Entity classification is a crucial step in establishing a business, and the IRS Form 8832 is a vital document in this process. As a business owner, it's essential to understand the purpose of Form 8832 and how to file it correctly to avoid any potential issues with the IRS. In this article, we will provide you with 7 essential Form 8832 filing instructions to help you navigate the process with ease.

What is Form 8832?

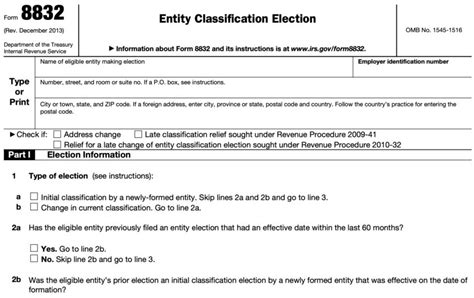

Form 8832, also known as the Entity Classification Election, is a document used to classify an entity for federal tax purposes. The form is used by entities that are not automatically classified as a corporation or partnership, such as limited liability companies (LLCs) and trusts. By filing Form 8832, an entity can elect to be classified as a corporation, partnership, or sole proprietorship for tax purposes.

Why is Form 8832 Important?

Filing Form 8832 is crucial for several reasons. Firstly, it helps the IRS to determine how to tax the entity. Secondly, it affects the entity's ability to deduct losses and claim tax credits. Finally, it impacts the entity's ability to make certain tax elections, such as the election to be treated as a Subchapter S corporation.

7 Essential Form 8832 Filing Instructions

To ensure that you file Form 8832 correctly, follow these 7 essential instructions:

**Step 1: Determine Eligibility**

Before filing Form 8832, you need to determine if your entity is eligible to make an entity classification election. Generally, any entity that is not automatically classified as a corporation or partnership can file Form 8832. This includes LLCs, trusts, and certain foreign entities.

**Step 2: Choose the Correct Classification**

The next step is to choose the correct classification for your entity. You can elect to be classified as a corporation, partnership, or sole proprietorship. The classification you choose will affect how your entity is taxed, so it's essential to choose the correct classification.

**Classification Options**

- Corporation: This classification is suitable for entities that want to be taxed as a separate entity from their owners.

- Partnership: This classification is suitable for entities that want to pass through income and losses to their owners.

- Sole Proprietorship: This classification is suitable for single-owner entities that want to report income and losses on their personal tax return.

**Step 3: Gather Required Information**

Before filing Form 8832, you need to gather the required information. This includes the entity's name, address, and Employer Identification Number (EIN). You will also need to provide information about the entity's owners, including their names, addresses, and percentages of ownership.

**Step 4: Complete Form 8832**

Once you have gathered the required information, you can complete Form 8832. The form consists of several sections, including the entity's information, classification election, and owner information. Make sure to complete all sections accurately and sign the form.

**Step 5: Attach Required Documentation**

You may need to attach additional documentation to Form 8832, such as a copy of the entity's operating agreement or a resolution authorizing the classification election.

**Step 6: File Form 8832**

Form 8832 can be filed electronically or by mail. If you file electronically, you will need to use the IRS's Electronic Federal Tax Payment System (EFTPS). If you file by mail, you will need to send the form to the IRS address listed in the instructions.

**Step 7: Maintain Records**

Finally, it's essential to maintain records of your entity's classification election. You will need to keep a copy of Form 8832 and any additional documentation for at least three years in case of an audit.

Conclusion

Filing Form 8832 is a crucial step in establishing a business. By following these 7 essential instructions, you can ensure that your entity is classified correctly for federal tax purposes. Remember to choose the correct classification, gather required information, complete the form accurately, attach required documentation, file the form on time, and maintain records.

What's Next?

If you have any questions or concerns about filing Form 8832, we encourage you to comment below. We also invite you to share this article with your colleagues and friends who may benefit from this information. By working together, we can ensure that our businesses are established correctly and in compliance with federal tax laws.

What is the purpose of Form 8832?

+The purpose of Form 8832 is to classify an entity for federal tax purposes.

Who can file Form 8832?

+Entities that are not automatically classified as a corporation or partnership can file Form 8832.

What are the classification options on Form 8832?

+The classification options on Form 8832 are corporation, partnership, and sole proprietorship.