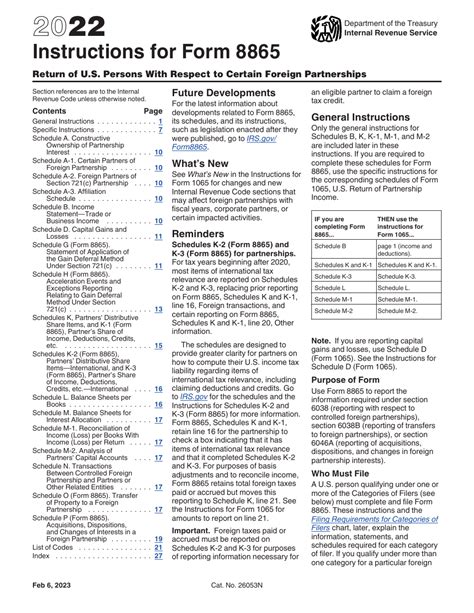

Filing Form 8865 is a crucial requirement for certain U.S. persons with interests in foreign partnerships. The form is used to report the information required under section 6038 (Form 1065) and section 6046 (Form 5471) of the Internal Revenue Code. In this article, we will delve into the essential Form 8865 filing instructions to help you navigate the process successfully.

Understanding Who Needs to File Form 8865

Before we dive into the filing instructions, it's essential to understand who needs to file Form 8865. The form is required for U.S. persons who have an interest in a foreign partnership, including:

- A U.S. citizen or resident who is a partner in a foreign partnership

- A domestic partnership that is a partner in a foreign partnership

- A U.S. citizen or resident who is a shareholder in a foreign corporation that is a partner in a foreign partnership

- A U.S. citizen or resident who is a beneficiary of a foreign trust that is a partner in a foreign partnership

Gathering Required Information and Documents

To file Form 8865 successfully, you will need to gather the required information and documents. These include:

- The name, address, and taxpayer identification number (TIN) of the foreign partnership

- The name, address, and TIN of each partner in the foreign partnership

- The percentage of interest in the foreign partnership owned by each partner

- The gross income and deductions of the foreign partnership

- Any taxes paid by the foreign partnership

Required Schedules and Attachments

When filing Form 8865, you will need to attach certain schedules and documents, including:

- Schedule A: This schedule is used to report the income and deductions of the foreign partnership

- Schedule B: This schedule is used to report the partner's share of the foreign partnership's income and deductions

- Schedule C: This schedule is used to report the foreign partnership's gross income and deductions

- Schedule D: This schedule is used to report the foreign partnership's capital gains and losses

- Schedule E: This schedule is used to report the foreign partnership's income and deductions from the sale of partnership interests

- Schedule F: This schedule is used to report the foreign partnership's income and deductions from the sale of assets

- Schedule G: This schedule is used to report the foreign partnership's income and deductions from the sale of intangible assets

- Schedule H: This schedule is used to report the foreign partnership's income and deductions from the sale of real estate

- Schedule I: This schedule is used to report the foreign partnership's income and deductions from the sale of securities

- Schedule J: This schedule is used to report the foreign partnership's income and deductions from the sale of commodities

Filing Form 8865 Electronically

Form 8865 can be filed electronically through the IRS's Electronic Federal Tax Payment System (EFTPS). To file electronically, you will need to:

- Create an account on the EFTPS website

- Log in to your account and select the "File a Return" option

- Choose the correct tax year and form type (Form 8865)

- Follow the prompts to upload your return and schedules

Benefits of Electronic Filing

Electronic filing offers several benefits, including:

- Faster processing times

- Reduced errors and rejections

- Improved security and confidentiality

- Ability to file 24/7

Penalties for Failure to File or Late Filing

Failure to file or late filing of Form 8865 can result in significant penalties, including:

- A penalty of $10,000 or more for failure to file

- A penalty of $1,000 or more for late filing

- Interest on any unpaid tax liability

Avoiding Penalties

To avoid penalties, it's essential to file Form 8865 on time and accurately. If you are unable to file by the deadline, you can request an automatic 6-month extension by filing Form 7004.

We hope this article has provided you with the essential Form 8865 filing instructions. Remember to gather all required information and documents, attach the necessary schedules and attachments, and file electronically to avoid penalties. If you have any questions or concerns, please don't hesitate to reach out to a tax professional.

What are your thoughts on the Form 8865 filing process? Share your experiences and tips in the comments below.

Who needs to file Form 8865?

+A U.S. person with an interest in a foreign partnership, including a U.S. citizen or resident who is a partner in a foreign partnership, a domestic partnership that is a partner in a foreign partnership, a U.S. citizen or resident who is a shareholder in a foreign corporation that is a partner in a foreign partnership, and a U.S. citizen or resident who is a beneficiary of a foreign trust that is a partner in a foreign partnership.

What is the deadline for filing Form 8865?

+The deadline for filing Form 8865 is the 15th day of the 4th month following the end of the partnership's tax year.

Can Form 8865 be filed electronically?

+Yes, Form 8865 can be filed electronically through the IRS's Electronic Federal Tax Payment System (EFTPS).