Understanding Form 8949 Code L: A Comprehensive Guide

If you're an investor or trader, you're probably familiar with the concept of reporting your capital gains and losses to the Internal Revenue Service (IRS) using Form 8949. However, if you've received a Form 8949 with a Code L, you might be wondering what it means and how it affects your tax obligations. In this article, we'll break down the Form 8949 Code L explanation, its implications, and provide examples to help you understand the concept better.

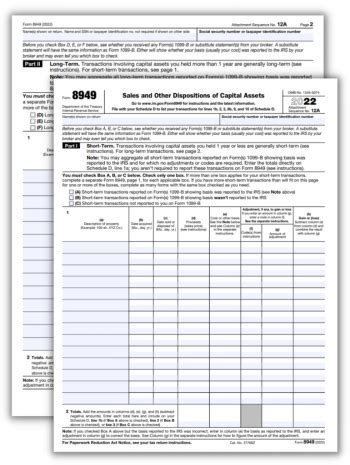

What is Form 8949?

Form 8949 is a tax form used to report sales and other dispositions of capital assets, such as stocks, bonds, and mutual funds. The form is typically filed with your annual tax return (Form 1040) and helps the IRS track your capital gains and losses. You'll receive a Form 8949 from your broker or financial institution if you've sold or exchanged any capital assets during the tax year.

What is Code L on Form 8949?

Code L on Form 8949 indicates that the sale or exchange of a capital asset is "Long-term" and " Uncertain" or " Missing" information about the acquisition date or the type of asset. This code is used when the broker or financial institution doesn't have enough information to accurately report the sale or exchange on Form 8949.

Why Does Code L Appear on Form 8949?

Code L may appear on Form 8949 due to various reasons, such as:

- Missing or incomplete information about the acquisition date or the type of asset

- Uncertain or unknown information about the sale or exchange

- Insufficient records or documentation to accurately report the transaction

- Changes in the tax laws or regulations that affect the reporting of capital gains and losses

How to Report Code L on Form 8949

If you receive a Form 8949 with Code L, you'll need to report the sale or exchange on your tax return (Form 1040). Here's how to report Code L on Form 8949:

- Review your records: Verify the information on the Form 8949, including the date of sale or exchange, the proceeds, and the basis of the asset.

- Determine the holding period: If you can determine the holding period of the asset, you can report the sale or exchange as either short-term or long-term.

- Report the sale or exchange: Enter the proceeds and basis of the asset on Schedule D (Form 1040), and report the sale or exchange as either short-term or long-term.

- Attach a statement: If you're unable to determine the holding period or the type of asset, attach a statement to your tax return explaining the situation and providing any supporting documentation.

Example of Code L on Form 8949

Let's say you sold 100 shares of XYZ stock on January 10, 2022, for $10,000. However, your broker doesn't have the acquisition date or the type of asset, so they report the sale on Form 8949 with Code L.

- Date of sale: January 10, 2022

- Proceeds: $10,000

- Basis: Unknown

- Code: L

In this example, you'll need to review your records and determine the holding period of the asset. If you can determine that the stock was held for more than one year, you can report the sale as long-term on Schedule D (Form 1040).

FAQs About Form 8949 Code L

What does Code L on Form 8949 mean?

+Code L on Form 8949 indicates that the sale or exchange of a capital asset is "Long-term" and "Uncertain" or "Missing" information about the acquisition date or the type of asset.

Why does Code L appear on Form 8949?

+Code L may appear on Form 8949 due to missing or incomplete information about the acquisition date or the type of asset, uncertain or unknown information about the sale or exchange, or insufficient records or documentation to accurately report the transaction.

How do I report Code L on Form 8949?

+If you receive a Form 8949 with Code L, you'll need to review your records, determine the holding period of the asset, and report the sale or exchange on Schedule D (Form 1040). You may also need to attach a statement explaining the situation and providing any supporting documentation.

Take Action Today

If you've received a Form 8949 with Code L, don't delay. Review your records, determine the holding period of the asset, and report the sale or exchange on your tax return. If you're unsure about how to report Code L or need help with your tax obligations, consult with a tax professional or financial advisor today.

We encourage you to share your thoughts and experiences with Form 8949 Code L in the comments section below. If you have any questions or need further clarification, feel free to ask.