Tax season can be a stressful time for many individuals, especially when dealing with complex tax forms. One such form is the Form 8915-F, also known as the Qualified Disaster Retirement Plan Distributions and Repayments form. This form is used to report qualified disaster distributions and repayments to an eligible retirement plan. In this article, we will provide you with 5 tips to help you complete Form 8915-F correctly.

Understanding the Purpose of Form 8915-F

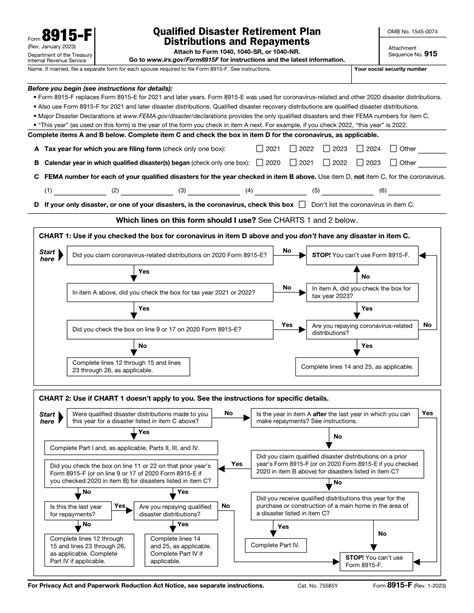

Before we dive into the tips, it's essential to understand the purpose of Form 8915-F. This form is used to report qualified disaster distributions and repayments to an eligible retirement plan. A qualified disaster distribution is a distribution from an eligible retirement plan that is made to an individual whose principal residence is located in a qualified disaster area. The distribution must be made on or after the first day of the incident period and before the date that is six months after the last day of the incident period.

What is a Qualified Disaster Area?

A qualified disaster area is an area that has been designated by the President as a disaster area due to a terrorist attack or a federally declared disaster. The area must be located within a state or territory of the United States.

Tips to Complete Form 8915-F Correctly

Now that we have a basic understanding of the purpose of Form 8915-F, let's move on to the tips to complete it correctly.

Tip 1: Gather All Required Documents

Before you start filling out Form 8915-F, make sure you have all the required documents. These documents may include:

- A copy of the qualified disaster distribution

- A copy of the repayment, if applicable

- Your tax return from the previous year

- Your social security number or Individual Taxpayer Identification Number (ITIN)

Having all the required documents will help you fill out the form accurately and avoid any delays.

Tip 2: Determine the Correct Filing Status

Your filing status will determine which lines you need to complete on Form 8915-F. Make sure you determine your correct filing status before filling out the form.

Filing Status Options

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Tip 3: Report Qualified Disaster Distributions Correctly

When reporting qualified disaster distributions, make sure you complete the correct lines on Form 8915-F. You will need to report the total amount of the qualified disaster distribution and the amount of the distribution that is taxable.

Lines to Complete

- Line 1: Total amount of qualified disaster distribution

- Line 2: Taxable amount of qualified disaster distribution

Tip 4: Report Repayments Correctly

If you repaid any part of the qualified disaster distribution, you will need to report the repayment on Form 8915-F. Make sure you complete the correct lines on the form.

Lines to Complete

- Line 3: Total amount of repayment

- Line 4: Amount of repayment that is taxable

Tip 5: Review and Double-Check Your Form

Before submitting Form 8915-F, review and double-check your form for accuracy. Make sure you have completed all the required lines and that your calculations are correct.

Common Mistakes to Avoid

When completing Form 8915-F, there are several common mistakes to avoid. These mistakes may include:

- Failing to report qualified disaster distributions correctly

- Failing to report repayments correctly

- Failing to determine the correct filing status

- Failing to review and double-check the form for accuracy

By avoiding these common mistakes, you can ensure that your Form 8915-F is completed correctly and that you avoid any delays or penalties.

Conclusion

Completing Form 8915-F correctly can be a complex task, but by following these 5 tips, you can ensure that your form is accurate and complete. Remember to gather all required documents, determine the correct filing status, report qualified disaster distributions and repayments correctly, and review and double-check your form for accuracy. By following these tips, you can avoid common mistakes and ensure a smooth tax filing process.

What is Form 8915-F used for?

+Form 8915-F is used to report qualified disaster distributions and repayments to an eligible retirement plan.

What is a qualified disaster distribution?

+A qualified disaster distribution is a distribution from an eligible retirement plan that is made to an individual whose principal residence is located in a qualified disaster area.

What is a qualified disaster area?

+A qualified disaster area is an area that has been designated by the President as a disaster area due to a terrorist attack or a federally declared disaster.