Understanding the Importance of Form MV IRP-15

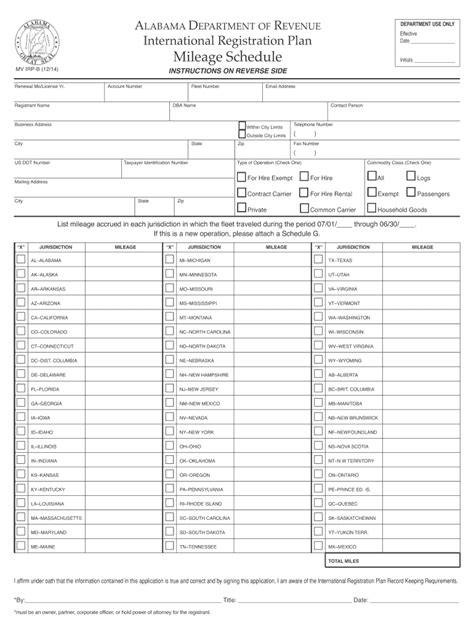

If you're a fleet manager or owner-operator, you're likely familiar with the complexities of obtaining and maintaining apportioned registration for your commercial vehicles. Form MV IRP-15 is a critical document in this process, serving as the application for an International Registration Plan (IRP) account. Completing this form accurately is essential to ensure your vehicles are properly registered and compliant with regulations.

In this article, we'll break down the key elements of Form MV IRP-15 and provide a step-by-step guide on how to complete it successfully. Whether you're new to the IRP program or a seasoned veteran, this guide will help you navigate the process with confidence.

What is Form MV IRP-15?

Form MV IRP-15 is the official application for an IRP account, which allows you to register your commercial vehicles in multiple jurisdictions. The IRP program is a collaborative effort between states and Canadian provinces to simplify the registration process for commercial vehicles that operate across multiple jurisdictions.

The form requires detailed information about your fleet, including vehicle descriptions, mileage, and jurisdictional data. Accurate completion of the form is crucial to ensure that your vehicles are properly registered and that you're in compliance with IRP regulations.

Gathering Required Information

Before starting the application process, it's essential to gather all required information to ensure accuracy and efficiency. Here are some key details you'll need to have:

- Fleet information: Vehicle descriptions, including make, model, year, and vehicle identification number (VIN)

- Mileage data: Total miles traveled in each jurisdiction during the reporting period

- Jurisdictional data: List of jurisdictions where your vehicles operate, including states and Canadian provinces

- Business information: Company name, address, and contact details

- Taxpayer identification number: Federal Employer Identification Number (FEIN) or Social Security Number (SSN)

Step 1: Complete the Fleet Information Section

The fleet information section requires detailed descriptions of each vehicle in your fleet. Make sure to include:

- Vehicle make and model

- Year of manufacture

- Vehicle identification number (VIN)

- Gross vehicle weight rating (GVWR)

- Number of axles

Step 2: Calculate and Report Mileage Data

Accurate mileage reporting is critical to ensure that your vehicles are properly registered and that you're in compliance with IRP regulations. Calculate the total miles traveled in each jurisdiction during the reporting period, and report this information on the form.

Step 3: List Jurisdictions and Report Mileage

List all jurisdictions where your vehicles operate, including states and Canadian provinces. Report the total miles traveled in each jurisdiction during the reporting period.

Step 4: Complete the Business Information Section

Complete the business information section, including:

- Company name and address

- Contact details, including phone number and email address

- Taxpayer identification number (FEIN or SSN)

Step 5: Review and Submit the Application

Carefully review the application for accuracy and completeness. Ensure that all required information is included, and that calculations are accurate. Submit the application to the appropriate IRP authority for processing.

By following these steps and providing accurate information, you'll be able to complete Form MV IRP-15 successfully and ensure that your commercial vehicles are properly registered and compliant with IRP regulations.

We hope this guide has been helpful in navigating the complex process of completing Form MV IRP-15. If you have any questions or need further assistance, please don't hesitate to reach out.

What is the purpose of Form MV IRP-15?

+Form MV IRP-15 is the official application for an International Registration Plan (IRP) account, which allows you to register your commercial vehicles in multiple jurisdictions.

What information is required to complete Form MV IRP-15?

+Required information includes fleet information, mileage data, jurisdictional data, business information, and taxpayer identification number.

How do I calculate mileage data for Form MV IRP-15?

+Calculate the total miles traveled in each jurisdiction during the reporting period, and report this information on the form.