In the world of finance and taxation, numerous forms and documents play crucial roles in ensuring compliance and transparency. Among these, the DTF-802 form holds significance, particularly for individuals and businesses dealing with withholding taxes in New York State. Despite its importance, many find the form and its requirements somewhat mysterious. Let's delve into the key aspects of the DTF-802 form to better understand its purpose, usage, and implications.

The DTF-802 form is fundamentally linked to the concept of withholding taxes. Withholding taxes are amounts deducted from income or other payments, set aside, and remitted to the tax authorities on behalf of the recipient. This mechanism is essential for ensuring timely tax payments and reducing the likelihood of tax evasion. In New York State, the DTF-802 form serves as a critical document for reporting and detailing these withholdings.

One of the primary purposes of the DTF-802 form is to provide a detailed breakdown of the withholding taxes made during a specific period. This form is particularly relevant for employers, financial institutions, and other entities responsible for withholding taxes from payments made to employees, vendors, or other parties. By using the DTF-802 form, these entities can accurately report the amounts withheld, ensuring compliance with New York State tax laws.

Who Needs to File the DTF-802 Form?

The necessity to file the DTF-802 form is not universal; it specifically targets entities with withholding tax obligations in New York State. This includes employers who withhold taxes from employee wages, as well as financial institutions and other businesses that make payments subject to withholding taxes. Essentially, any entity required by law to withhold taxes on behalf of another party in New York State will likely need to file the DTF-802 form.

What Information Does the DTF-802 Form Require?

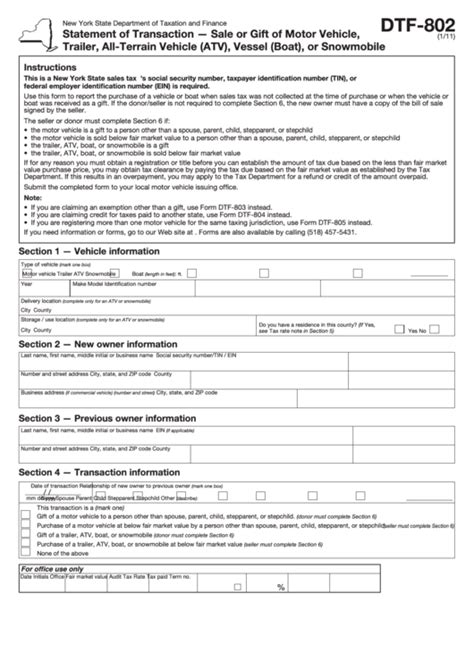

The DTF-802 form is designed to capture detailed information about the withholding taxes made during a specific period. This includes the total amount of payments made, the total amount of taxes withheld, and the recipient's information, such as their name, address, and tax identification number. Additionally, the form may require details about the type of income or payment from which taxes were withheld, such as wages, interest, or dividends.

For entities filing the DTF-802 form, accuracy is paramount. Incorrect or incomplete information can lead to delays in processing, potential penalties, and complications in resolving any discrepancies that may arise. It is advisable to carefully review the form's instructions and ensure that all required fields are completed accurately.

Due Dates and Filing Requirements

The due dates for filing the DTF-802 form are critical for maintaining compliance with New York State tax regulations. Typically, the form must be filed on a quarterly basis, with due dates in April, July, October, and January for the preceding quarters. However, it's essential to verify the exact due dates and any specific filing requirements, as these can change and may vary depending on the entity's circumstances.

Penalties for Non-Compliance

Failure to file the DTF-802 form or making inaccurate submissions can result in penalties and fines. New York State tax authorities impose these penalties to ensure compliance and maintain the integrity of the tax system. The amounts of these penalties can vary, depending on the nature and extent of the non-compliance.

Entities required to file the DTF-802 form should understand that timely and accurate submission is crucial not only for compliance but also for avoiding unnecessary costs associated with penalties and fines. In cases of unintentional errors or missed deadlines, it's advisable to address these issues promptly and seek guidance from tax professionals or the relevant authorities.

Best Practices for Filing the DTF-802 Form

Several best practices can help ensure a smooth and compliant filing process for the DTF-802 form:

- Maintain Accurate Records: Keeping detailed and accurate records of all payments and withholdings is essential for completing the DTF-802 form correctly.

- Understand Filing Requirements: Verify the specific filing requirements and due dates applicable to your entity to avoid any potential issues.

- Seek Professional Advice: If uncertain about any aspect of the filing process, consulting with a tax professional can provide clarity and ensure compliance.

- File Electronically: When possible, filing the DTF-802 form electronically can expedite the process and reduce the risk of errors.

Conclusion: Simplifying the DTF-802 Form Process

The DTF-802 form, while seemingly complex, serves a vital role in the administration of withholding taxes in New York State. By understanding the form's purpose, who needs to file it, what information it requires, and the best practices for filing, entities can navigate this process with greater ease and confidence. Whether you're an employer, financial institution, or another type of business, ensuring accurate and timely submission of the DTF-802 form is crucial for maintaining compliance and avoiding potential penalties.

We hope this detailed overview of the DTF-802 form has provided valuable insights and guidance. If you have any further questions or concerns, feel free to ask in the comments below. Sharing your experiences or advice on dealing with the DTF-802 form can also be beneficial for our community. Remember, staying informed and proactive about tax compliance can make all the difference in ensuring a smooth and successful financial year.

What is the primary purpose of the DTF-802 form?

+The primary purpose of the DTF-802 form is to provide a detailed breakdown of withholding taxes made during a specific period, ensuring compliance with New York State tax laws.

Who needs to file the DTF-802 form?

+Entities with withholding tax obligations in New York State, including employers and financial institutions, need to file the DTF-802 form.

What information does the DTF-802 form require?

+The form requires detailed information about the withholding taxes made, including the total amount of payments, the total amount of taxes withheld, and the recipient's information.