As a tax professional or an individual dealing with taxes, it's essential to understand the various forms and documents that are used to report income, claim deductions, and fulfill other tax-related obligations. One such form is Form DR 1093, which is used to report Colorado state income tax withholding. In this article, we will delve into the details of Form DR 1093, its importance, and how to fill it out accurately.

What is Form DR 1093?

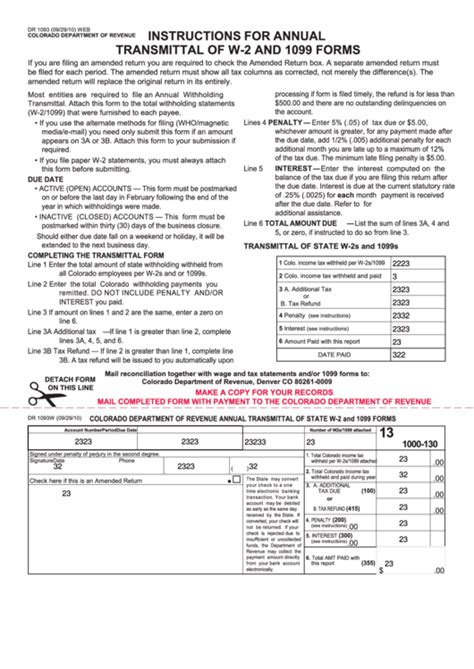

Form DR 1093 is a Colorado state tax form used to report state income tax withholding. It is typically filed by employers, payers, and withholding agents who have withheld state income taxes from employees' wages, retirement accounts, or other sources of income. The form provides a detailed breakdown of the amount of state income tax withheld and remitted to the Colorado Department of Revenue.

Who Needs to File Form DR 1093?

Form DR 1093 is required to be filed by:

- Employers who have withheld Colorado state income taxes from employees' wages

- Payors of retirement accounts, such as pensions and annuities

- Withholding agents who have withheld state income taxes from other sources of income, such as rent, royalties, and prizes

- Businesses that have made payments to non-resident individuals or entities subject to Colorado state income tax withholding

How to Fill Out Form DR 1093

To fill out Form DR 1093 accurately, follow these steps:

- Enter the filer's information: Provide the filer's name, address, and federal employer identification number (FEIN) or social security number (SSN).

- Report the total amount of state income tax withheld: Enter the total amount of state income tax withheld from all sources, including wages, retirement accounts, and other sources of income.

- Report the total amount of state income tax remitted: Enter the total amount of state income tax remitted to the Colorado Department of Revenue.

- Report the number of withholding statements: Enter the number of withholding statements (Form 1099 or W-2) issued to employees or payees.

- Sign and date the form: Sign and date the form to certify that the information provided is accurate and complete.

Deadlines and Penalties

The deadline for filing Form DR 1093 is typically January 31st of each year, for the previous tax year. Failure to file or pay the required state income tax withholding by the deadline may result in penalties and interest.

Importance of Accurate Filing

Accurate filing of Form DR 1093 is crucial for several reasons:

- Compliance with state tax laws: Filing Form DR 1093 demonstrates compliance with Colorado state tax laws and regulations.

- Avoidance of penalties and interest: Accurate and timely filing of Form DR 1093 helps avoid penalties and interest associated with late or inaccurate filing.

- Proper allocation of tax credits: Accurate filing of Form DR 1093 ensures that tax credits are properly allocated to the correct tax year.

Common Mistakes to Avoid

To avoid common mistakes when filing Form DR 1093:

- Ensure accurate reporting of state income tax withholding: Verify that the total amount of state income tax withheld is accurately reported.

- Use the correct filing status: Ensure that the correct filing status is used, such as single, married, or head of household.

- Sign and date the form: Sign and date the form to certify that the information provided is accurate and complete.

Conclusion

In conclusion, Form DR 1093 is an essential document for reporting Colorado state income tax withholding. Accurate and timely filing of Form DR 1093 is crucial for compliance with state tax laws, avoidance of penalties and interest, and proper allocation of tax credits. By following the instructions and avoiding common mistakes, filers can ensure that their Form DR 1093 is accurate and complete.

Take Action

If you have any questions or concerns about filing Form DR 1093, we encourage you to:

- Consult with a tax professional: Reach out to a qualified tax professional for guidance on filing Form DR 1093.

- Visit the Colorado Department of Revenue website: Visit the Colorado Department of Revenue website for more information on Form DR 1093 and other state tax forms.

- Share your experience: Share your experience with filing Form DR 1093 in the comments below.

FAQ Section:

What is the deadline for filing Form DR 1093?

+The deadline for filing Form DR 1093 is typically January 31st of each year, for the previous tax year.

Who needs to file Form DR 1093?

+Form DR 1093 is required to be filed by employers, payors of retirement accounts, and withholding agents who have withheld Colorado state income taxes from employees' wages, retirement accounts, or other sources of income.

What are the consequences of late or inaccurate filing of Form DR 1093?

+Late or inaccurate filing of Form DR 1093 may result in penalties and interest associated with late or inaccurate filing.