As a business owner or individual, navigating the complex world of tax forms and regulations can be overwhelming. One of the most important forms you may need to file is Form Reg 343, also known as the "Certificate of Registration" form. This form is used to register your business with the relevant state authorities, but what exactly does it entail? In this article, we will delve into the 5 essential facts you need to know about Form Reg 343.

What is Form Reg 343?

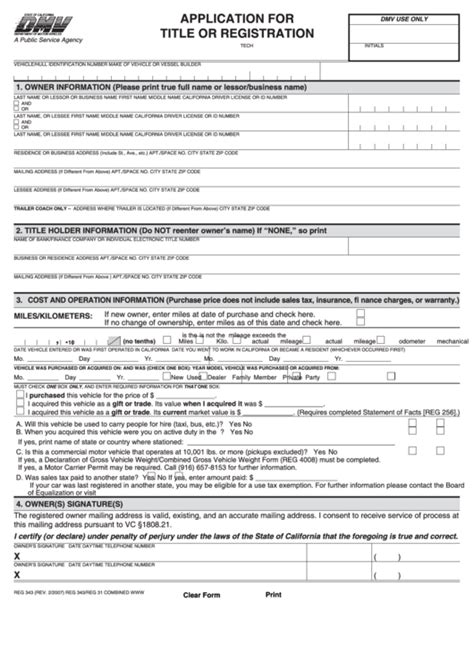

Form Reg 343 is a certificate of registration that businesses must file with the state to obtain a registration number. This form is usually required for businesses that operate in specific industries, such as construction or manufacturing. The form typically asks for basic business information, such as the business name, address, and owner's details.

Who Needs to File Form Reg 343?

Not all businesses need to file Form Reg 343. Typically, businesses that are required to register with the state must file this form. These businesses may include:

- Construction companies

- Manufacturing businesses

- Retail businesses

- Service-based businesses

If you're unsure whether your business needs to file Form Reg 343, it's best to consult with a tax professional or check with your state's tax authority.

Benefits of Filing Form Reg 343

Filing Form Reg 343 has several benefits for businesses. Some of these benefits include:

- Obtaining a registration number: By filing Form Reg 343, businesses can obtain a unique registration number that is required for various business transactions.

- Compliance with state regulations: Filing this form ensures that businesses comply with state regulations and avoid any potential penalties or fines.

- Increased credibility: Registering your business with the state can increase your business's credibility and reputation.

- Access to state contracts: Registered businesses may have access to state contracts and other business opportunities.

How to File Form Reg 343

Filing Form Reg 343 is a relatively straightforward process. Here are the steps to follow:

- Gather required documents: You'll need to gather basic business information, such as your business name, address, and owner's details.

- Download the form: You can download Form Reg 343 from your state's tax authority website or obtain a copy from a local tax office.

- Fill out the form: Fill out the form accurately and completely, making sure to sign and date it.

- Submit the form: Submit the form to your state's tax authority, either online or by mail.

Common Mistakes to Avoid When Filing Form Reg 343

When filing Form Reg 343, it's essential to avoid common mistakes that can delay or reject your application. Some common mistakes to avoid include:

- Inaccurate or incomplete information: Make sure to provide accurate and complete information on the form.

- Missing signatures: Ensure that the form is signed and dated correctly.

- Late filing: File the form on time to avoid any penalties or fines.

Penalties for Not Filing Form Reg 343

If you fail to file Form Reg 343, you may face penalties and fines. These penalties can include:

- Late filing fees: You may be charged a late filing fee for failing to file the form on time.

- Interest on unpaid taxes: You may be charged interest on any unpaid taxes or fees.

- Business closure: In extreme cases, your business may be closed for failing to comply with state regulations.

Conclusion

Form Reg 343 is an essential form for businesses to file with the state. By understanding the 5 essential facts about this form, businesses can ensure compliance with state regulations and avoid any potential penalties or fines. Remember to file the form accurately and on time to avoid any mistakes or delays.

We hope this article has provided you with valuable insights into Form Reg 343. If you have any questions or need further clarification, please don't hesitate to comment below. Share this article with your friends and colleagues who may find it helpful.

What is the purpose of Form Reg 343?

+Form Reg 343 is a certificate of registration that businesses must file with the state to obtain a registration number.

Who needs to file Form Reg 343?

+Typically, businesses that are required to register with the state must file this form. These businesses may include construction companies, manufacturing businesses, retail businesses, and service-based businesses.

What are the benefits of filing Form Reg 343?

+By filing Form Reg 343, businesses can obtain a unique registration number, comply with state regulations, increase their credibility, and access state contracts.