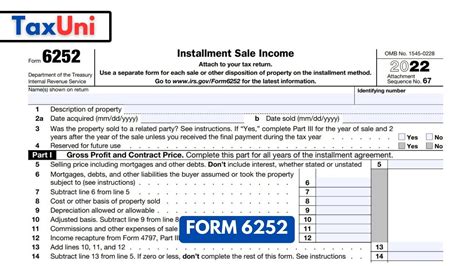

Property ownership is a significant aspect of any individual's financial portfolio, and the IRS recognizes this by providing various tax benefits and incentives. One of these incentives is the installment sale method, which allows taxpayers to report the gain from the sale of certain property over time, rather than all at once. To take advantage of this method, taxpayers must file Form 6252, which requires them to identify the type of property being sold using a specific code. In this article, we will delve into the world of Form 6252 property type codes, explaining them in simple terms and providing examples to illustrate their application.

The installment sale method is particularly useful for taxpayers who sell property that has significantly appreciated in value over time, such as real estate or securities. By spreading the gain over multiple years, taxpayers can reduce their tax liability in any given year, which can help with cash flow and overall financial planning. However, to qualify for this method, the sale must meet specific requirements, including the use of a valid property type code on Form 6252.

Understanding Property Type Codes

The IRS uses a series of codes to identify the type of property being sold under the installment sale method. These codes are crucial in determining the correct treatment of the sale for tax purposes. The codes are listed in the instructions for Form 6252 and are categorized into several groups, including:

- Real property: This includes land, buildings, and other permanent structures.

- Personal property: This includes items such as artwork, collectibles, and other tangible assets.

- Securities: This includes stocks, bonds, and other investment securities.

Each property type code has a specific set of rules and requirements that must be met to qualify for the installment sale method. For example, real property sales may be subject to different rules than personal property sales.

Real Property Codes

The real property codes are used to report the sale of land, buildings, and other permanent structures. These codes include:

- Code 1: Land, including vacant lots and parcels of land.

- Code 2: Improved real property, including buildings and other permanent structures.

- Code 3: Real property that is being held for sale to customers, such as inventory.

Personal Property Codes

The personal property codes are used to report the sale of tangible assets, such as artwork and collectibles. These codes include:

- Code 4: Artwork, including paintings, sculptures, and other works of art.

- Code 5: Collectibles, including rare coins, stamps, and other items.

- Code 6: Other personal property, including jewelry, furniture, and other tangible assets.

Securities Codes

The securities codes are used to report the sale of investment securities, such as stocks and bonds. These codes include:

- Code 7: Stocks, including common and preferred stock.

- Code 8: Bonds, including government and corporate bonds.

- Code 9: Other securities, including mutual funds and exchange-traded funds.

Practical Examples

To illustrate the application of property type codes, let's consider a few examples:

- Example 1: John sells a piece of land to a developer for $100,000. He reports the sale using Code 1, Land.

- Example 2: Jane sells a collection of rare coins to a collector for $50,000. She reports the sale using Code 5, Collectibles.

- Example 3: Bob sells a portfolio of stocks to an investor for $200,000. He reports the sale using Code 7, Stocks.

Benefits of Using Property Type Codes

Using the correct property type code on Form 6252 can provide several benefits, including:

- Accurate reporting: By using the correct code, taxpayers can ensure that they are reporting the sale correctly and taking advantage of the installment sale method.

- Reduced tax liability: By spreading the gain over multiple years, taxpayers can reduce their tax liability in any given year.

- Improved financial planning: By reporting the sale accurately, taxpayers can better plan their financial affairs and make informed decisions.

In conclusion, Form 6252 property type codes are an essential aspect of reporting the sale of certain property under the installment sale method. By understanding the different codes and their application, taxpayers can ensure accurate reporting, reduce their tax liability, and improve their financial planning. If you have any questions or concerns about Form 6252 property type codes, please share them with us in the comments below.

What is the purpose of Form 6252?

+Form 6252 is used to report the sale of certain property under the installment sale method, which allows taxpayers to report the gain from the sale over time, rather than all at once.

What are the different property type codes on Form 6252?

+The property type codes on Form 6252 include real property, personal property, and securities. Each code has a specific set of rules and requirements that must be met to qualify for the installment sale method.

How do I choose the correct property type code on Form 6252?

+To choose the correct property type code, taxpayers should consult the instructions for Form 6252 and identify the type of property being sold. They should also consider the specific rules and requirements for each code to ensure accurate reporting.