As a California resident, filing your taxes can be a daunting task, especially when it comes to understanding the various schedules and forms required by the state. One of the most important schedules for individuals and businesses is the California Tax Form 540 Schedule S, also known as the "Other State Tax Credit" schedule. In this article, we will delve into the world of Schedule S, explaining its purpose, how to fill it out, and providing examples to help you better understand this crucial tax form.

What is California Tax Form 540 Schedule S?

Understanding the Purpose of Schedule S

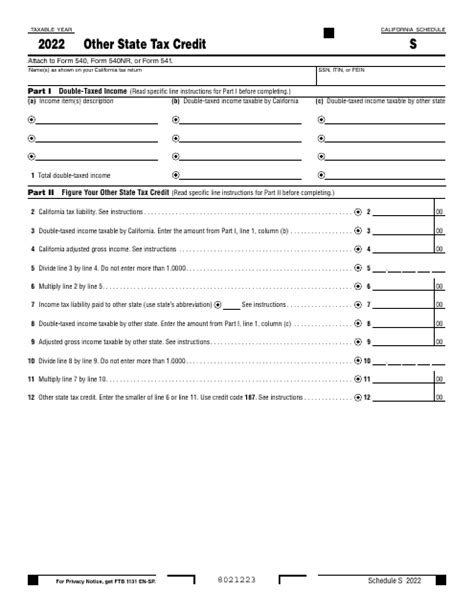

California Tax Form 540 Schedule S is used to calculate the Other State Tax Credit, which allows individuals and businesses to claim a credit for taxes paid to other states. This schedule is used in conjunction with Form 540, the California Resident Income Tax Return, and is required for taxpayers who have income from other states or have paid taxes to other states.

Who Needs to File Schedule S?

Individuals and Businesses Affected by Schedule S

Not everyone needs to file Schedule S. However, if you fall into one of the following categories, you will need to complete this schedule:

- Individuals who have income from other states, such as wages, salaries, or self-employment income

- Businesses that operate in multiple states and have paid taxes to other states

- Taxpayers who have claimed a credit for taxes paid to other states on their federal tax return

How to Fill Out Schedule S

Step-by-Step Instructions for Completing Schedule S

Filling out Schedule S can be a bit complex, but by following these step-by-step instructions, you'll be able to complete it with ease:

- Identify the states where you have income or have paid taxes: Make a list of the states where you have income or have paid taxes. This will help you determine which states to include on Schedule S.

- Gather the necessary tax documents: Collect the tax documents from each state, including W-2s, 1099s, and tax returns.

- Complete the schedule: Fill out the schedule by listing each state, the amount of income earned, and the amount of taxes paid. You will also need to calculate the credit for each state.

- Calculate the total credit: Add up the credits from each state to determine the total Other State Tax Credit.

Examples and Scenarios

Real-Life Examples to Help You Understand Schedule S

Let's take a look at a few examples to help illustrate how Schedule S works:

- Example 1: John is a California resident who works in Nevada. He earns $50,000 in wages and pays $5,000 in Nevada state taxes. John would complete Schedule S to claim a credit for the taxes paid to Nevada.

- Example 2: ABC Corporation is a California-based business that operates in multiple states, including New York and Texas. The corporation pays taxes to each state and would complete Schedule S to claim a credit for the taxes paid to those states.

Common Mistakes to Avoid

Pitfalls to Watch Out for When Filing Schedule S

When filing Schedule S, there are several common mistakes to avoid:

- Failure to include all states: Make sure to include all states where you have income or have paid taxes.

- Incorrect calculation of the credit: Double-check your calculations to ensure accuracy.

- Failure to attach supporting documentation: Attach all supporting documentation, including W-2s, 1099s, and tax returns.

Conclusion and Next Steps

Wrapping Up Schedule S and Preparing for Tax Season

In conclusion, California Tax Form 540 Schedule S is an essential schedule for individuals and businesses with income from other states or who have paid taxes to other states. By understanding the purpose and requirements of Schedule S, you'll be able to accurately complete the schedule and claim the credit you're eligible for. Remember to avoid common mistakes and seek professional help if needed.

FAQs

What is the purpose of Schedule S?

+Schedule S is used to calculate the Other State Tax Credit, which allows individuals and businesses to claim a credit for taxes paid to other states.

Who needs to file Schedule S?

+Individuals and businesses with income from other states or who have paid taxes to other states need to file Schedule S.

What documentation is required to complete Schedule S?

+W-2s, 1099s, and tax returns from each state are required to complete Schedule S.