Utah. Accurate completion of the form ensures compliance with Utah State Tax Commission regulations, avoids penalties and fines, and reduces the risk of audits. By following best practices and avoiding common mistakes, businesses and individuals can ensure accurate and timely completion of Form TC-69C.

What is Form TC-69C used for?

+Form TC-69C is used to report fuel tax liabilities and claim refunds for fuel taxes paid on fuels used for non-highway purposes.

Who is required to file Form TC-69C?

+Businesses and individuals who are required to file fuel tax returns with the Utah State Tax Commission are required to file Form TC-69C.

What are the consequences of non-compliance with Form TC-69C?

+Failure to accurately complete Form TC-69C can result in penalties, fines, audits, loss of business licenses, and damage to business reputation.