The Form 886-H EIC, also known as the Earned Income Credit (EIC) examination changes, is a document that plays a crucial role in the process of claiming the Earned Income Tax Credit (EITC). As one of the most valuable tax credits available to low-to-moderate-income working individuals and families, understanding the intricacies of the Form 886-H EIC is essential for tax professionals and individuals alike. In this article, we will delve into the world of the Form 886-H EIC and explore five essential facts that you need to know.

What is Form 886-H EIC?

Why is the Form 886-H EIC important?

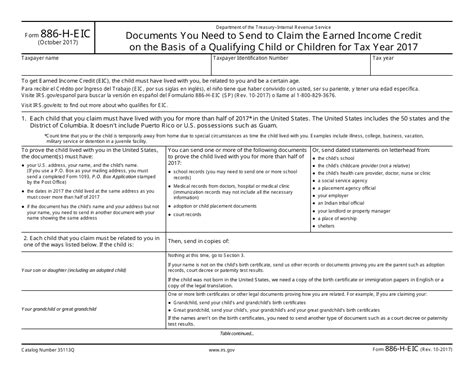

The Form 886-H EIC is a critical document for taxpayers claiming the EITC, as it directly impacts the amount of credit they are eligible to receive. The EITC is a refundable tax credit, meaning that taxpayers can receive a refund even if the credit exceeds their tax liability. However, if the IRS makes adjustments to the EITC claim, the taxpayer may receive a reduced credit or even be required to repay a portion of the credit. By understanding the Form 886-H EIC, taxpayers can ensure that they receive the correct amount of credit and avoid any potential issues.What information is included on the Form 886-H EIC?

- The taxpayer's name and address

- The tax year and return type (e.g., Form 1040)

- The original EITC claim amount

- The adjusted EITC claim amount

- The reason for the adjustment

- Any additional taxes owed or refund due

This information is essential for taxpayers to understand the changes made to their EITC claim and to identify any potential issues or discrepancies.

How to handle a Form 886-H EIC

If you receive a Form 886-H EIC, it is essential to review the document carefully and understand the changes made to your EITC claim. Here are some steps to take:- Review the form for accuracy and completeness

- Verify the adjusted EITC claim amount

- Understand the reason for the adjustment

- If you agree with the changes, sign and return the form

- If you disagree with the changes, follow the instructions provided on the form to appeal the decision

What are the consequences of not responding to a Form 886-H EIC?

- Forfeiting your right to appeal the changes

- Being required to repay the EITC claim amount

- Incurring additional taxes, penalties, and interest

- Potential audit and examination of your tax return

It is crucial to respond to the Form 886-H EIC in a timely and accurate manner to avoid these consequences.

Best practices for working with Form 886-H EIC

To ensure a smooth and efficient process when working with the Form 886-H EIC, follow these best practices:- Carefully review the form for accuracy and completeness

- Verify the adjusted EITC claim amount

- Understand the reason for the adjustment

- Respond promptly to the form, either by signing and returning it or by appealing the decision

- Keep accurate records of the form and any related correspondence

By following these best practices, you can ensure that you receive the correct amount of EITC and avoid any potential issues or discrepancies.

Conclusion

We encourage you to share your experiences and questions about the Form 886-H EIC in the comments below. Additionally, if you found this article informative, please share it with others who may benefit from this knowledge.

What is the purpose of the Form 886-H EIC?

+The Form 886-H EIC is used to notify taxpayers of changes made to their EITC claim. It serves as a record of the changes made and provides taxpayers with an opportunity to understand the reasoning behind the adjustments.

What information is included on the Form 886-H EIC?

+The Form 886-H EIC typically includes the taxpayer's name and address, the tax year and return type, the original EITC claim amount, the adjusted EITC claim amount, the reason for the adjustment, and any additional taxes owed or refund due.

What are the consequences of not responding to a Form 886-H EIC?

+If you fail to respond to a Form 886-H EIC, you may face severe consequences, including forfeiting your right to appeal the changes, being required to repay the EITC claim amount, incurring additional taxes, penalties, and interest, and potential audit and examination of your tax return.