Like-kind exchanges are a powerful tool for taxpayers to defer capital gains taxes when disposing of investment properties. However, navigating the complexities of Form 8824 can be a daunting task. The Form 8824 Worksheet is a valuable resource to help taxpayers simplify their like-kind exchange calculations and ensure compliance with IRS regulations.

The Importance of Like-Kind Exchanges

Like-kind exchanges, also known as 1031 exchanges, allow taxpayers to exchange investment properties for similar properties without recognizing capital gains. This can be a significant tax savings strategy for real estate investors, businesses, and individuals. However, the IRS has specific rules and regulations governing like-kind exchanges, making it essential to understand the requirements and calculations involved.

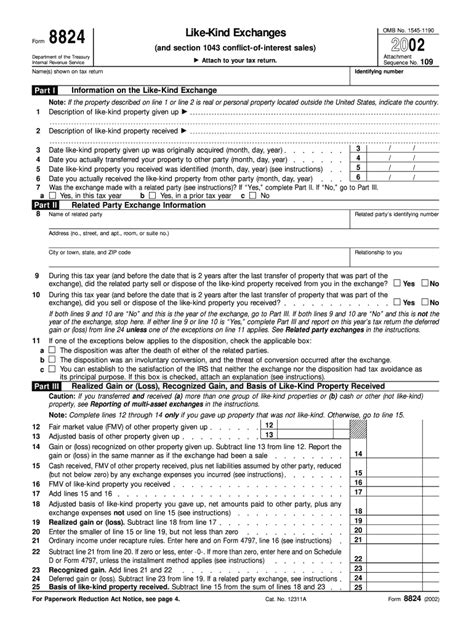

The Role of Form 8824

Form 8824 is the IRS form used to report like-kind exchanges. It requires taxpayers to calculate the recognized gain or loss on the exchange, as well as the basis of the new property received. The form is typically filed with the taxpayer's annual tax return and is subject to strict deadlines and requirements.

Simplifying Form 8824 Calculations

The Form 8824 Worksheet is a useful tool to help taxpayers simplify their like-kind exchange calculations. The worksheet breaks down the calculation into manageable steps, ensuring that taxpayers accurately report their exchange and comply with IRS regulations. The worksheet typically includes the following sections:

- Exchange Information: This section requires taxpayers to provide basic information about the exchange, including the date of the exchange, the type of property exchanged, and the fair market value of the properties involved.

- Gain or Loss Calculation: This section helps taxpayers calculate the recognized gain or loss on the exchange. It takes into account the fair market value of the properties, the adjusted basis of the relinquished property, and any depreciation or amortization claimed.

- Basis Calculation: This section assists taxpayers in calculating the basis of the new property received. It considers the fair market value of the new property, the adjusted basis of the relinquished property, and any gain or loss recognized on the exchange.

Benefits of Using the Form 8824 Worksheet

Using the Form 8824 Worksheet offers several benefits to taxpayers, including:

- Accurate Calculations: The worksheet ensures that taxpayers accurately calculate the recognized gain or loss on the exchange and the basis of the new property received.

- Simplified Reporting: The worksheet simplifies the reporting process, making it easier for taxpayers to complete Form 8824 and comply with IRS regulations.

- Reduced Risk of Audit: By using the worksheet, taxpayers can reduce the risk of audit and penalties associated with incorrect reporting.

Common Mistakes to Avoid

When using the Form 8824 Worksheet, taxpayers should avoid common mistakes, such as:

- Incorrect Identification of Properties: Taxpayers must correctly identify the properties involved in the exchange, including the relinquished property and the replacement property.

- Inaccurate Valuations: Taxpayers must accurately determine the fair market value of the properties involved in the exchange.

- Failure to Consider Depreciation: Taxpayers must consider depreciation or amortization claimed on the relinquished property when calculating the recognized gain or loss on the exchange.

Best Practices for Using the Form 8824 Worksheet

To get the most out of the Form 8824 Worksheet, taxpayers should follow best practices, including:

- Seek Professional Advice: Taxpayers should consult with a qualified tax professional to ensure they understand the requirements and calculations involved in like-kind exchanges.

- Keep Accurate Records: Taxpayers should maintain accurate records of the exchange, including documentation of the properties involved, the fair market value of the properties, and any depreciation or amortization claimed.

- Review and Update: Taxpayers should regularly review and update their records to ensure compliance with IRS regulations and accuracy in reporting.

Conclusion

In conclusion, the Form 8824 Worksheet is a valuable resource for taxpayers navigating the complexities of like-kind exchanges. By using the worksheet, taxpayers can simplify their calculations, ensure compliance with IRS regulations, and reduce the risk of audit and penalties. By following best practices and seeking professional advice, taxpayers can maximize the benefits of like-kind exchanges and achieve significant tax savings.

Additional Tips and Resources

For more information on like-kind exchanges and Form 8824, taxpayers can consult the following resources:

- IRS Publication 544: This publication provides guidance on sales and other dispositions of assets, including like-kind exchanges.

- IRS Form 8824 Instructions: The instructions provide detailed guidance on completing Form 8824 and reporting like-kind exchanges.

- Tax Professional Associations: Taxpayers can consult with qualified tax professionals who are members of professional associations, such as the American Institute of Certified Public Accountants (AICPA) or the National Association of Enrolled Agents (NAEA).

FAQ Section:

What is a like-kind exchange?

+A like-kind exchange, also known as a 1031 exchange, is a tax-deferred exchange of investment properties for similar properties.

What is Form 8824?

+Form 8824 is the IRS form used to report like-kind exchanges. It requires taxpayers to calculate the recognized gain or loss on the exchange and the basis of the new property received.

Why is it important to use the Form 8824 Worksheet?

+The Form 8824 Worksheet helps taxpayers simplify their like-kind exchange calculations, ensure compliance with IRS regulations, and reduce the risk of audit and penalties.