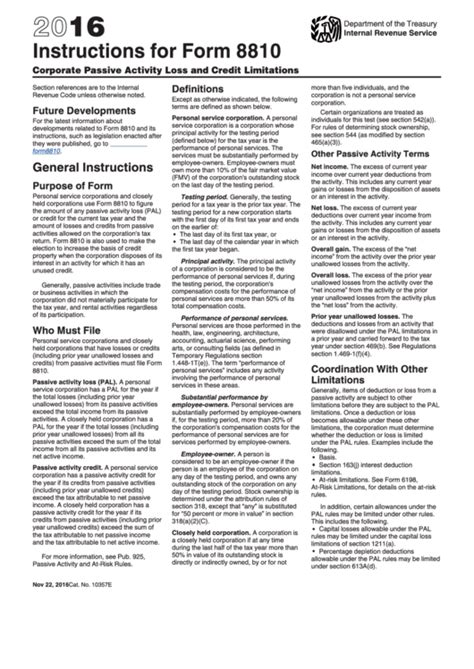

As a tax professional or business owner, you're likely familiar with the complexities of corporate taxation. One of the key forms used by corporations to report their income and claim deductions is Form 8810, also known as the Corporate Passive Activity Loss and Credit Limitations. In this article, we'll provide a comprehensive guide to help you navigate the Form 8810 instructions and ensure accurate filing.

The importance of Form 8810 cannot be overstated. It helps the IRS track and limit the amount of passive losses and credits that corporations can claim. By understanding the Form 8810 instructions, you'll be better equipped to manage your corporation's tax obligations and avoid any potential penalties or audits.

Who Needs to File Form 8810?

Before diving into the Form 8810 instructions, it's essential to determine if your corporation needs to file this form. Generally, corporations that engage in passive activities, such as renting properties or investing in partnerships, must file Form 8810. This includes:

- Corporations with passive income from investments, such as dividends, interest, or capital gains

- Corporations with passive losses from investments, such as rental properties or partnerships

- Corporations with credits from passive activities, such as the low-income housing credit

Passive Activity Loss Limitations

One of the primary purposes of Form 8810 is to report and limit passive activity losses. Passive activity losses occur when a corporation's passive income is less than its passive deductions. These losses can be carried forward to future tax years, but there are limitations on the amount that can be claimed.

The passive activity loss limitation is calculated by multiplying the corporation's taxable income by 0.23. This limit applies to both passive activity losses and credits. Any excess losses or credits are carried forward to future tax years.

Form 8810 Instructions: A Step-by-Step Guide

Now that we've covered the basics, let's dive into the Form 8810 instructions. Here's a step-by-step guide to help you complete the form accurately:

Step 1: Identify Passive Activities

Begin by identifying your corporation's passive activities, including investments, rentals, and partnerships. You'll need to report the income and deductions from these activities on Form 8810.

Step 2: Calculate Passive Income and Deductions

Calculate your corporation's passive income and deductions from the identified passive activities. You'll need to report these amounts on Form 8810.

Step 3: Calculate Passive Activity Loss Limitation

Calculate the passive activity loss limitation by multiplying your corporation's taxable income by 0.23. This limit applies to both passive activity losses and credits.

Step 4: Complete Form 8810

Complete Form 8810 by reporting the following information:

- Passive income and deductions from each passive activity

- Passive activity loss limitation

- Carryforward of excess losses or credits

Common Mistakes to Avoid

When completing Form 8810, it's essential to avoid common mistakes that can lead to penalties or audits. Some common mistakes include:

- Failing to report all passive activities

- Incorrectly calculating passive income and deductions

- Failing to calculate the passive activity loss limitation

By following these Form 8810 instructions and avoiding common mistakes, you'll be able to accurately report your corporation's passive activity losses and credits.

Additional Resources

If you're still unsure about the Form 8810 instructions, there are several additional resources available to help:

- IRS Publication 925: Passive Activity and At-Risk Rules

- IRS Form 8810 Instructions

- IRS Phone Support: 1-800-829-1040

Conclusion

Form 8810 is a critical component of corporate taxation, and understanding the Form 8810 instructions is essential for accurate filing. By following this step-by-step guide and avoiding common mistakes, you'll be able to navigate the complexities of corporate passive activity losses and credits.

We encourage you to share this article with your colleagues and peers who may benefit from this comprehensive guide. If you have any questions or comments, please don't hesitate to reach out.

What is Form 8810 used for?

+Form 8810 is used to report and limit passive activity losses and credits for corporations.

Who needs to file Form 8810?

+Corporations that engage in passive activities, such as renting properties or investing in partnerships, must file Form 8810.

What is the passive activity loss limitation?

+The passive activity loss limitation is calculated by multiplying the corporation's taxable income by 0.23.