The process of filing Form CT-706 NT can be daunting, especially for those who are dealing with the complexities of estate tax for the first time. However, understanding the intricacies of this form and following the correct filing procedures can help alleviate stress and ensure compliance with state regulations.

Filing Form CT-706 NT is a crucial step in the estate tax process for Connecticut residents. This form is used to report the transfer of a decedent's assets to their beneficiaries and calculate the estate tax due. Failure to file the form correctly can lead to penalties, fines, and even delays in the distribution of assets. In this article, we will provide a comprehensive guide on how to file Form CT-706 NT correctly.

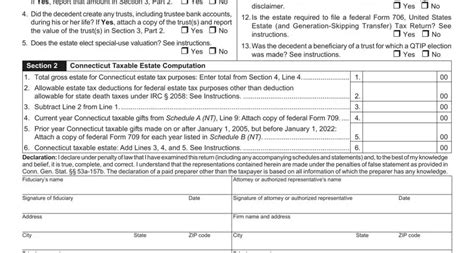

Understanding Form CT-706 NT

Before we dive into the filing process, it's essential to understand what Form CT-706 NT is and why it's necessary. Form CT-706 NT is a non-transfer tax return form used to report the transfer of a decedent's assets to their beneficiaries. The form is used to calculate the estate tax due and provide information about the assets being transferred.

Who Needs to File Form CT-706 NT?

Not all estates are required to file Form CT-706 NT. In general, the form is required for estates with assets exceeding $3.6 million, which is the Connecticut estate tax exemption amount. However, even if the estate is below the exemption amount, it's still necessary to file the form if the decedent made gifts during their lifetime that exceeded the annual gift tax exclusion amount.

Gathering Required Documents

Before filing Form CT-706 NT, it's crucial to gather all the necessary documents and information. This includes:

- The decedent's will and any codicils

- Trust documents, if applicable

- Asset valuations, such as appraisals and financial statements

- Gift tax returns, if applicable

- Beneficiary information, including names, addresses, and social security numbers

Calculating Estate Tax

Calculating the estate tax due is a critical part of the filing process. The tax is calculated based on the total value of the estate, minus any exemptions and deductions. The Connecticut estate tax rates range from 7.2% to 12%.

Filing Form CT-706 NT

Once all the necessary documents and information have been gathered, it's time to file Form CT-706 NT. The form can be filed electronically or by mail. If filing electronically, the form must be submitted through the Connecticut Department of Revenue Services' (DRS) online portal. If filing by mail, the form must be sent to the DRS address listed on the form.

Due Dates and Extensions

The due date for filing Form CT-706 NT is typically nine months after the decedent's date of death. However, an automatic six-month extension can be obtained by filing Form CT-706 NT EXT. If the estate needs more time, an additional extension can be requested by filing Form CT-706 NT EXT-2.

5 Ways to File Form CT-706 NT Correctly

To ensure accurate filing, follow these five tips:

- Gather all necessary documents and information: Before filing, make sure to gather all the necessary documents, including the decedent's will, trust documents, asset valuations, and beneficiary information.

- Calculate estate tax accurately: Calculate the estate tax due based on the total value of the estate, minus any exemptions and deductions.

- File the form electronically or by mail: File the form electronically through the DRS online portal or by mail to the DRS address listed on the form.

- Meet the due date or request an extension: Meet the nine-month due date or request an automatic six-month extension by filing Form CT-706 NT EXT.

- Seek professional help if needed: If the filing process seems overwhelming, consider seeking the help of a tax professional or estate attorney.

Avoiding Common Mistakes

Common mistakes to avoid when filing Form CT-706 NT include:

- Failing to gather all necessary documents and information

- Calculating estate tax incorrectly

- Missing the due date or failing to request an extension

- Filing the form incorrectly or incompletely

By following the tips outlined above and avoiding common mistakes, you can ensure accurate and timely filing of Form CT-706 NT.

Conclusion

Filing Form CT-706 NT is a critical step in the estate tax process for Connecticut residents. By understanding the form's requirements, gathering necessary documents, calculating estate tax accurately, and filing the form correctly, you can ensure compliance with state regulations and avoid penalties. If you're unsure about any part of the process, consider seeking the help of a tax professional or estate attorney.

What is Form CT-706 NT?

+Form CT-706 NT is a non-transfer tax return form used to report the transfer of a decedent's assets to their beneficiaries and calculate the estate tax due.

Who needs to file Form CT-706 NT?

+Estates with assets exceeding $3.6 million are required to file Form CT-706 NT. However, even if the estate is below the exemption amount, it's still necessary to file the form if the decedent made gifts during their lifetime that exceeded the annual gift tax exclusion amount.

How do I calculate estate tax?

+Estate tax is calculated based on the total value of the estate, minus any exemptions and deductions. The Connecticut estate tax rates range from 7.2% to 12%.