Filing taxes can be a daunting task, especially for small business owners and self-employed individuals. One of the most common tax forms for businesses in the state of New York is the Form CT-3-S, also known as the New York S Corporation Franchise Tax Return. In this article, we will guide you through the process of completing Form CT-3-S, highlighting the five most common ways to file this form.

Understanding Form CT-3-S

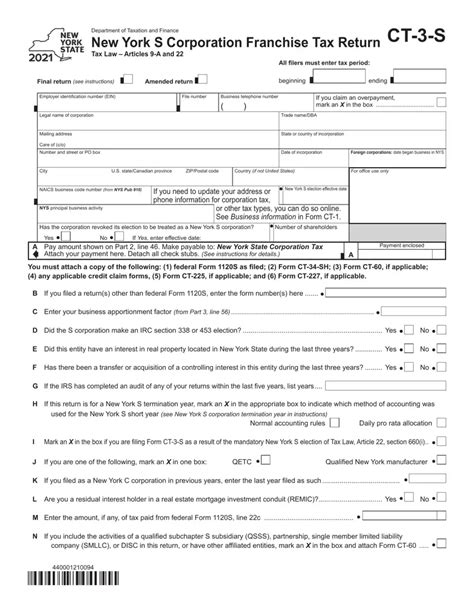

Before we dive into the five ways to complete Form CT-3-S, let's first understand what this form is used for. Form CT-3-S is an annual tax return filed by S corporations in the state of New York. The form is used to report the corporation's income, deductions, and credits, as well as to calculate the amount of tax owed.

Method 1: Manual Preparation and Filing

One of the most traditional ways to complete Form CT-3-S is by manually preparing and filing the form. This involves printing out the form from the New York State Department of Taxation and Finance website, filling it out by hand, and mailing it to the tax authority.

To manually prepare and file Form CT-3-S, you will need to gather all necessary documentation, including financial statements, tax returns, and other supporting documents. You will then need to carefully fill out the form, making sure to accurately report all income, deductions, and credits.

Once the form is complete, you will need to sign and date it, and then mail it to the New York State Department of Taxation and Finance.

Method 2: Electronic Filing through the New York State Website

Another way to complete Form CT-3-S is by electronically filing through the New York State website. This method is faster and more convenient than manual preparation and filing.

To electronically file Form CT-3-S, you will need to create an account on the New York State Department of Taxation and Finance website. Once you have created an account, you can log in and select the Form CT-3-S option.

You will then be guided through a series of questions and prompts, which will help you complete the form. You will need to enter all necessary information, including financial data and tax returns.

Once you have completed the form, you can review and submit it electronically.

Method 3: Using Tax Preparation Software

If you are not comfortable manually preparing and filing Form CT-3-S, or if you prefer a more streamlined process, you can use tax preparation software to complete the form. There are many tax preparation software programs available, including TurboTax, H&R Block, and TaxAct.

To use tax preparation software to complete Form CT-3-S, you will need to purchase and download the software, or use an online version. You will then need to follow the prompts and enter all necessary information, including financial data and tax returns.

The software will guide you through the process and help you complete the form accurately. Once you have completed the form, you can review and submit it electronically.

Method 4: Hiring a Tax Professional

If you are not comfortable completing Form CT-3-S on your own, or if you have complex tax situations, you may want to consider hiring a tax professional to complete the form for you.

A tax professional can help you navigate the complexities of the tax code and ensure that you are taking advantage of all available deductions and credits. They can also help you avoid common mistakes and ensure that you are in compliance with all tax laws and regulations.

To find a tax professional, you can search online or ask for referrals from friends or family members.

Method 5: Using an Online Tax Preparation Service

Finally, you can use an online tax preparation service to complete Form CT-3-S. These services provide a convenient and streamlined way to prepare and file your taxes.

To use an online tax preparation service, you will need to create an account and provide all necessary information, including financial data and tax returns. The service will then guide you through the process and help you complete the form accurately.

Once you have completed the form, you can review and submit it electronically.

Conclusion

Completing Form CT-3-S can be a daunting task, but with the right guidance and resources, it can be done efficiently and accurately. Whether you choose to manually prepare and file the form, electronically file through the New York State website, use tax preparation software, hire a tax professional, or use an online tax preparation service, make sure to take your time and carefully review the form before submitting it.

Remember to also keep accurate records and documentation, as these will be essential in case of an audit or other tax-related issues.

We hope this article has provided you with the necessary information and resources to complete Form CT-3-S with confidence. If you have any further questions or concerns, please don't hesitate to reach out to a tax professional or the New York State Department of Taxation and Finance.

FAQs

What is Form CT-3-S?

+Form CT-3-S is the New York S Corporation Franchise Tax Return. It is an annual tax return filed by S corporations in the state of New York.

Who needs to file Form CT-3-S?

+All S corporations in the state of New York are required to file Form CT-3-S annually.

What is the deadline for filing Form CT-3-S?

+The deadline for filing Form CT-3-S is typically March 15th of each year, or the 15th day of the third month following the close of the corporation's tax year.